Swiss Franc Currency Index The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now – and with it the franc recovered. Trade-weighted index Swiss Franc, February 04(see more posts on Swiss Franc Index, ) Source: market.ft.com - Click to...

Read More »The Futility of Predictions

Awesome Forecasts and the Unknowable Future Back in late 2013 I wrote a piece on human nature which was in part inspired by the bullish exuberance exhibited by a MarketWatch article predicting the DJIA at 20,000 in the near term future. Yesterday afternoon, a bit over three years later, that prediction actually became reality and I’m sure the author of that article as well as many other like minded traders popped some...

Read More »Destroying The “Wind & Solar Will Save Us” Delusion

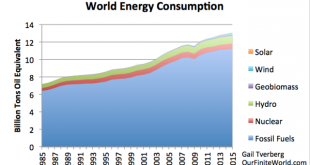

The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short list will not include fossil fuels. Some would exclude nuclear, as well. Without these energy types, we find ourselves with a short list of types of energy — what...

Read More »Switzerland: Chocolate, Watches, And Jihad

Submitted by Judith Bergmann via The Gatestone Institute, Swiss authorities are currently investigating 480 suspected jihadists in the country. “Radical imams always preached in the An-Nur Mosque… Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad.” — Saïda Keller-Messahli, president of Forum for a Progressive Islam. Switzerland is the answer to those who...

Read More »Switzerland: Chocolate, Watches, And Jihad

Submitted by Judith Bergmann via The Gatestone Institute, Swiss authorities are currently investigating 480 suspected jihadists in the country. “Radical imams always preached in the An-Nur Mosque… Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad.” — Saïda Keller-Messahli, president of Forum for a Progressive Islam. Switzerland is the answer to those who...

Read More »Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is...

Read More »Emerging Markets: What has Changed

Summary Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer...

Read More »Don’t Blame Trump When the World Ends

Alien Economics There was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook. One should probably not be overly surprised that the abominable statist rag Time Magazine is fulsomely praising Keynes’ nigh unreadable tome. We too...

Read More »What Would a Labor-Centered Economy Look Like?

How about moving the power to create money from the apex of the pyramid down to its lowest level? Let’s spend a moment deconstructing the word “capitalism.” Note it contains the word Capital. So far so good. Obviously the key concept here is capital. So what is “capital”? It turns out there are multiple kinds of capital. The most familiar kinds are tangible: cash, orchards, factories, water rights, tools, and so on....

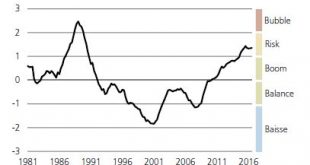

Read More »Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report. Major Findings • The UBS Swiss Real Estate Bubble Index stood in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org