Stock Markets EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling. Markets ignored reports that the PBOC has asked banks to limit lending, which we think is negative for growth and EM in general. Several EM countries were either downgraded or had their outlooks cut last week, including Turkey, Nigeria, and Chile. S&P affirmed China’s AA- rating but maintained a negative outlook due to rising financial risks. Our quarterly EM and Frontier Sovereign ratings models warn of a continued bias towards downgrades this year. Stock Markets Emerging Markets January 30 Source: economist.com - Click to enlarge Chile Chile reports December manufacturing production and retail sales Monday. The former is expected at -1.3% y/y while the latter is expected at +4.9% y/y. The soft economy and falling inflation allowed the central bank to start the easing cycle this month. The next policy meeting is February 14, and we think another 25 bp cut to 3.0% is likely then.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

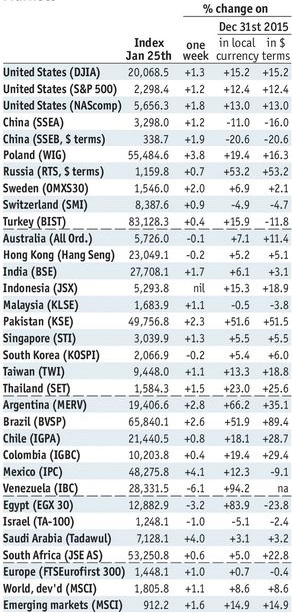

Stock MarketsEM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling. Markets ignored reports that the PBOC has asked banks to limit lending, which we think is negative for growth and EM in general. Several EM countries were either downgraded or had their outlooks cut last week, including Turkey, Nigeria, and Chile. S&P affirmed China’s AA- rating but maintained a negative outlook due to rising financial risks. Our quarterly EM and Frontier Sovereign ratings models warn of a continued bias towards downgrades this year. |

Stock Markets Emerging Markets January 30 Source: economist.com - Click to enlarge |

ChileChile reports December manufacturing production and retail sales Monday. The former is expected at -1.3% y/y while the latter is expected at +4.9% y/y. The soft economy and falling inflation allowed the central bank to start the easing cycle this month. The next policy meeting is February 14, and we think another 25 bp cut to 3.0% is likely then. S&P cut the outlook on Chile’s AA- rating from stable to negative, citing risks of an extended period of weak growth. BrazilBrazil reports December central government budget data Monday, which is expected at -BRL64.5 bln. If so, the 12-month total would rise for the second straight month. Consolidated budget data will be reported Tuesday, which is expected at -BRL74.5 bln. December IP will be reported Wednesday, which is expected at -0.1% y/y vs. -1.1% in November. January trade will also be reported Wednesday. South AfricaSouth Africa reports December money and loan growth and trade Tuesday. Both are expected to stabilize compared to November, but have slowed significantly over the course of last year in response to SARB tightening. While the central bank is clearly reluctant to hike rates further, inflation remains too high to contemplate easing. Next policy meeting is March 30, no change is likely then. TurkeyTurkey reports December trade Tuesday, which is expected at -$5.6 bln. The central bank releases its quarterly inflation report Tuesday, while January CPI will be reported Friday. Headline inflation is seen at 8.6% y/y vs. 8.5% in December. Core and PPI inflation are also expected to accelerate, yet the central bank refrained this month from hiking the benchmark rate. Fitch downgraded Turkey a notch to sub-investment grade BB+ Friday, as expected, but moved the outlook to stable even as S&P moved the outlook on its BB rating from stable to negative. MexicoMexico reports Q4 GDP Tuesday. According to the monthly data already reported, growth is likely to pick up from 2.0% y/y in Q3. Inflation was 4.78% y/y in mid-January. It is moving further above the 3% target, which will require further central bank tightening. Next policy meeting is February 9, and another 50 bp hike seems likely then. Relations between the US and Mexico are likely to be the key peso driver this week, and signs point to further tensions ahead. KoreaKorea reports December IP and January trade Wednesday. January CPI will be reported Thursday, which is expected to rise 1.5% y/y vs. 1.3% in December. If so, this would be the highest since and closer to the 2% target/. As such, the BOK is likely to retain a hawkish bias in 2017. Next policy meeting is February 23, no change is expected then. December current account data will be reported Friday. ChinaChina reports official manufacturing PMI for January Wednesday, which is expected to drop slightly to 51.2. Caixin reports its manufacturing PMI Friday, which is expected to also tick lower to 51.8 vs. 51.9 in December. Press reports that the PBOC asked banks to limit loan activity in Q1 is negative for the economic outlook. If so, we would expect the economic numbers to soften a bit going forward. ThailandThailand reports January CPI Wednesday, which is expected to rise 1.5% y/y vs. 1.1% in December. If so, this would be the highest rate since September 2014 and further within the 1-4% target range. Rising price pressures should keep the BOT in hawkish mode this year, though no move is expected at the next policy meeting February 8. Czech RepublicCzech central bank meets Thursday and is expected to keep policy unchanged. It should also keep its forward guidance steady, which sees an end to the koruna cap around mid-year. There is still a lot of debate about what the bank can and should do to limit CZK gains after the cap is ended. Negative rates seem unlikely, but perhaps the bank will shed some more light on this issue. RussiaRussian central bank meets Friday and is expected to keep rates steady at 10%. A small handful of analysts look for 25-50 bp of easing, but we think it’s too soon to cut rates. CPI rose 5.4% y/y in December, the low for the cycle but still higher than the central bank’s 4% target. We do not think the recently announced FX purchase plan will materially change the ruble’s direction, which will be determined mostly by oil prices. ColombiaColombia’s central bank releases its quarterly inflation report Friday. Colombia then reports January CPI Saturday, which is expected to rise 5.26% y/y vs. 5.75% in December. On Friday, the central bank unexpectedly kept rates steady at 7.5% while markets were looking for another 25 bp cut. While easing is likely to continue, markets will have to rethink the expected pace. Next meeting is February 24, and 25 bp cut then seems likely. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter