It’s Just a Flesh Wound – But a Sad Day for Vol Sellers On January 31 we wrote about the unprecedented levels – for a stock market index that is – the weekly and monthly RSI of the DJIA had reached (see: “Too Much Bubble Love, Likely to Bring Regret” for the astonishing details – provided you still have some capacity for stock market-related astonishment). We will take the opportunity to toot our horn by reminding...

Read More »“Strong Dollar”, “Weak Dollar” – What About a Gold-Backed Dollar?

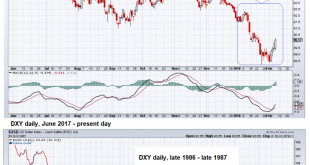

Contradictory Palaver The recent hullabaloo among President Trump’s top monetary officials about the Administration’s “dollar policy” is just the start of what will likely be the first of many contradictory pronouncements and reversals which will take place in the coming months and years as the world’s reserve currency continues to be compromised. So far, the Greenback has had its worst start since 1987, the year of...

Read More »How to Buy Low When Everyone Else is Buying High

When to Sell? The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s...

Read More »Too Much Bubble-Love, Likely to Bring Regret

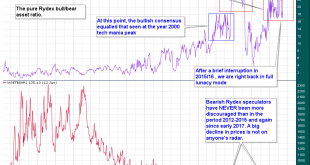

Unprecedented Extremes in Overbought Readings Readers may recall our recent articles on the blow-off move in the stock market, entitled Punch-Drunk Investors and Extinct Bears (see Part 1 & Part 2 for the details). Bears remained firmly extinct as of last week – in fact, some of the sentiment indicators we are keeping tabs on have become even more stretched, as incredible as that may sound. For instance, assets in...

Read More »Monetary Metals Brief 2018

Short and Long Term Forecasts Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We have invested many man-years in developing the theory, model, and software to calculate it. Every week we publish charts and our calculated fundamental prices. However, predicting the outlook for a longer period of time is much harder. The fundamental shows the relative...

Read More »The Donald Saves the Dollar

Something for Nothing The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon. Looking at the expression of this Mickey’s Malt Liquor tester one might...

Read More »The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

FOMC Strategy Revisited As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. The rate hikes are actually leading somewhere – after the Wile E. Coyote moment, the FOMC meeting strategy is especially useful - Click to enlarge A study published by the Federal Reserve Bank of New York in 2011 examined the effect of...

Read More »Tax Reform and Trump’s Chinese Trade Deficit Conundrum

Trade Deficit with China Widens on Trump’s Watch Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again. Photo credit: Jonathan Ernst / Reuters - Click to enlarge We are often...

Read More »As the Controlled Inflation Scheme Rolls On

Controlled Inflation American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. After an extended period of indulging in excessive moderation (left), the US consumer makes his innermost wishes known (right). - Click to enlarge On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to...

Read More »Punch-Drunk Investors & Extinct Bears, Part 2

Rydex Ratios Go Bonkers, Bears Are Dying Off For many years we have heard that the poor polar bears were in danger of dying out due to global warming. A fake photograph of one of the magnificent creatures drifting aimlessly in the ocean on a break-away ice floe was reproduced thousands of times all over the internet. In the meantime it has turned out that polar bears are doing so well, they are considered a quite...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org