Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »Effective Fed Funds and Money Markets

Summary: Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers. The weighted average of the Fed funds rate has edged higher. Following the Fed hike in December 2015, the Fed funds average around 36 bp in January before...

Read More »Draghi Does not Surprise and Euro Edges Away from $1.10

Summary: Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken. Draghi said nothing that surprised the...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

Read More »FX Daily, July 11: Dollar Extends Gains

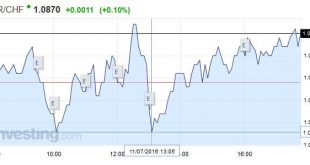

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »Caixin Monthly Column: Brexit

(Here is the latest monthly column I write for Caixin. It is on Brexit and I wrote it as an email to my mother. Here is the link. The text follows) To: Mother Date: July 4, 2016 Subject: Re: Did you know Britain was leaving Europe? Should I worry? Glad to see you figured out how to access your email account. I smiled when I saw your note in my inbox. Thank you, though I am not sure that Thomas Watson felt the...

Read More »New Wrinkle in European Bail-In Efforts

Summary: European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness. After the 2007-2008 bank recapitalization by governments, which means taxpayers’ money, Europe changed the rules. The...

Read More »CTA-Gewinnsträhne geht weiter

Philippe Ferreira, Senior Strategist bei Lyxor. Gemäss Philippe Ferreira von Lyxor bieten CTA's im aktuellen Umfeld eine attraktive Möglichkeit, das Portfolio zu diversifizieren. Die Marktentwicklungen nach dem Brexit-Referendum waren irgendwie rätselhaft. Die Schockstarre der Märkte war nur von kurzer Dauer und die Risikoanlagen erholten sich, da sich nichts Durchgreifendes...

Read More »Fat People for Trump!

Alphas and Epsilons BALTIMORE – One of the delights of being an American is that it is so easy to feel superior to your fellow countrymen. All you have to do is stand up straight and smile. Or if you really need an ego boost, just go to a local supermarket. Better yet, go to a supermarket with a Trump poster in the parking lot. Trigger warning: In the following ramble, we make fun of democracy, Trump, obesity,...

Read More »A Sense of Foreboding

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Amerexit and Brexit… Doubts About Debt This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amerexit”, 240 years ago. The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org