Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out. You see inflation around you; anyone can only tell deflation by hopefully noticing and...

Read More »A Real Example Of Price Imbalance

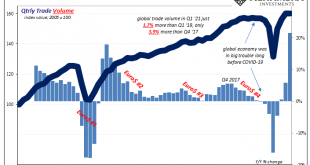

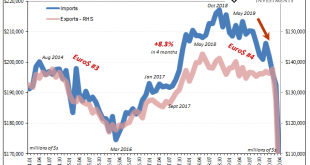

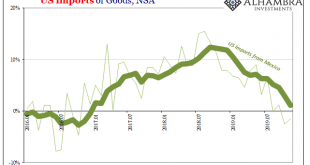

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim. That’s a problem, and much bigger one that may otherwise appear especially given current...

Read More »Real Dollar ‘Privilege’ On Display (again)

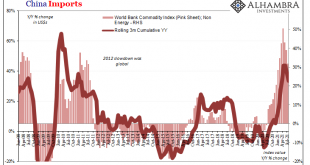

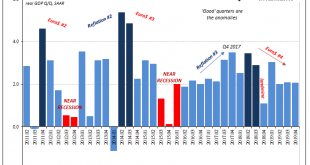

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime showed otherwise....

Read More »Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »Someone’s Giving Us The (Trade) Business

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun. Rather than becoming much...

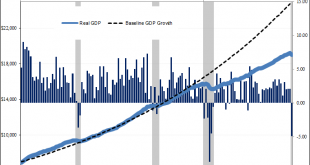

Read More »GDP + GFC = Fragile

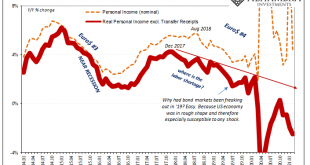

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation. It wasn’t until the middle of March that the first major shutdown orders began to appear – on Twitter feeds – and these weren’t the total lockdowns...

Read More »Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013. And that’s where the good news ends. Eurodollar Disruption, Peaks &...

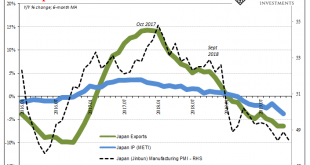

Read More »The Big And Small of Leading Japan

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.” They even publicly speculated on just when QQE would be terminated. At least that was the story, one which...

Read More »Clarida Picks Up Some Data

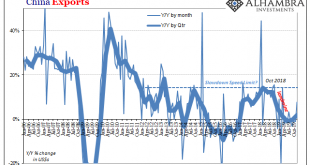

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a...

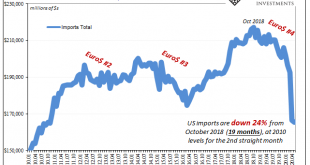

Read More »The Real Trade Dilemma

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are. They may be winners because of it but somehow they all still end up in the losing column. Late...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org