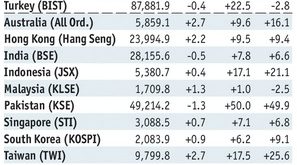

Stock Markets EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy. We believe markets are underestimating the Fed’s capacity to tighten...

Read More »Emerging Markets: What has Changed

Summary Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans. Nigerian President Buhari may...

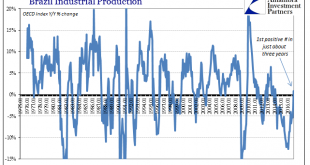

Read More »Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what...

Read More »Emerging Market Preview of the Week Ahead

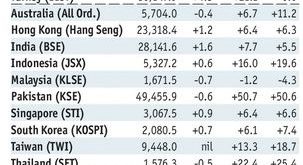

Stock Markets EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday. Stock Markets Emerging Markets February 08 Source: economist.com - Click...

Read More »Emerging Markets: What Has Changed

Summary Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to...

Read More »Emerging Markets Offer Unique Opportunities

Despite slower growth: Emerging markets remain of key importance for the Swiss financial center. Only a few years ago, emerging markets were considered a prime example of economies with almost unlimited growth potential. Thanks to annual double-digit growth rates in the wake of the financial...

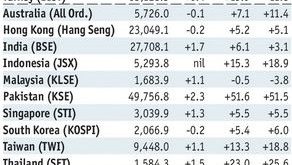

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM ended the week on a firm note, with markets digesting what they perceived as a dovish Fed bias. We disagree, and continue to believe that markets are underestimating the Fed’s capacity to tighten this year. EM FX could continue gaining some traction if the dollar correction continues, but we think US interest rates will ultimately move higher and put pressure on EM once again. Stock Markets Emerging...

Read More »Emerging Markets: What has Changed

Summary Philippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. The Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Allies of Brazil President Michel Temer...

Read More »Economic Normalization vs. Political Polarization

The global economy appears to be enjoying a solid start to 2017. Business surveys such as the Purchasing Managers' Indices (PMI) indicate that momentum accelerated toward the end of 2016 in nearly all major economies. Still low interest rates, stable commodity prices, as well as a generally...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling. Markets ignored reports that the PBOC has asked banks...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org