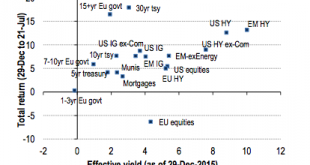

When x happens, yields fall — Rule 1? It’s not a search for yield, it’s a search for safety — Potential Rule 2? Two charts to make the point for us once again from the good folks at BofAML’s relative value department: Click to enlarge. You could also pop in here and have a look at Credit Suisse’s roughly similar argument (and the state of the negatively rate inspired corporate bond market). CS’s point has to do with...

Read More »Unsound Money Has Destroyed the Middle Class

Duped and Distorted DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane....

Read More »FX Daily, July 25: Big Week Begins Slowly

Swiss Franc Click to enlarge. FX Rates What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere. ...

Read More »Great Graphic: OIl Breaks Down Further

Summary: With today’s losses the Sept contract has retraced 50% of this year’s rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row. Oil Future Today’s 2.5% fall in the September light sweet crude oil futures contract extends the decline that began on June 9. It is the third consecutive loss and the fifth loss in the past six...

Read More »Gold is not Going to $10,000

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango One Cannot Trade Based on the Endgame The prices of the metals were down again this week, -$15 in gold and more substantially -$0.57 in silver. Stories continued to circulate this week, hitting even the mainstream media. Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it’s still cheap...

Read More »European Bank Stress Test: Preview

Summary European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries’ banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules. The results of the latest stress tests on European banks are expected to be released at 10:00 am CET (5:00 am ET). The...

Read More »A Fully Automated Stock Market Blow-Off?

Anecdotal Skepticism vs. Actual Data About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals. All...

Read More »Emerging Markets: Week Ahead Preview

EM ended the week on a soft note, as the dollar reasserted broad-based strength against most currencies. The FOMC meeting this week could see the Fed push back against the market’s dovish take on policy, in which case EM would be likely to remain under pressure. Idiosyncratic risk remains in play across several countries. The Turkish situation remains fluid, with the nation subject to ongoing ratings downgrades....

Read More »FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More »The Real Reason the “Rich Get Richer”

Time the Taskmaster DUBLIN – “Today’s money,” says economist George Gilder, “tries to cheat time. And you can’t do that.” It may not cheat time, but it cheats far easier marks – consumers, investors, and entrepreneurs. It took us a moment to understand what Gilder meant. Then we realized he’s right. Time is the ultimate limitation… the ultimate truth… the ultimate fact. You’ll recall. There are facts and there are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org