Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More »FX Daily, July 27: Dollar Remains on the Defensive

Swiss Franc The Euro has risen by 0.82% to 1.1244 CHF. EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and...

Read More »Gold Seasonal Sweet Spot – August and September – Coming

– Gold seasonal sweet spot – August and September – is coming– Gold’s performance by month from 1979 to 2016 – must see table– August sees average return of 1.4% and September of 2.5%– September is best month to own gold, followed by January, November & August Looking back at gold’s performance since 1979, August and September are big months for the yellow metal. What is the cause? No one really knows but there are...

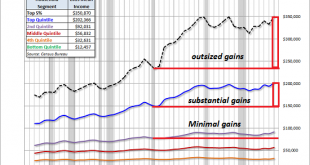

Read More »The Two Charts That Dictate the Future of the Economy

If you study these charts closely, you can only conclude that the US economy is doomed to secular stagnation and never-ending recession. The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable...

Read More »Progress in St. Petersburg

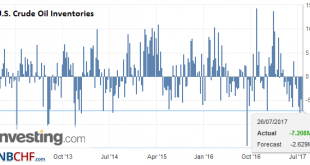

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further. Ecuador announced it would no longer participate in the output restraint. Hopes that...

Read More »Zurich airport reports record passenger numbers

Last year more than 100,000 passengers passed through Zurich airport in a day, last Sunday a new record was set (Keystone) Switzerland’s main airport of Zurich is going from strength to strength, setting a new daily record. On Sunday about 107,000 passengers travelled through the airport in just one day, a spokeswoman said. The figure compares with the average daily figure of 30,000 passengers. Travellers flying to a...

Read More »Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans. Source image:...

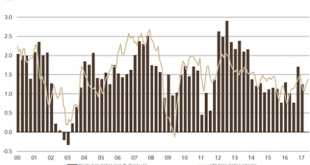

Read More »Switzerland UBS Consumption Indicator June: Subdued Growth

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however...

Read More »Against Irredeemable Paper – Precious Metals Supply and Demand

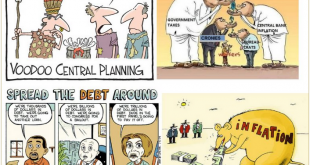

The Antidote Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal. When we write to debunk the conspiracy theories that say manipulation is keeping gold from hitting $5,000 (one speaker here at Freedom Fest...

Read More »Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org