Swiss Franc The Euro has risen by 0.08% to 1.1415 CHF. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we...

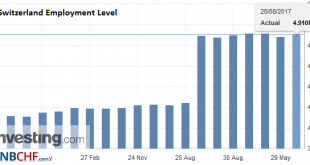

Read More »Employment barometer in 2nd quarter 2017: Employment situation: more confident business outlook

Neuchâtel, 28.08.2017 (FSO) – In the 2nd quarter 2017, total employment (number of jobs) rose by 0.4% in comparison with the same quarter a year earlier (+0.1% with previous quarter). In full-time equivalents, employment in the same period rose by 0.2%. The Swiss economy counted 5700 more vacancies than in the corresponding quarter of the previous year (+10.5%) and the employment outlook indicator is also indicating an...

Read More »Il y a plus d’esclaves aujourd’hui qu’il n’y en a eu du XVIe au XIXe siècle, par Annie Kelly

« La vie humaine est devenue plus sacrifiable » : pourquoi l’esclavage n’a-t-il jamais rapporté autant d’argent. Une nouvelle étude montre que l’esclavage moderne est plus lucratif que jamais, les trafiquants du sexe engrangeant des bénéfices records. Aujourd’hui, les marchands d’esclaves enregistrent un retour sur investissement 25 à 30 fois plus important que leurs semblables aux 18e et 19e siècles. Siddharth Kara, un...

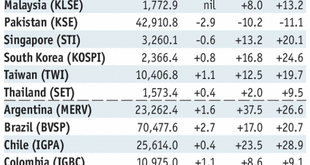

Read More »Emerging Market: Preview of the Week Ahead

Stock Markets EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018. Stock Markets Emerging Markets, August 23 Source: economist.com - Click to enlarge Mexico...

Read More »FX Weekly Preview: Three Drivers in the Week Ahead

Summary: EMU preliminary August CPI headline rise may not translate into core. US jobs growth is fine; earnings growth is key. Trump’s coalition is fraying, and the weekend pardon will not help mend fences. The US dollar’s consolidation ended with an exclamation point last week. The downtrend since the beginning of the year is resuming, and there is a reasonable risk that the pace accelerates. In addition to...

Read More »Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

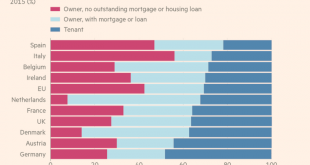

Read More »Great Graphic: Home Ownership and Measuring Inflation

Summary Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not. This Great Graphic was in the Financial Times recently. It shows home ownership rates several EU countries. The useful chart also shows those who own (red bar) and those...

Read More »Parents of murdered au pair get compensation

The family of the murdered au pair hold up a picture of Lucie (picture from 2009) (Keystone) The parents of a 16-year-old au pair who was murdered in canton Aargau eight years ago have received compensation from the canton in an out-of-court settlement. The authorities have admitted that they made mistakes. It marks the end of a long legal battle by the parents of Lucie, who was murdered by a former convict who had been...

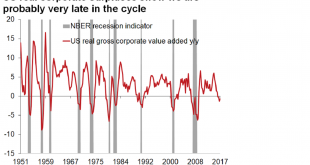

Read More »More Noise Than Signal

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking. The gist of the article is that a bunch of sell side analysts think we are nearing the end of the current business...

Read More »United States Durable Goods In July; Rinse, Repeat

The Census Bureau reported today updated estimates for Durable Goods in July 2017. Quite frankly, nothing has changed so minimal commentary is all that is required. The aircraft anomaly from last month faded, leaving total new orders of $229.2 billion (seasonally-adjusted). That is less than in May before the Boeing surge, and less even than estimated order volume in March 2017. US Durable Goods Orders, Jul 1993 -...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org