Time the Taskmaster

DUBLIN – “Today’s money,” says economist George Gilder, “tries to cheat time. And you can’t do that.” It may not cheat time, but it cheats far easier marks – consumers, investors, and entrepreneurs.

It took us a moment to understand what Gilder meant. Then we realized he’s right. Time is the ultimate limitation… the ultimate truth… the ultimate fact.

You’ll recall. There are facts and there are myths. The facts are true no matter what you think. Everything else is opinion, conjecture, or claptrap.

Elizabeth, your editor’s wife, has a different relationship with time than he does. He sees it as a taskmaster – strict and unyielding. The sun rises. It sets. If you goof off during the daylight hours, the opportunity will be gone forever. That part of your life will evaporate, like the morning dew, never to be seen again.

Elizabeth takes it personally. If she is running late, she expects time to slow down and wait for her. She thinks the sun ought to linger a little longer before saying goodnight, giving her time to finish her email before starting dinner. She is annoyed when it doesn’t.

Elizabeth treats time like a movie she is watching on her computer. When the telephone rings in the middle of it, she wants to put time on hold, until she is ready for it to resume – or even push a button to make time back up, so she can relive particularly interesting segments.

“The party starts at seven; it’s already quarter after; we’re late,” we say grumpily, after waiting in the car.

“Well, maybe you could drive a little faster so we could get there on time.” |

Tempus fugit – every action humans undertake has to take time into account. In the economy, interest rates serve as the signal and regulator of the inter-temporal structure of capital. In an unhampered free market economy, they tell entrepreneurs how large the pool of available savings is, and whether consumers have become more or less future-oriented. The issuance of additional money from thin air can neither alter the size of the pool of real savings, nor can it alter actual consumer time preferences. But it can and does temporarily suppress interest rates and distort relative prices. This falsifies economic calculation and promotes the malinvestment of capital – which in turn sets the boom-bust cycle into motion. Photo credit: fmh |

No More Real Money

Alas, time does not cooperate. Time is a “fact,” not a myth. It does not back up. No matter how much you wish it would slow down, or what you think about it… time moves on.

Real money is similarly indifferent to the wishes of tardy commuters, cash-short consumers, and manipulating Fed chiefs. Like the ancient Greek Moirai (Μοῖραι), the goddesses who measured out the thread of life, real money is beyond the control of man. |

Clotho weaves the thread, Lachesis measures it and Atropos cuts it. Once Atropos swings into action, it’s game over… Image credit: |

| The last of the three goddesses, Atropos, was known as “she who cannot be turned.” It was she who cut the thread when your time came to an end. Real money, like real time, cannot be jigged or jived. It can’t be stretched or compressed. It is what it is.

But that was then, pre-1971. This is now. Now, we have no more real money. Instead, the world has a gaggle of imposters – the dollar, the euro, the yen – all stage managed by benighted central bankers.

The miracle of real modern money – which has been around only for a few thousand years – is that it could function across time and space. It allowed people to trade with others far away who they didn’t know, often crossing language, cultural and religious barriers.

Money in hand, the deal was done. It made no difference what they thought or what happened to them later. Money made it possible to accumulate wealth (capital), too.

A crop of tomatoes or lettuce might be worthless in a few days. But with money, the farmer could hold the real value of his past work far into the future. Using money, he could also invest the fruits of his labor in new and more fruitful projects. |

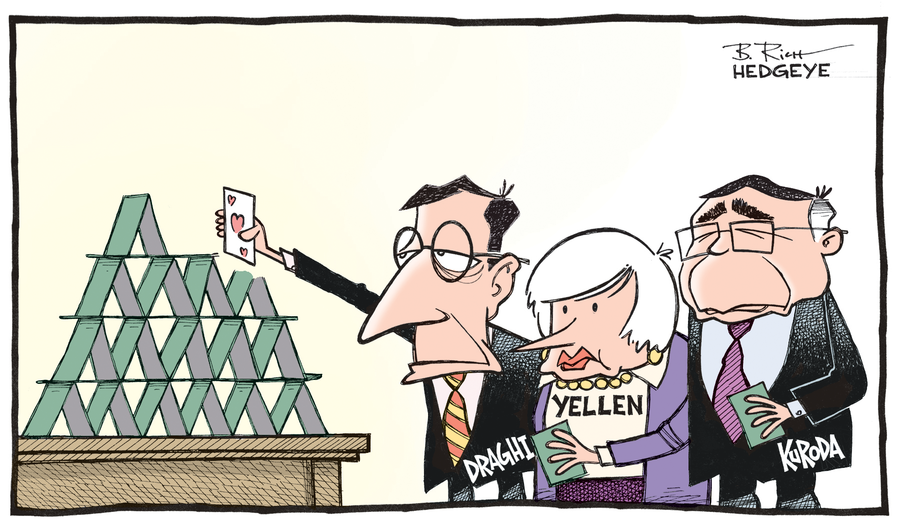

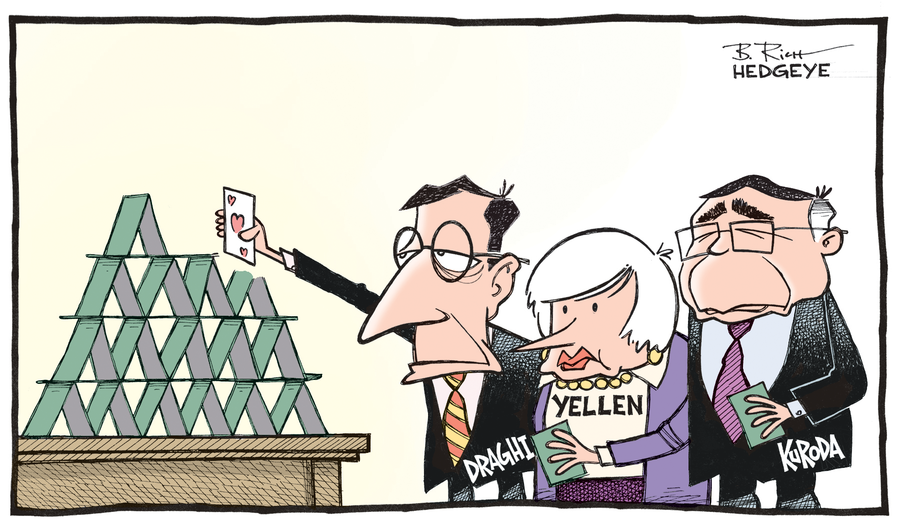

Convocation of the benighted… it is only a cartoon, but there is veritas in this satura. They are building a house of cards, and the same fate that awaits all card houses awaits this one too. Cartoon by Bob Rich |

Rigged System

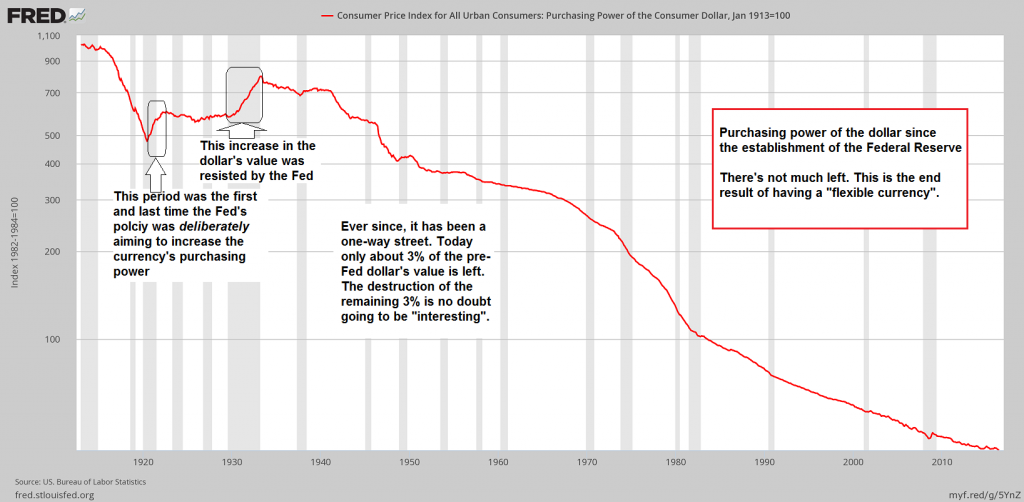

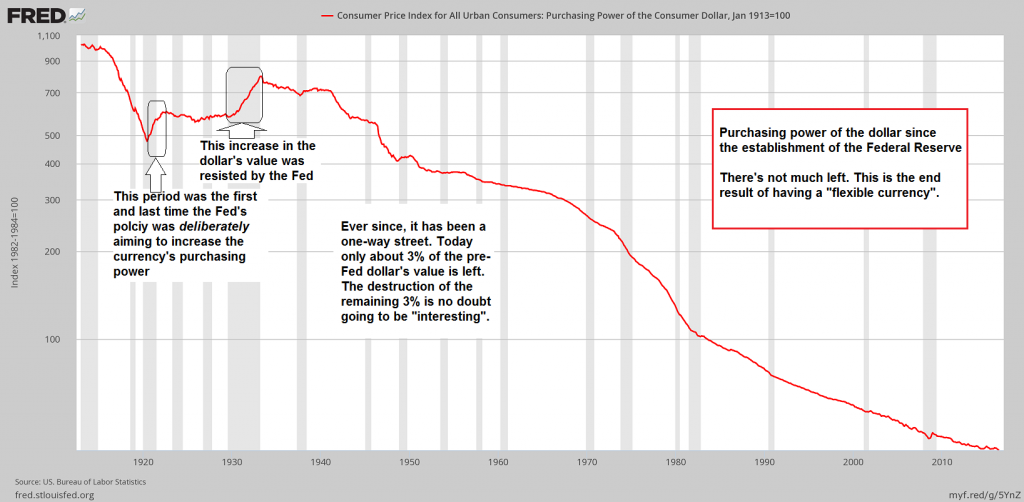

The new money substitute, which we’ve lived with for 45 years, is a fraud. A dollar in 1971 is worth about 17 cents today. In other words, it has lost roughly 80% of its buying power. Had you been counting on it to preserve the value of your work from the previous decade, it robbed you of everything from 1960 to 1968.

The phony dollar has misled an entire generation into spending money it didn’t really have… doubling or tripling its debt-to-earnings ratio, and shifting more and more of its real wealth to the least productive people – the Parasitocracy.

In 1971, the financial services industry was just 1.25% of GDP. Today, it’s more than three times that much. In terms of real output, finance is still tiny. But that’s now where the money is!

Here’s an item from Monday’s paper: The biggest six banks in America raised their CEO pay by 7.6% last year – about three times faster than GDP growth. The “Big Six” executives now earn an average of $13.1 million a year. JPMorgan Chase boss Jamie Dimon is in the lead with a $27.6 million pay package.

The richest 1% of the population, meanwhile, has increased its share of national wealth from 25% to 40%. And the richest 1/10th of 1% has done even better – going from 10% of national income in 1971 to 20% today. Lucky?

Not really. The system was rigged with the new money. More to come – as we continue connecting the dots between our money, our economy, and our Parasitocracy.

Stay tuned… |

The dollar’s purchasing power since the founding of the Fed. There was a single period (under Harding, in 1921 – 1922) when the Fed deliberately pursued a policy of strengthening the dollar’s value. The rise in purchasing power in 1930 – 1933 was resisted by the Fed with all its might – it increased its balance sheet by 404% between November 1929 and March 1933. The story that the Fed “didn’t fight deflation” in the early 1930s is a complete fabrication, a propaganda lie designed to pull the wool over the eyes of the rubes. It did all it could, but for a number of reasons it still failed to pump up the money supply. Only about 50% of all commercial banks were members of the Federal Reserve system at the time and banks became insolvent so rapidly and in such great numbers, that deposit money evaporated back into thin air faster than the Fed could “print” it. There was still a gold standard in place as well, and after the vast credit expansion of the 1920s boom the money supply attempted to contract back to its specie backing. Under a gold standard the fraudulent nature of fractional reserve banking tends to be revealed regularly, which is one of its great virtues (and one of several reasons why governments eventually sabotaged it) – click to enlarge. |