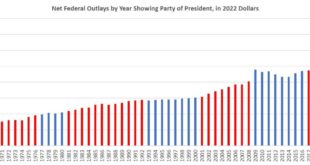

After countless predictions of economic armaggeddon and panicky entreaties to raise the debt ceiling with no strings attached, the Biden White House and Congressional Republicans agreed on a new budget deal this week that does virtually nothing at all to change the status quo. The deal in no way returns federal spending to pre-covid levels. At best, the deal does "limit" spending by placing tentative caps on spending which—assuming they are not abandoned in the face...

Read More »Can We Understand AI? A Response to Jordan Peterson’s Podcast

Like snobby teenagers claim of themselves, many say that “nobody understands artificial intelligence (AI).” For example, in a recent interview between Jordan Peterson and Brian Roemmele about ChatGPT, Jordan Peterson claimed that “The system is too complex to model” and each AI system is not only incomprehensible but unique. He further claims that “some of these AI systems, they’ve [AI experts] managed to reduce what they do learn to something approximating an...

Read More »The “Buy Black” Movement: Divisive or a Boon to Black Entrepreneurs?

Calls for black consumers to "Buy Black" can be interpreted as socially divisive, but they are also a way to encourage black entrepreneurs in a free market. Original Article: "The "Buy Black" Movement: Divisive or a Boon to Black Entrepreneurs?" [embedded content] Tags: Featured,newsletter

Read More »Smarter Talk Is Smarter Action

Americans have long thought of themselves as people of action. As Leonard Read noted in his article “How to Gain Liberty,” the sentiment “I want less talk and more action” is (or at least once was) common among Americans. It even extends to situations when people recognize that their liberties are threatened. But then the question arises as to what sorts of action are appropriate in defense of our liberties: Thus speak Americans when they suddenly awaken to the fact...

Read More »The Fed Is Insolvent, and That’s a Bad Thing

On this first episode of the Fed Watch Podcast, Ryan McMaken and Senior Fellow Alex Pollock talk about how the Federal Reserve has negative cash flow. The Fed will print money to "solve" the problem. Be sure to follow the Fed Watch Podcast at Mises.org/FedPod. Recommended Reading "The Fed’s Capital Goes Negative" by Alex J. Pollock: Mises.org/FW_01_A "Who Owns Federal Reserve Losses and How Will They Impact Monetary Policy?" by Alex J. Pollock and Paul H....

Read More »Understanding Relationships between Money Supply and Liquidity

Can the injection of new money into the economic system enhance economic growth? Not really. Increasing (or decreasing) the money supply affects the demand for money but doesn't make us wealthier. Original Article: "Understanding Relationships between Money Supply and Liquidity" [embedded content] Tags:...

Read More »A Collection of the Political Writings of William Leggett, Two Volumes

A Collection of the Political Writings of William Leggett, selected and arranged, with a preface, by Theodore Sedgwick, in two volumes. (1839) This collection provides important example of populist laissez-faire opinion from the Jacksonian Era in the United States. In terms of economic policy, the Jacksonians favored low taxes, decentralization, and hard-money while opposing central banks and regulation of private business. William Leggett was born on April 30, 1801...

Read More »The Economic Nationalists Are Wrong: Free Trade Means Freedom and Prosperity

Recently, I had the pleasure of attending a debate about the morality of capitalism between James Otteson and Michael Anton, a defender of economic nationalism. Otteson made a good case for capitalism; however, Anton derailed the debate by choosing to focus on specific policies rather than ethical concerns. Ironically, Anton admits that he has hardly ever picked up an economics textbook. Throughout the debate, Anton made claims that were either misleading or false. I...

Read More »The Putrid Underbelly of Woke Capitalism

American corporations are lavishing billions of dollars on leftist groups in the name of "equity." But many of them also are donating to even more questionable people and causes. Original Article: "The Putrid Underbelly of Woke Capitalism" [embedded content] Tags: Featured,newsletter

Read More »The Street of the Palaces

[In this 1836 editorial, William Leggett laments how Wall Street and the "privileged" orders of the American upper class employ the power of the state to protect their own financial interests at the expense of ordinary taxpayers. In the nineteenth century, Leggett was an important spokesman for the laissez-faire, populist wing of the Democratic Party which supported hard money.] There is, in the city of Genoa, a very elegant street, commonly called, The Street of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org