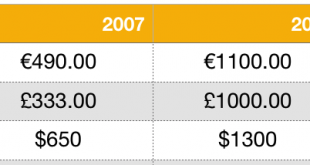

– Gold up over 100% in major currencies since financial crisis– Gold up 100% in USD, 124% in EUR and surged 200% in GBP– Gold has outperformed equity, bonds and most assets– Gold remains an important safe-haven in long term Gold Prices(see more posts on Gold prices, )Gold prices from August 9th 2007 to August 9th 2017 - Click to enlarge It has been ten years since the global financial crisis began to take hold. At...

Read More »We Need a Social Revolution

In the conventional view, there are two kinds of revolutions: political and technological. Political revolutions may be peaceful or violent, and technological revolutions may transform civilizations gradually or rather abruptly—for example, revolutionary advances in the technology of warfare. In this view, the engines of revolution are the state–government in all its layers and manifestations—and the corporate economy....

Read More »Swiss firms face greater shareholder opposition

At a stormy shareholders meeting in April, Tidjane Thiam, CEO of Switzerland's second biggest bank Credit Suisse, faced a revolt from shareholders over compensation and management bonuses for its top managers despite financial losses (Keystone) - Click to enlarge Shareholder rebellion over executive pay at Credit Suisse earlier this year is just one example of growing dissent by Swiss company owners. While annual...

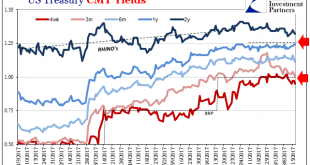

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments Last week he price of gold was up nine bucks, and that of silver 6 cents. These small changes mask the relatively big drop on Tuesday—$13 in gold and $0.48 in silver — and recovery the rest of the week. The gains above previous week occurred on Thursday. Speculators have lately warmed up to...

Read More »Swiss Trade Balance July 2017: Decline in Export Regime

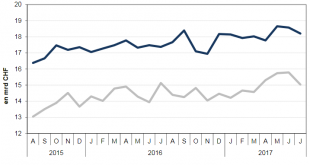

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »FX Daily, August 22: Turn Around Tuesday Sees Firmer Dollar, Rates, and Equities

Swiss Franc The Euro has risen by 0.11% to 1.1375 CHF. EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has recouped most of yesterday’s declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar’s rise through the European morning has...

Read More »Payerne Airport Finally Starts to take off

Payerne Airport officials hope to increase the number of civilian flights from 400 a year to 8,400. (Keystone) After years of negotiations, Payerne’s regional civilian airport and future business aviation hub is starting to take shape. The first stone of an airport building in northwest Switzerland has been laid. “It’s a day of celebration and joy,” Fribourg businessman Damien Piller told reporters at a ceremony to mark...

Read More »Wall Street: comment achever la bête immonde? Michel Santi

- Click to enlarge Quelle est la raison profonde – intime –des crises financières ? Comment sont provoqués les kracks et pourquoi les bulles implosent-elles ? Toujours pour une simple et unique raison qui est que les paris irraisonnés et démesurés entrepris par le monde de la finance le sont avec de l’argent emprunté ! Le dernier épisode de crise grave – les subprimes – n’ayant à cet égard pas failli à cette...

Read More »Why There Will Be No 11th Hour Debt Ceiling Deal

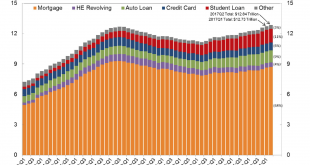

Milestones in the Pursuit of Insolvency A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago. United States Consumer DebtUS consumer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org