Summary:

Summary Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans. Nigerian President Buhari may re-emerge into the public eye soon. South African regulators are investigating a dozen banks in New York and Johannesburg for possible collusion in off-shore ZAR trading. Mexico’s President Pena Nieto has reportedly asked Banco de Mexico Governor Carstens to stay on until December. New Venezuelan Vice President El Aissami was put on the US Treasury’s list of foreign nationals subject to economic sanctions. Stock Markets In the EM equity space as measured by MSCI, Brazil (+2.6%), Hungary (+2.5%), and Qatar (+2.0%) have outperformed this week, while Peru (-3.7%), Egypt (-2.8%), and Colombia (-2.7%) have underperformed. To put this in better context, MSCI EM rose 0.9% this week while MSCI DM rose 0.9%.

Topics:

Win Thin considers the following as important: El Aissami, emerging markets, Featured, Jay Y. Lee, Kim Jong-un, newsletter, Pena Nieto, Samsung Group, win-thin, Yakubu Dogara

This could be interesting, too:

Summary Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans. Nigerian President Buhari may re-emerge into the public eye soon. South African regulators are investigating a dozen banks in New York and Johannesburg for possible collusion in off-shore ZAR trading. Mexico’s President Pena Nieto has reportedly asked Banco de Mexico Governor Carstens to stay on until December. New Venezuelan Vice President El Aissami was put on the US Treasury’s list of foreign nationals subject to economic sanctions. Stock Markets In the EM equity space as measured by MSCI, Brazil (+2.6%), Hungary (+2.5%), and Qatar (+2.0%) have outperformed this week, while Peru (-3.7%), Egypt (-2.8%), and Colombia (-2.7%) have underperformed. To put this in better context, MSCI EM rose 0.9% this week while MSCI DM rose 0.9%.

Topics:

Win Thin considers the following as important: El Aissami, emerging markets, Featured, Jay Y. Lee, Kim Jong-un, newsletter, Pena Nieto, Samsung Group, win-thin, Yakubu Dogara

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

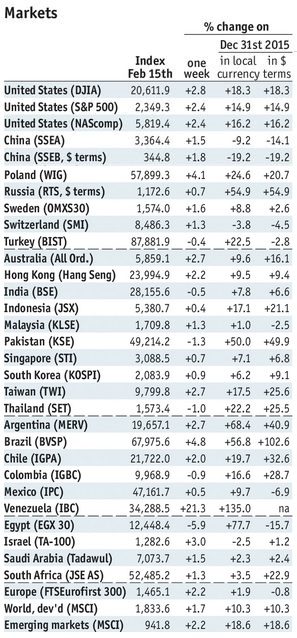

Stock MarketsIn the EM equity space as measured by MSCI, Brazil (+2.6%), Hungary (+2.5%), and Qatar (+2.0%) have outperformed this week, while Peru (-3.7%), Egypt (-2.8%), and Colombia (-2.7%) have underperformed. To put this in better context, MSCI EM rose 0.9% this week while MSCI DM rose 0.9%.

In the EM local currency bond space, China (10-year yield -7 bp), Hungary (-6 bp), and Poland (-4 bp) have outperformed this week, while Russia (10-year yield +18 bp), Mexico (+16 bp), and Czech Republic (+12 bp) have underperformed. To put this in better context, the 10-year UST yield was flat this week at 2.41%.

In the EM FX space, EGP (+9.8% vs. USD), ZAR (+2.1% vs. USD), and TRY (+1.7% vs. USD) have outperformed this week, while COP (-1.9% vs. USD), PLN (-0.8% vs. EUR), and CLP (-0.6% vs. USD) have underperformed.

|

Stock Markets Emerging Markets February 15 Source: economist.com - Click to enlarge |

KoreaHead of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The arrest as linked to the influence-peddling scandal that resulted in the impeachment of President Park. Other shoes may drop, as the heads of all nine chaebol were hauled before parliament in December to answer questions about possible corruption. Some believe that this scandal and the ensuing fallout may fundamentally change the way business is done in Korea.

The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. Coming on the heels of the recent missile test, some political analysts believe that Kim Jong Un is becoming more erratic.

PolandThe Polish central bank is tilting more hawkish. MPC member Zubelewicz said he can’t exclude a rate hike in 2017. He noted that “If risk of inflation staying above central bank reference rate increases and starts to negatively impact savings, I would expect discussion and votes within MPC.” Prior to this, MPC members had been targeting 2018 for the start of the tightening cycle.

TurkeyThe Turkish central bank said it will allow domestic companies to use liras to repay export loans. Companies will be allowed to use the bank’s FX purchase rate set on January 2 to pay off export loans maturing by May 31. This is just the latest of several unconventional moves to support the lira. It should lessen the need for companies to convert liras into foreign currencies to repay their loans.

NigeriaNigerian President Buhari may re-emerge into the public eye soon. Rumors of ill health have dogged Buhari all year. Local press reports suggest he is fit and will return to Nigeria from UK, where he has been receiving medical treatment. Buhari reportedly met the press and House of Representatives Speaker Yakubu Dogara in London Wednesday.

South AfricaSouth African regulators are investigating a dozen banks in New York and Johannesburg for possible collusion in off-shore ZAR trading. The Competition Commission said price-fixing has been going on since 2007, and that the investigation began in 2015. Regulators are reportedly seeking maximum fines equal to 10% of their turnover, but banks that cooperate are likely to be granted leniency.

MexicoMexico’s President Pena Nieto has reportedly asked Banco de Mexico Governor Carstens to stay on until December due to the ongoing risks facing the economy. Carstens has reportedly agreed to do so. Carstens had previously announced plans to step down in July and join the Bank for International Settlements in October.

VenezuelaNew Venezuelan Vice President El Aissami was put on the US Treasury’s list of foreign nationals subject to economic sanctions under the Foreign Narcotics Kingpin Designation Act. The US Treasury stated that he protected drug lords and oversaw a transportation network that exported cocaine. El Aissami has denied all charges.

|

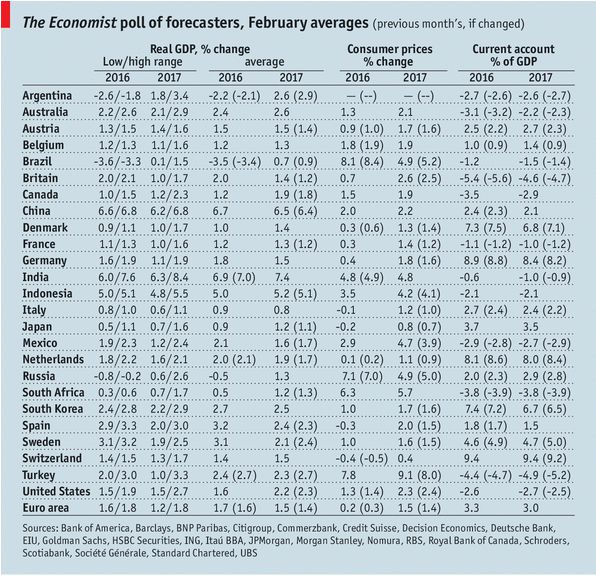

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: El Aissami,Emerging Markets,Featured,Jay Y. Lee,Kim Jong-un,newsletter,Pena Nieto,Samsung Group,win-thin,Yakubu Dogara