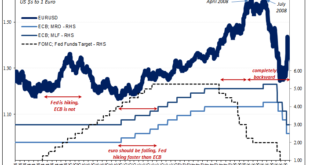

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials. A relatively more “hawkish” US policy therefore the wind in the sails of a “strong” dollar exchange regime. How else would we explain, for example, the euro’s absolute plunge since around May last year?...

Read More »Weekly Market Pulse: Welcome Back To The Old Normal

Stagflation. It’s a word that strikes fear in the hearts of investors, one that evokes memories – for some of us – of bell bottoms, disco, and Jimmy Carter’s American malaise. The combination of weak growth and high inflation is the worst of all worlds, one that required a transformational leader and a cigar-chomping central banker to defeat the last time it came around. Or at least that’s how it’s remembered. Whether the cigar-chomping central banker was really...

Read More »Expect the Unexpected from the Fed

It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%. . The equity market decline is coupled with announced layoffs. Robinhood, the popular online trading platform, announced a 9% reduction in full-time staff this week for...

Read More »Cool Video: CNBC-Asia–Brexit, Sterling, the Euro, and Dollar

I had the privilege to join Sri Jegarajah at CNBC Asia at the start of today’s Asia Pacific session. We had a broad chat about the dollar, Brexit, and the euro. He gave me the opportunity to sketch out my views: The dollar’s entered a cyclical decline, and the “twin deficit” issue will likely frame the narrative. Many observers do not use that particular phrase now, but their arguments seem to rest on one if not both of the legs. Sterling gains appear to be more...

Read More »Europas riesiger Schatz an US-Schuldtiteln

Die Eurozone ist einer der wichtigsten Gläubiger der USA. Sind diese dadurch politisch erpressbar? Irland ist der grösste US-Gläubiger in Europa, gefolgt von Luxemburg und Belgien. Foto: slon_dot_pics (Pexels) Der Handelsstreit zwischen den USA und China ist erst einmal entschärft. Beide Nationen unterzeichneten ein «Phase 1»-Abkommen. Nun rückt das Verhältnis zwischen den USA und der EU in den Fokus. Streitpunkte gibt es auch hier genügend: Donald Trump stösst sich an...

Read More »Lagarde Channels Past Self As To Japan Going Global

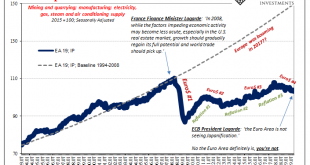

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar. The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch,...

Read More »European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

Read More »Die Kritik an der EZB greift zu kurz

Er steht vor seinem Abgang unter Kritik: EZB-Chef Mario Draghi. Foto: Keystone Eine Reihe von renommierten Ökonomen kritisieren erneut scharf die Geldpolitik der Europäischen Zentralbank mit Negativzinsen und Anlagekäufen unter dem abtretenden Mario Draghi. Die Nachrichtenagentur Bloomberg hat den Text in voller Länge publiziert. Die meisten von ihnen haben im ersten Jahrzehnt nach der Gründung der Europäischen Zentralbank (EZB) einflussreiche Ränge bei dieser bekleidet. Mit den beiden...

Read More »Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro’s price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day’s range and closing above its high. When Sri and I were talking early in the Asian morning, there...

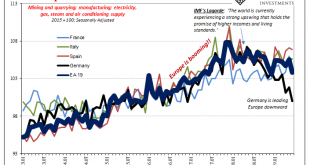

Read More »Some Brief European Leftovers

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org