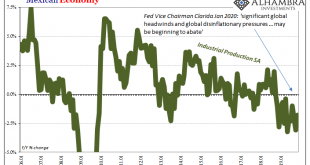

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October. That doesn’t sound like much, -1.8%, but apart from recent months this would’ve been the third worst result since 2009. Mexico has rarely experienced that kind of seemingly mild contraction. It signals...

Read More »Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts). Mexico is, as I’ve been writing this week, the presumed...

Read More »The Real Trade Dilemma

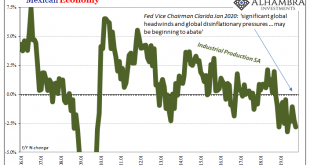

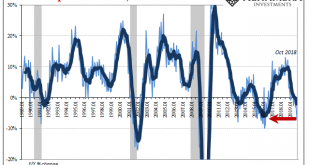

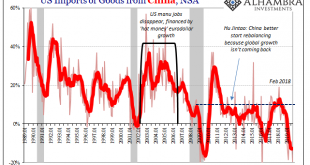

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are. They may be winners because of it but somehow they all still end up in the losing column. Late...

Read More »FX Daily, December 17: Sterling Drops as New Brinkmanship Begins

Swiss Franc The Euro has risen by 0.04% to 1.0945 EUR/CHF and USD/CHF, December 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Efforts by a UK Prime Minister emboldened by a strong electoral victory to ensure that trade negotiations with the EU are not extended as the divorce has encouraged further profit-taking on sterling. After testing the $1.35 area on the exit polls last week, sterling had returned...

Read More »More Signals Of The Downturn, Globally Synchronized

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »The Sudden Need For A Trade Deal

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018? I don’t mean to ask what his rationale was, more along the lines of, why 2018? Why...

Read More »FX Daily, September 26: Greenback Remains Firm

Swiss Franc The Euro has risen by 0.15% to 1.0866 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is...

Read More »FX Daily, September 23: Dreadful European Flash PMI Drags the Euro Lower

Swiss Franc The Euro has fallen by 0.24% to 1.089 EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The critics who claim the ECB’s policy response was disproportionate got a rude shock today with the unexpected weakness revealed by the flash PMI. The euro looks to re-visit the lows set recently near $1.0925. Sentiment has also been eroded by the poor South Korean export figures....

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

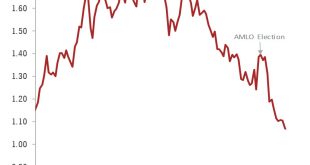

Read More »Uncertainty mounts over Mexico’s direction

The resignation of the Mexican finance minister raises further questions over prospects for Mexican assets.Carlos Urzúa, the Mexican Finance Minister, unexpectedly quit on Tuesday. His resignation, announced in a letter in which he set out the “many” disputes he had had with the administration of president Andrés Manuel López Obrador (AMLO), is meaningful from several standpoints. A respected official, Urzúa was seen by financial markets as a moderate, whose commitment to fiscal prudence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org