(Disclosure: Some of the links below may be affiliate links) Even before my son was born, I knew I was going to invest for my children. It is a great idea to invest for your children, and it makes a lot more sense than to let money rests on a bank account with very low interest rates. However, until recently, I never worried about how to achieve that. Once my son was born, it was time to research the best way to invest for my children! And I found a great way to do so. In this article, I will share how you can invest for your children and what I am going to do for mine. Why invest for your children? First, you may wonder why invest for your children in the first place. That is a good question. Most parents will gift some money over time to their children and then give it to them once

Topics:

The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

Even before my son was born, I knew I was going to invest for my children. It is a great idea to invest for your children, and it makes a lot more sense than to let money rests on a bank account with very low interest rates.

However, until recently, I never worried about how to achieve that. Once my son was born, it was time to research the best way to invest for my children! And I found a great way to do so.

In this article, I will share how you can invest for your children and what I am going to do for mine.

Why invest for your children?

First, you may wonder why invest for your children in the first place. That is a good question.

Most parents will gift some money over time to their children and then give it to them once they reach their majority (or any other specific age). In most cases, this money will end up in a bank account. The problem with that is that bank accounts have little to no returns. So, the money will slowly lose its value due to inflation.

The same reasons to invest that apply to you apply to your children as well. We want to increase returns and avoid losing value to inflation.

Another reason to invest for my children is to try to teach them the value of investing. It may be naive, but I hope to teach my children how to handle their money properly. I will tell you in 20 years how it went!

In parallel, I also plan to have a bank account for my children. In this bank account, I will simply deposit whatever he receives as gifts. I also prefer this to be separated.

Keep in mind that as long as your children do not pay taxes, you will have to pay net worth taxes on these assets. So, this is not a way to reduce your net worth taxes!

Decide in what to invest for your children

You will first need to decide in what you want to invest for your children. In this article, I am assuming you want to invest in stocks. But this technique would work with anything available on the stock market, including funds with real estate, crypto, or gold.

If you are thinking of investing for your children, you are likely to have a portfolio yourself. So, you could replicate your portfolio for your children.

Personally, our portfolio is very simple. It has only two ETFs:

- 80% Vanguard Total World (VT) – An ETF investing in the entire world.

- 20% iShares Core SPI (CHSPI) – An ETF investing in Switzerland.

And I could definitely replicate that for my children. However, I have decided to make it simpler and simply invest in VT. I may change this in the future and switch some to CHSPI (or others) as my children get closer to their majority, but for now, I feel comfortable with only VT. Using a single ETF will also make it much cheaper since buying on American stock exchanges is more than ten times cheaper than buying on the Swiss stock exchange.

If you do not know where to start, you can check out my guide on setting up a portfolio from scratch. But you should try to make it as simple as possible.

The best way to invest for your children

After some research, I have found what I consider the best way to invest for my children.

First, I wanted to have an account in their name, but that turned out to not be very practical since it would significantly limit access to the stock market and the good services. So, in the end, the account will be in my name. But this does not matter since I will gift that account once my child is major. And in any case, even if the money is in your child’s name, you are responsible for it until their majority.

The second thing I wanted was that their account was entirely separated from mine. I did not want to see their shares in my investment account. This separation is important for me because I can separate my net worth from their net worth. And it will also show the performance of each portfolio since they will be slightly different.

Third, I needed something where I could start with little money. I do not want to have to start with 2000 CHF or more just to fit the minimum of some services.

Finally, I wanted something cheap and efficient. For me, that meant investing in index ETFs with low transaction fees for buying.

With all these points, I found out only one good solution to invest for my children. I will use a separate Interactive Brokers account for each of my children.

This solution is very simple. You can manage the accounts directly from the same interface on Interactive Brokers. You only have one login. All the accounts are linked together. But they are separated so that they have shares and cash, and each has its own configuration.

This solution is very cheap since Interactive Brokers is the cheapest broker for Swiss investors. In 2021, Interactive Brokers has removed the custody fees below 120’000 USD. So, you can have several accounts, each with little money, and pay no fee. All the accounts are in my name, but again, this should change nothing.

So, in the rest of this article, I will detail how to invest for your children with Interacive Brokers.

Create a second Interactive Brokers account

Everything you need to buy stocks and ETFs, reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

This article assumes that you are already using Interactive Brokers. As such, we will create a second IB account linked to your main account. If you do not have an IB account, I have a guide on creating an IB account and start investing.

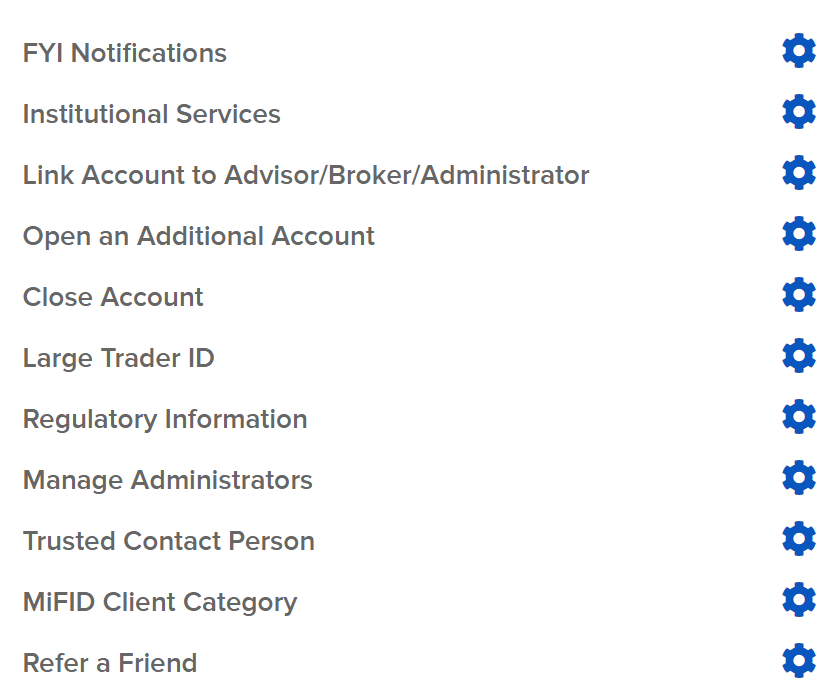

Creating a second account at IB to invest for your children is relatively easy. If you go into your account settings, you will see a button to open an additional account. This button will start creating an account that will be automatically linked to your current account. It means you will have only a single login but two accounts behind it.

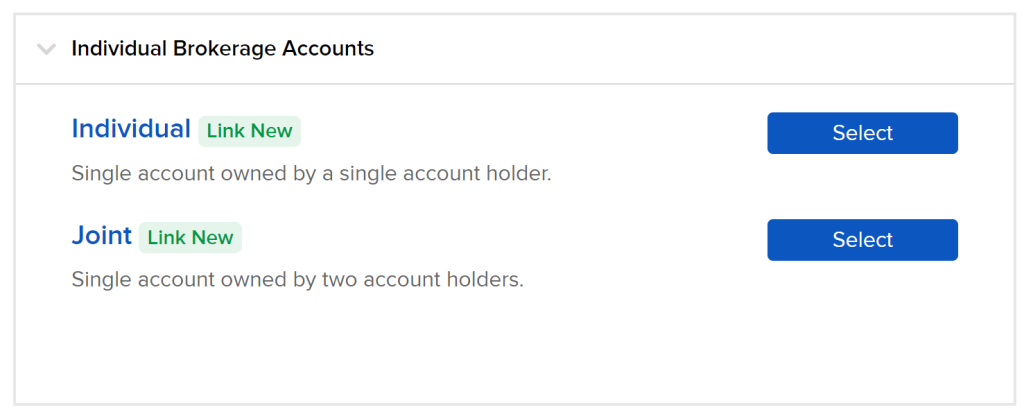

In the next step, you will have to select whether you want an individual account or a joint account. I recommend you create an account of the same type as your main account.

Then, you will have to select whether you want a cash or margin account. You should be unlikely to use leverage with your children’s money, so you probably want to use a cash account here.

After this, you will have to choose which permissions you want. These permissions will decide what you can access on the stock market. By default, this will be the same as your main account and should be fine already.

Then, you will have to check all the agreements and review all the information you have entered. Once you are sure that this information is correct, you can sign with your name and finish the application.

They are finally going to ask you why you asked for this account. I have simply answered truthfully, and there did not seem to be any problem.

Then, this will be up to the approval team to approve or deny your account. I honestly do not know what criteria they are using to do so. In my case, it took one working day to get the new account approved.

Finalize the new account

Once IB has approved your new account, you will be able to view both accounts in Interactive Brokers’ web interfaces. For instance, when you view your portfolio, you can choose between each of your accounts.

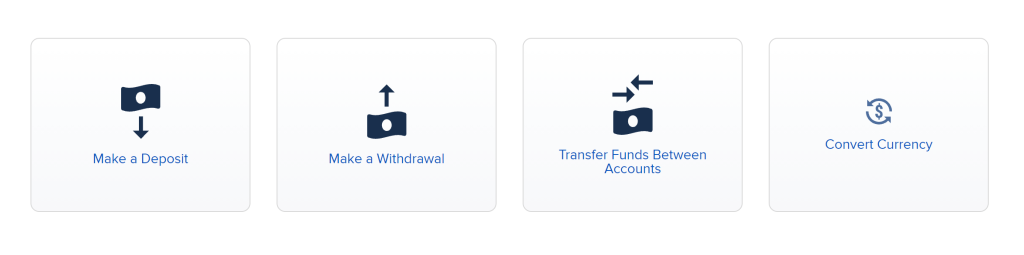

You need to wire money directly to the new account at least once. After this, you will be able to do internal transfers between your accounts. The first deposit is to validate the newly created account.

Once the first deposit is validated, you will get access to the new internal funds transfer feature in Interactive Brokers. With that feature, you cant transfer funds from one account to the other. And you can also transfer positions from account to account.

Invest in the new account

You have several ways to invest for your children with this account. And each way has advantages and disadvantages.

The first way is simply to transfer money each month, convert it (if necessary), and then buy shares in the second account. This technique is fairly simple. But it means doing two transfers (one to your main account and one to your children’s account). And it is also expensive.

If you have to convert CHF to USD, you will pay 2 CHF per conversion. And then, you will pay 0.35 USD to buy a share of a USD ETF. If we take one monthly share of VT, that’s currently about a 2.5% fee on buying shares. This price is clearly expensive. If you do not have to convert currency, it becomes an acceptable price.

If you buy ten shares of VT, that is acceptable. But most parents will not invest that much every month. You could decide to invest less regularly, but that is a bad option since investing often is better.

The second way is to transfer funds from your main account. That way, you can do conversions for yourself and then transfer some converted cash to your children’s accounts. And then, you can buy shares from there. You will only pay about 0.35 USD per investment.

Finally, you could simply transfer shares from your main portfolio into your children’s account. That way, you can buy shares for yourself and transfer some of these to the second account. This is the cheapest way to do it.

Even though it is not the optimal way, I will use the second option. I want to keep track of each operation in the children’s account to know how much I paid for shares. This technique will cost 0.35 USD in extra fees each month, but that is something I can live with.

Limitations

Remember that this technique to invest for your children does not work if you have several IB accounts with the same email address. In that case, you will not even see the button to add a new account.

In which case, you have two options:

- Delete the other accounts.

- Change your email in your other accounts so that your main account is the only one with this email.

This issue happened to me because I had an investart account with the same email address for testing. And Investart is using IB accounts to invest in your name. Once I cleared this out, I was able to create a new account.

Conclusion

There you have it! Using a second Interactive Brokers account is a great way to invest for your children. This solution is very cheap, very simple, and very complete.

I am using this technique to buy one share of VT every month until I give this account to my son once he is major. If I have other children, I will then open yet another account.

There are probably other ways to invest for your children. Unfortunately, this is the only good way I have found. All other brokers have strong disadvantages, either in costs or efficiency (or both!).

Robo-advisors could be a nice way to invest for your children, but they have high minimums that are not very practical for this case. Also, if you already invest with a robo-advisor, you would not be able to open a second account in most cases.

If you do not already, I would recommend starting to invest for you before you invest for your children. To help you, I have a guide on how to get started investing in the stock market.

What about you? Do you invest for your children? How?