Stock Markets EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX. Stock Markets Emerging Markets, May 08 - Click to enlarge India India reports April WPI and...

Read More »Emerging Markets Preview: The Week Ahead

Stock Markets EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure. Stock Markets Emerging Markets, May 08 - Click to enlarge Indonesia Indonesia reports Q1 GDP Monday,...

Read More »Emerging Markets: What Changed

Summary Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM. Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge Poland Poland reports February...

Read More »Emerging Markets: Preview Week Ahead

Stock Markets EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month. Stock Markets Emerging Markets,...

Read More »Emerging Markets: What Changed

Summary China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook. South Africa...

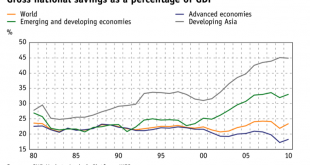

Read More »Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indicator to GDP growth. The Net National Savings Rate (NNSR) is rather positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. The relationship of GDP growth to those four criteria, however, is often a negative correlation. We critized GDP growth that has...

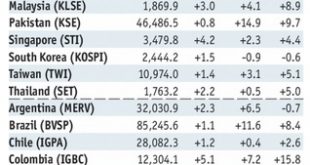

Read More »Emerging Equities Outshine Developed Markets

In the years before the 2008 financial crisis, investors flocked to equities in fast-growing emerging economies. But when the crisis put the brakes on global growth, that attraction to emerging markets proved a fickle one, and investors sought safe haven in less risky investments. In late 2016, however, the pendulum is swinging back again, with investors citing several reasons for renewed confidence in emerging market equities. Among the most surprising? Their politics are relatively more...

Read More »Tens of Thousands of Deaths from Forest Fires in Indonesia

In the FT, Jeevan Vasagar reports about a study according to which the haze spreading from Indonesian forest fires in Fall 2015 killed about 100 000 people in Southeast Asia.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org