The Mother of All Blow-Offs We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that...

Read More »2018: The Weakest Year in the Presidential Election Cycle Has Begun

The Vote Buying Mirror Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency. The market was e.g. just as...

Read More »Several Simple Suppositions and Suspicions for 2018

A New Year of Symbiotic Disharmony The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control. Certainly, your ability to stop...

Read More »Why Monetary Policy Will Cancel Out Fiscal Policy

Remarkable and Extraordinary Growth Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas? Here’s what really happened: the government’s minions confiscated everything Santa had on him when he crossed the border and then added it to GDP. - Click to...

Read More »Season’s Greetings

A Difficult, but Also Exciting Year… Dear Readers, Another year is coming to a close, and the team at Acting Man wishes you and your loved ones a Merry Christmas / Happy Holidays and all the best for the new year. You have probably noticed that your main scribe was a lot less prolific this year than he normally tends to be; unfortunately, we were held back by health-related issues. We remain among the quick though...

Read More »How the Asset Bubble Could End – Part 2

Contradictory Signals Special antennae that help traders catch upcoming opportunities. Available from the same outfit that sells the soup-cooling spoon (Acme Inc). - Click to enlarge There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is...

Read More »How the Asset Bubble Could End – Part 1

Another Shoeshine Boy Moment We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around. Provided one manages to...

Read More »The Rug Yank Phase of Fed Policy

Bogus Jobs Pay Big Bucks The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it. The short and sweet definition of democratic elections by eminent...

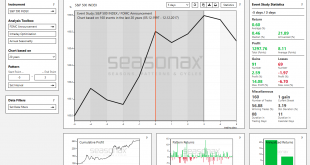

Read More »The Stock Market and the FOMC

An Astonishing Statistic As the final FOMC announcement of the year approaches, we want to briefly return to the topic of how the meeting tends to affect the stock market from a statistical perspective. As long time readers may recall, the typical performance of the stock market in the trading days immediately ahead of FOMC announcements was quite remarkable in recent decades. We are referring to the Seaonax event...

Read More »The Santa Claus Rally is Especially Pronounced in the DAX

The Gift that Keeps on Giving Every year a certain stock market phenomenon is said to recur, anticipated with excitement by investors: the Santa Claus rally. It is held that stock prices typically rise quite frequently and particularly strongly just before the turn of the year. I want to show you the Santa Claus rally in the German DAX Index as an example. Price moves are often exaggerated in the German stock market,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org