Swiss Franc The Euro has risen by 0.11% to 1.0535 EUR/CHF and USD/CHF, May 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and...

Read More »FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Swiss Franc The Euro has risen by 0.09% to 1.0562 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday’s loss. The S&P...

Read More »FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

Swiss Franc The Euro has fallen by 0.06% to 1.0513 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares...

Read More »FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Swiss Franc The Euro has fallen by 0.26% to 1.056 EUR/CHF and USD/CHF, March 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today....

Read More »Economy: Curved Again

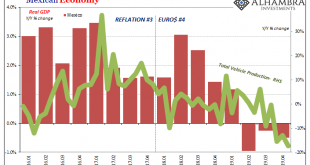

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession. On a yearly basis, it was actually the third straight. Nothing seems to have changed as 2019 drew to...

Read More »FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Swiss Franc The Euro has fallen by 0.27% to 1.0592 EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday’s moves were in excess. Japanese markets, which were...

Read More »FX Daily, February 24: Stocks Slammed and Yields Drop as Virus Containment Fails

Swiss Franc The Euro has fallen by 0.15% to 1.0588 EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a...

Read More »FX Daily, February 21: Covid-19 Contagion Outside China Keeps Investors on the Defensive

Swiss Franc The Euro has risen by 0.02% to 1.061 EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft..com - Click to enlarge FX Rates Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. ...

Read More »FX Daily, February 13: Surprise? China Undercounts Afflictions and Fatalities, Curbs Risk Taking

Swiss Franc The Euro has fallen by 0.13% to 1.0619 EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears...

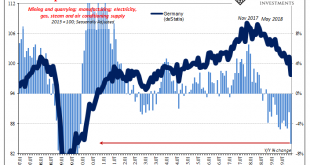

Read More »As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org