© Blondsteve | Dreamstime As next year’s health premium bills find their way into Swiss mail or email boxes, the reality of another round of price increases starts to bite. Earlier this week, Switzerland’s Federal Council unveiled 38 measures that will be considered as part of a plan to tackle Switzerland’s rising health costs. A final plan will be presented next spring, according to 20 Minutes. A number of measures,...

Read More »Eurozone Crisis Is Back

– Gold will be safe haven again in looming EU crisis – EU crisis is no longer just about debt but about political discontent– EU officials refuse to acknowledge changing face of politics across the union– Catalonia shows measures governments will use to maintain control– EU currently holds control over banks accounts and ability to use cash– Protect your savings with gold in the face of increased financial threat from...

Read More »Subject To Gradation

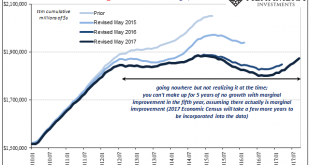

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side. It was misconception sometimes by design,...

Read More »KOF Economic Barometer: Prospects for the Swiss Economy Continue to Brighten Up

The KOF Economic Barometer rose by 3.0 points in October. This is the second upward movement in succession. The indicator reached 109.1 points in October (after revised 106.1 in September). Autumn is welcoming the Swiss economy with a tailwind. In October 2017, the KOF Economic Barometer rose to a new reading of 109.1 points, its highest level since September 2010. The upward tendency is mainly driven by the...

Read More »Emerging Markets: What has Changed

Stock Markets EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon. Stock Markets Emerging Markets, October 30 Source: economist.com - Click to enlarge South...

Read More »FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

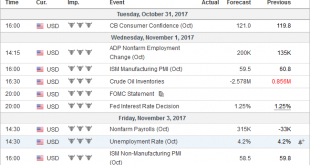

Summary Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain. The week ahead will be among the busiest in Q4. In this note, we provide a brief sketch of the different events and data points that will shape the investment climate. Given the importance of initial conditions, we will begin with an overview of the...

Read More »Three Developments in Europe You may have Missed

The focus in Europe has been Catalonia’s push for independence and the attempt by Madrid to prevent it. Tomorrow’s ECB meeting, where more details about next year’s asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many...

Read More »Global billionaire club gets bigger and richer

Ernesto Bertarelli is one of Switzerland's 35 billionaires (Keystone) - Click to enlarge The total wealth of the world’s 1,542 billionaires – including 35 in Switzerland – grew 17% to $6 trillion (CHF5.93 trillion) last year, led by a surge in Asia’s emerging billionaire class and growth in the materials, industrials, financial and technology sectors. The wealth of Switzerland’s billionaires grew by a mere...

Read More »Swiss tax spy ‘acted out of patriotism’

A Swiss man (centre, between his lawyers) has confessed to spying on the tax authorities in the German state of North Rhine-Westphalia. (Keystone) - Click to enlarge A Swiss man accused of spying on the German state of North Rhine-Westphalia’s (NRW) tax authority has confessed and named names. In a Frankfurt court on Thursday, the 54-year-old man, identified only as Daniel M., explained via his defence team...

Read More »Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

– Gold is better store of value than bitcoin – Goldman Sachs report– Gold will continue to perform well thanks to uncertainty and wealth demand– Bitcoin’s volatility continues to impact its role as money– Gold up 12% in 2017, bitcoin over 600% – BTC is six times more volatile than gold – see chart– Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value Bitcoin Price...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org