Summary: Fundamental driver, divergence is still intact. The dollar’s losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US. The US dollar is sitting near multi-month lows against the major European currencies and the dollar bloc. Where does this leave our strategic view of the third...

Read More »Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy” UK banks are “dicing with the spiral of complacency” again Bank of England official believes household debt is good in moderation Household debt now equals 135% of household income Now costs half of average income to raise a child Real incomes not keeping up with real inflation 41% of those in debt are in full-time work £1.537 trillion owed...

Read More »Great Graphic: What Is the Swiss Franc Telling Us?

Summary: Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc. The Swiss franc is trading at its lowest level against the euro since the Swiss National Bank surprised the world by lifting the currency cap in early 2015. This week’s move has been...

Read More »FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Summary: Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way. The FOMC statement reads very much like the June statement. There were some minor tweaks in the first paragraph that discusses the broad economic performance since the last FOMC statement. There...

Read More »Missing glass eye? Contact Swiss railways

More than half of the objects left on Swiss trains were reunited with their owners (Keystone) A glass eye, wedding dress and fakir costume were among the 127,000 items passengers left behind on Swiss trains last year. Wheelchairs, prostheses and dentures counted among the unusual objects on the list, which was dominated by clothes and mobile phones. Large sums of money were also found but the most valuable misplaced...

Read More »Swiss students reveal prototype for experimental hyperloop

The Swiss team hopes the pod will attain speeds of 400km/h on the SpaceX track in California (swissloop) A pod built by students at Zurich’s Federal Institute of technology (ETHZ) will be competing to be the fastest to navigate the Hyperloop experimental high-speed transportation system in California. The Swiss pod, named Escher after the 19th century Swiss entrepreneur Alfred Escher, was unveiled at ETHZ at a ceremony...

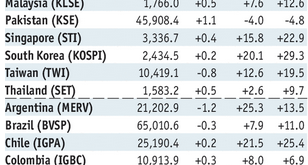

Read More »Emerging Markets: What has Changed

Summary Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party. The European Commission (EC) is preparing possible sanctions against Poland. The US House of Representatives voted to impose new sanctions against Russia, Iran, and...

Read More »KOF Economic Barometer: Outlook for the Swiss Economy Remains Favourable

The KOF Economic Barometer rose further and reaches a value of 106.8 in July. In June, the Barometer stood at a value of 105.8 (revised from 105.5). The Barometer has been trending above its historical average for some time now and the outlook for the Swiss economy remains favourable. In July 2017, the KOF Economic Barometer rose further – the new reading of 106.8 remains above its long-term average. The strongest...

Read More »Strong franc forces Swiss paper mill to close

The paper mill closure will end 125 years of industrial history in the region (Keystone) The closure of a paper factory in canton Bern will leave only one such plant supplying the newspaper and magazine industry in Switzerland from next year. The 125-year-old Utzenstorf factory will close its doors at the end of 2017, management announced on Tuesday. The decision was blamed on the strong franc that has appreciated...

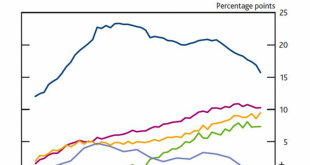

Read More »Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org