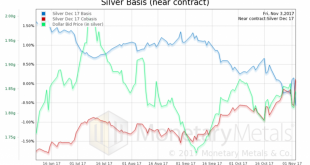

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. New Chief Monetary Bureaucrat Goes from Good to Bad for Silver The prices of the metals ended all but unchanged last week, though they hit spike highs on Thursday. Particularly silver his $17.24 before falling back 43 cents, to close at $16.82. Never drop silver carelessly, since it might land on your toes. If you are at...

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

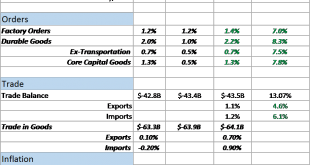

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

Read More »World’s Largest Gold Producer China Sees Production Fall 10 percent

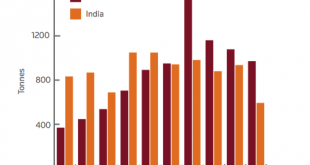

Gold mining production in China fell by 9.8% in H1 2017 Decreasing mine supply in world’s largest gold producer and across the globe GFMS World Gold Survey predicts mine production to contract year-on-year Peak gold production being seen in Australia, world’s no 2 producer Peak gold production globally while global gold demand remains robust China Gold Mine Production 1H 2016 vs 1H 2017 - Click to enlarge Gold...

Read More »Global Asset Allocation Update

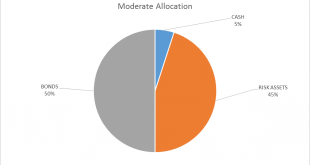

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

– Gold versus bitcoin debate makes further headlines as tech experts weigh in – Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold – Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar -Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency – Gold continues to hold...

Read More »Le vol de l’or de Chine.

- Click to enlarge L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays...

Read More »Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

– Gold is better store of value than bitcoin – Goldman Sachs report– Gold will continue to perform well thanks to uncertainty and wealth demand– Bitcoin’s volatility continues to impact its role as money– Gold up 12% in 2017, bitcoin over 600% – BTC is six times more volatile than gold – see chart– Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value Bitcoin Price...

Read More »Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class. And once we know what sort of...

Read More »Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Chart Patterns The prices of the metals dropped $20 and $0.39, a downhill slide interrupted on Thursday by speculation fueled by some economic data (as we covered in our special report), and which resumed on Friday. A look at the price charts of both metal shows what could be head and shoulders patterns. The left...

Read More »Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky. Which is fine I suppose since we own the devils (although not much in the way of the US variety) but I can’t help but wonder what happens when the spell breaks. Goldilocks may be in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org