Son of the Imperial City What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high. The new central planner-in-chief. - Click to enlarge Central banks are facing a special case of the socialist calculation problem...

Read More »US Stock Market – How Bad Can It Get?

SPX, Quo Vadis? Considering the Crash Potential In view of the fact that the stock market action has gotten a bit out of hand again this week, we are providing a brief update of charts we have discussed in these pages over the past few weeks (see e.g. “The Flight to Fantasy”). We are doing this mainly because the probability that a low probability event will actually happen has increased somewhat in recent days....

Read More »Incrementum’s New Cryptocurrency Research Report

Another Highly Useful Report As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link). BTC Hourly, 16 - 23 March 2018(see more...

Read More »US Stock Market – The Flight to Fantasy

Divergences Continue to Send Warning Signals The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based...

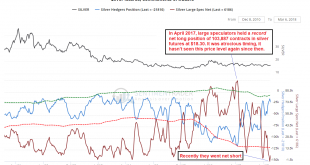

Read More »Despondency in Silver-Land

Speculators Throw the Towel Over the past several years we have seen a few amazing moves in futures positioning in a number of commodities, such as e.g. in crude oil, where the by far largest speculative long positions in history have been amassed. Over the past year it was silver’s turn. In April 2017, large speculators had built up a record net long position of more than 103,000 contracts in silver futures with the...

Read More »Stock and Bond Markets – The Augustine of Hippo Plea

Lord, Grant us Chastity and Temperance… Just Not Yet! Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their...

Read More »US Equities – Mixed Signals Battling it Out

A Warning Signal from Market Internals Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator. S&P 500 New High Lows Percent, Feb 2015 - Apr 2018(see more posts on...

Read More »US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

Stretched to the Limit There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will...

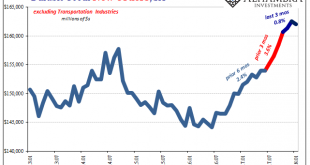

Read More »Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading. The seasonally-adjusted data gives a better sense of the distortions created by those storms. New...

Read More »Purchasing Power Parity or Nominal Exchange Rates?

Extracting Meaning from PPP “An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank Headquarters of the World Bank in Washington. - Click to enlarge We have it on good authority that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org