© Pogonici | Dreamstime - Click to enlarge At the end of September the Swiss government announced an average nationwide health premium rise of 4% in 2018. This government calculation is rather narrow. It only looks at the price of standard compulsory insurance, including accident cover, for an adult with a CHF 300 deductible. Price comparison site bonus.ch calculates that this policy configuration only applies to 18.3%...

Read More »A Different Powelling – Precious Metals Supply and Demand Report

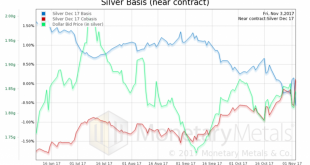

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. New Chief Monetary Bureaucrat Goes from Good to Bad for Silver The prices of the metals ended all but unchanged last week, though they hit spike highs on Thursday. Particularly silver his $17.24 before falling back 43 cents, to close at $16.82. Never drop silver carelessly, since it might land on your toes. If you are at...

Read More »Stumbling UK Economy Shows Importance of Gold

– UK economy outlook bleak amid Brexit, debt woes and rising inflation – Confidence in UK housing market at five-year low – UK high street sales crash at fastest rate since 2009– Number registering as insolvent in England and Wales hit a five-year high in Q3 – UK public finance hole of almost £20bn in the public finances set to grow to £36bn by 2021-22– Protect your savings with gold in the face of increased financial...

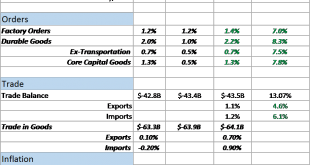

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

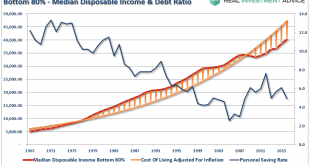

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »Is a Rapid Advance in the Japanese Stock Market Imminent?

Japanese Market About to Break Out The Japanese stock market is quite unique: it would need to rally by approximately 80% to reach its former historical peak. What’s more, said peak was attained on the final trading day of 1989, more than 25 years ago. In short, Japanese stocks have been anything but a good investment in recent years. Conversely this means that the market has a lot of potential if it were to return to...

Read More »Swiss Consumer Price Index in October 2017: Consumer prices increased by 0.1% in October

Neuchâtel, 6.11.2017 (FSO) – The consumer price index (CPI) increased by 0.1% in October 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Switzerland Consumer Price Index, )...

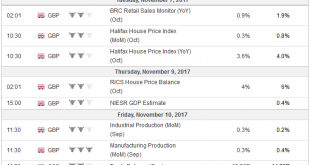

Read More »FX Weekly Preview: The Week of Digestion

Summary: Quiet week ahead. RBA and RBNZ policy meetings; no change is expected. US tax reform and the newest Fed governor, Quarles speaks. Q3 data renders September data too old to matter much. United Kingdom The week ahead does not have nearly the event risk of last week. It is difficult to compete with a BOE rate hike that spurred the largest sterling decline in five months, the nomination of a new Fed...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018. Stock Markets Emerging Markets, November 04 Source: economist.com - Click to enlarge...

Read More »Cool Video: Bloomberg TV on Powell–Heir Apparent

- Click to enlarge In London on business and had the opportunity to go to Bloomberg. In this clip, Francine Lacqua discuss the likely nomination of Fed Governor Powell to succeed Yellen at the helm of the Federal Reserve. I make three points. First, that, like others, I recognize a strong element of continuity between Bernanke, who was first appointed by a Republican, Yellen, and now, presumably Powell. Obama...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org