The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other words, you can’t blame December on the pandemic. COVID-19 is a 2020 thing. We aren’t supposed to be concerned with the end of 2019 anyway according to the popular economic narrative. This is the one, widely repeated, that says the global economy finished up last year the right way. In whole and in most

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, China, coronavirus, currencies, economy, Europe, Featured, Federal Reserve/Monetary Policy, France, GDP, Germany, industrial production, Italy, Markets, Mexico, newsletter, real GDP, South Africa, Spain

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be probed. In other words, you can’t blame December on the pandemic. COVID-19 is a 2020 thing. We aren’t supposed to be concerned with the end of 2019 anyway according to the popular economic narrative. This is the one, widely repeated, that says the global economy finished up last year the right way. In whole and in most parts, things had already begun moving in the right direction. Transitory headwinds and disinflationary pressures were, to some officials, moved out. |

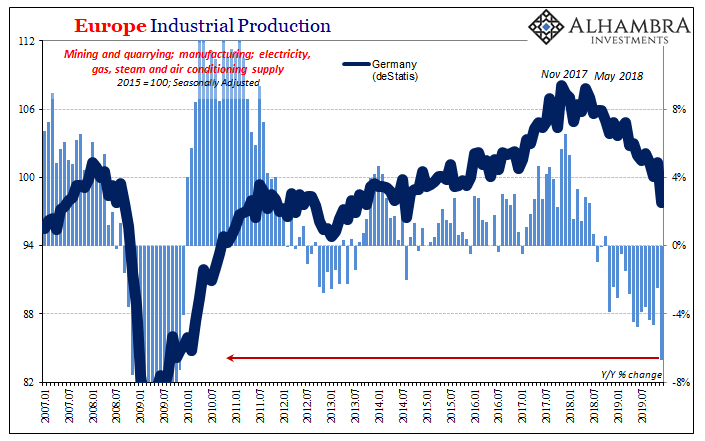

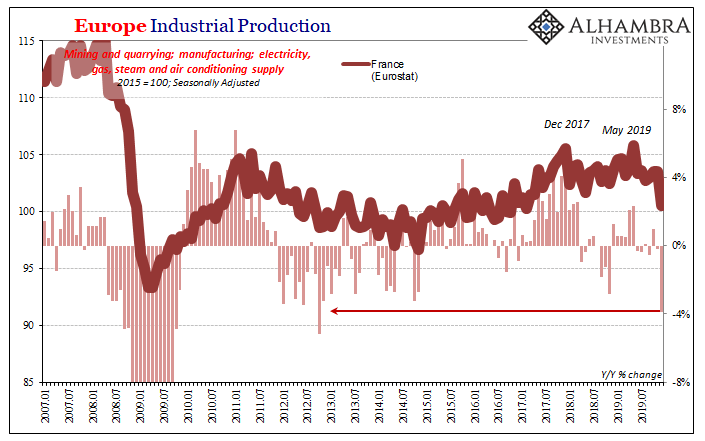

Europe Industrial Production, 2007-2019 |

| Except, no, we continue to find more actual evidence that the whole global economy as well as it parts began this year precariously at best. Before the Chinese plague, far too many places were indicating serious, gross economic deterioration.

It only begins with Europe. On that side of the Atlantic we’ve already noted what happened to German industry. The bellwether sector of this global bellwether economy collapsed in very recessionary fashion. Classical cyclical stuff more like 2008 and 2009 than even 2012. |

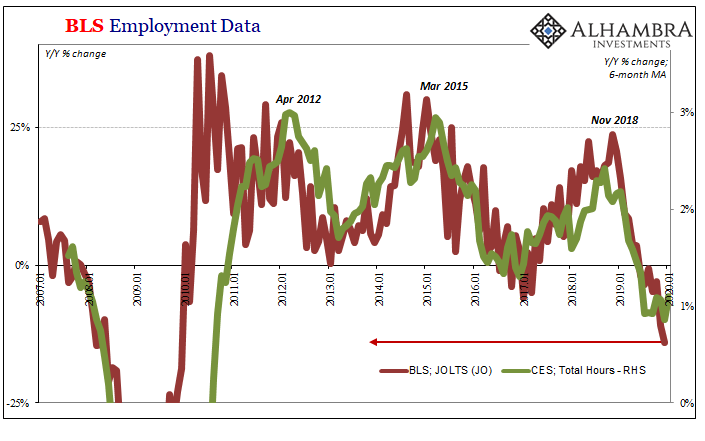

BLS Employment Data, 2007-2019 |

| The hope has been, oftentimes promised, that Germany’s problems were either idiosyncratic or they’d be squared away by QE and “stimulus” before it could infect (to continue using the disease metaphor) the rest of Europe’s national economies. Smart preemptive thinking by Mario Draghi in his last heroic act.

No dice. |

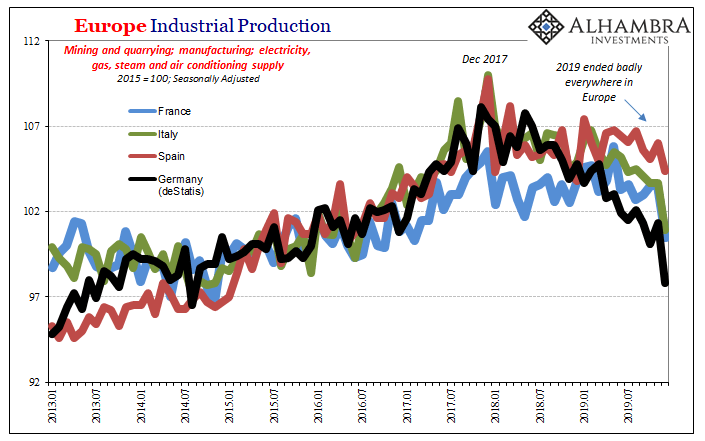

Europe Industrial Production, 2013-2019 |

| The latest data from Eurostat on European industry, quite to the contrary, indicates a big lurch downward to end 2019. Industrial Production in both France and Italy pulled a Germany in December and contracted at the fastest rates in years. Spain wasn’t far behind as it has become very clear, contrary to the sentimental upturn, that Europe’s economy took a turn for the worse just as the calendar ran out.

And now the fallout from the coronavirus. |

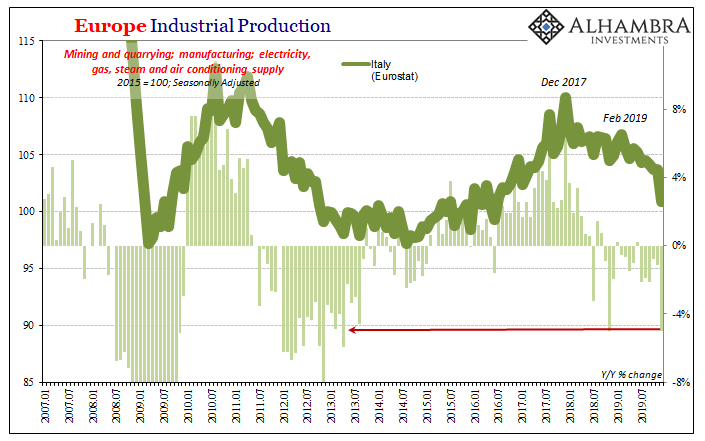

Europe Industrial Production, 2007-2019 |

| But it wasn’t just Europe. From Mexico to South Africa, there’s little to no evidence outside of sentiment surveys (some easily swayed by the myths of QE and monetary policies) the global economy had bottomed by December let alone had been several months into a rebound.

We can add the US labor market in that mix, too, after today’s Job Openings. The pictures and charts tell the story all-too-well. |

Europe Industrial Production, 2007-2019 |

Tags: China,coronavirus,currencies,economy,Europe,Featured,Federal Reserve/Monetary Policy,France,GDP,Germany,industrial production,Italy,Markets,Mexico,newsletter,real GDP,South Africa,Spain