Taper Is Coming: Got Bonds?

Taper Is Coming: Got Bonds?

2021-05-26

Taper Is Coming: Got Bonds? The solid economic recovery and easing of COVID restrictions lead us to believe a tapering of QE may not be far off. Further supporting our opinion, inflation has fully recovered to pre-pandemic levels, and employment is improving rapidly.

Weekly SNB Sight Deposits and Speculative Positions: Inflation is there, CHF must Rise

Weekly SNB Sight Deposits and Speculative Positions: Inflation is there, CHF must Rise

2021-05-25

Update May 24 2021: SNB intervening. Sight Deposits have risen by +1.9 bn CHF, this means that the SNB is intervening and buying Euros and Dollars.

Technically Speaking: Yardeni – The Market Will Soon Reach 4500

Technically Speaking: Yardeni – The Market Will Soon Reach 4500

2021-05-18

“The strong economic recovery will not get interrupted by inflation or a credit crunch, and the market will soon reach 4,500.” – Ed Yardeni via Advisor Perspectives. After discussing BofA’s view of why the market could drop to 3800, I thought it fair to discuss a more optimistic view.

Technically Speaking: If Everyone Sees It, Is It Still A Bubble?

Technically Speaking: If Everyone Sees It, Is It Still A Bubble?

2021-05-11

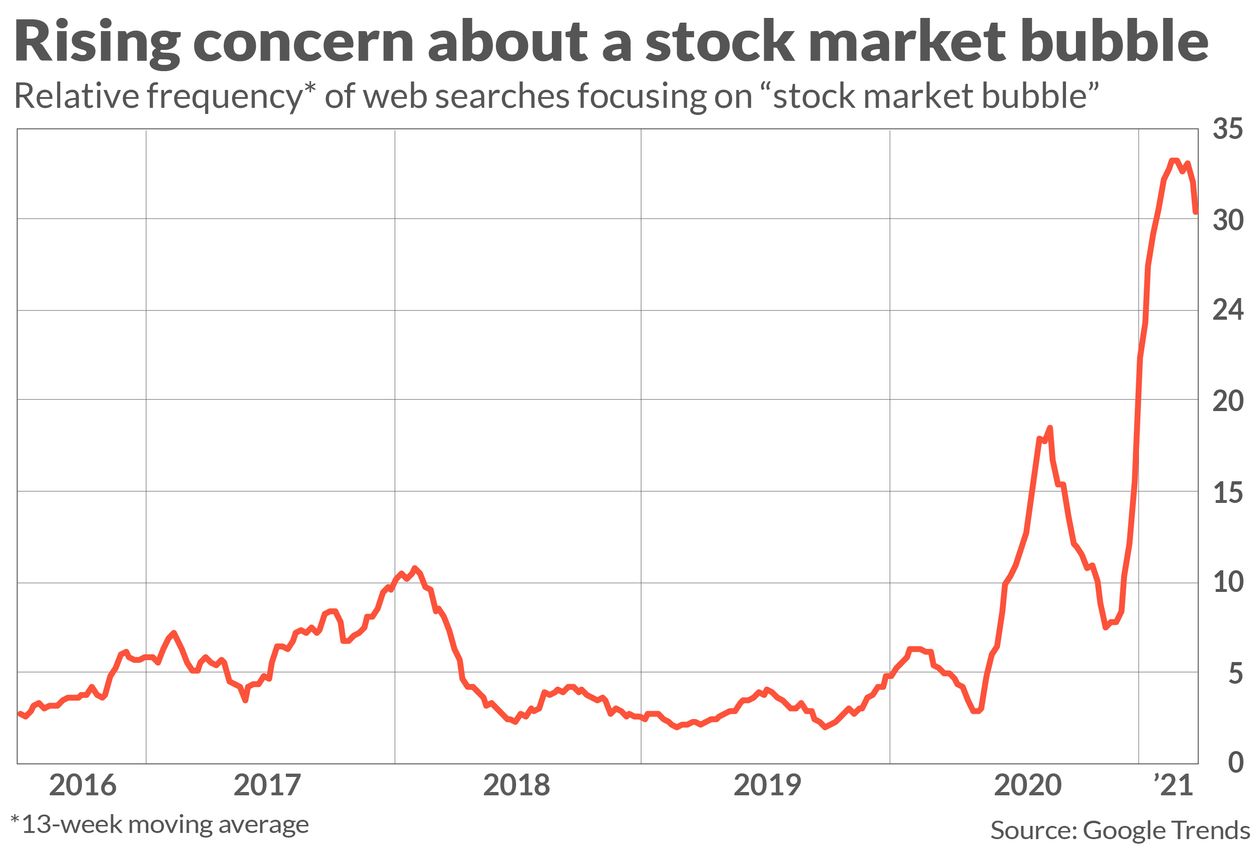

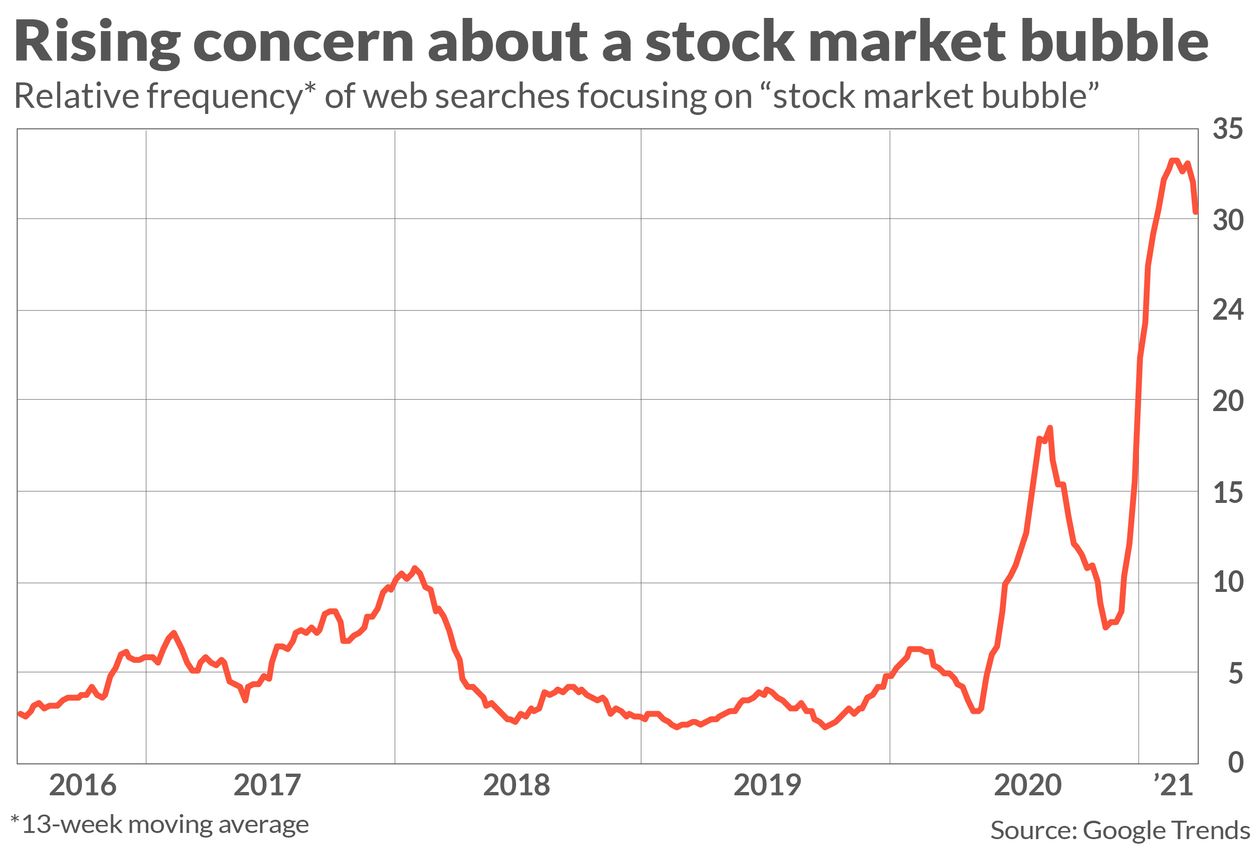

“If everyone sees it, is it still a bubble?” That was a great question I got over the weekend. As a “contrarian” investor, it is usually when “everyone” is talking about an event; it doesn’t happen.

As Mark Hulbert noted recently, “everyone” is worrying about a “bubble” in the stock market.

#MacroView: Are Stocks Cheap, Or Just Another Rationalization?

#MacroView: Are Stocks Cheap, Or Just Another Rationalization?

2021-05-07

Are stocks “cheap,” or is this just another bullish “rationalization.” Such was the suggestion by the consistently bullish Brian Wesbury of First Trust in a research note entitled “Yes, Stocks Are Cheap.” To wit:

“The Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as a whole remains undervalued. As a result, we remain bullish and are lifting our targets.”

Yes, it is true the Fed remains highly accommodative, which has undoubtedly pushed asset prices higher. In fact, financial conditions recently reached a historic low, which suggests elevated asset valuations ironically.

We have busted the “myth of cash on the

All Inflation Is Transitory. The Fed Will Be Late Again.

All Inflation Is Transitory. The Fed Will Be Late Again.

2021-05-02

In this issue of “All Inflation Is Transitory, The Fed WIll Be Late Again.“

Market Review And Update

All Inflation Is Temporary

The Fed Should Be Hiking Now

Portfolio Positioning

#MacroView: No. Bonds Aren’t Overvalued.

Sector & Market Analysis

401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Catch Up On What You Missed Last Week

Market Review & Update

Last week, we said:

“The market is trading well into 3-standard deviations above the 50-dma, and is overbought by just about every measure. Such suggests a short-term ‘cooling-off’ period is likely. With the weekly ‘buy signals’ intact, the markets should hold above key support levels during the next consolidation phase.”

“As shown above, that is what is currently occurring. While

Seth Levine: Bitcoin Doesn’t Fix Defi, Defi Fixes Bitcoin

Seth Levine: Bitcoin Doesn’t Fix Defi, Defi Fixes Bitcoin

2021-05-02

Does Bitcoin Fix Defi (Definancialization)? “Bitcoin fixes this.” I cringe every time I see this popular meme. I find it worse than nails on a chalkboard. Bitcoin and other cryptocurrencies (crypto) supporters seem to wheel this tired trope out for every problem they see, particularly at economic ones. To their credit, they genuinely want to fix the financial system’s problems.

The Battle Royale: Stocks vs. Bonds (Which Is Right?)

The Battle Royale: Stocks vs. Bonds (Which Is Right?)

2021-04-28

The Battle Royale: Stocks vs. Bonds. The S&P 500 is at valuations higher than those in 1929 and rival those of 1999. Despite a recession, the index is 25% above where it was trading before the pandemic. The equity stampede is undoubtedly bullish about corporate earnings prospects and, by default, economic growth.