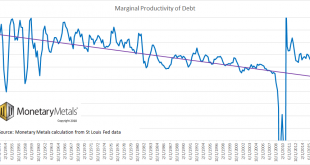

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops. “OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!” The National Balance Sheet In the first part of this series, we introduce some concepts from...

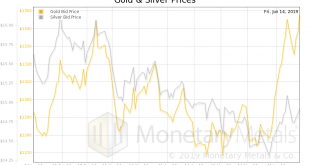

Read More »Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years. Gold is overbought and may go lower or higher in the short term, but the many financial, geopolitical and monetary risks in the world are issues which are here to stay. This bodes well for the price of gold and should...

Read More »Keith Weiner Gets Interviewed

Our economic views and unique product are generating buzz. There have been a number of interviews recently (more will be posted soon). Lobo Tiggre interviewed Keith Weiner (video) about the unique Monetary Metals business model to pay interest on gold. Silver Bullion interviewed Keith Weiner (video) when he visited Singapore, about the belief that Basel III regulations are good for the price of gold. Claudio Grass...

Read More »GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth. Borrowing to Consume Today,...

Read More »Big Tech, Big Banks Push for “Cashless Society”

The War on Cash isn’t a conspiracy theory. It’s an open agenda. It’s being driven by an alignment of interests among bankers, central bankers, politicians, and Silicon Valley moguls who stand to benefit from an all-digital economy. Last week, Facebook – in partnership with major banks, payment processors, and e-commerce companies – launched a digital currency called Libra. Unlike decentralized, free-floating...

Read More »What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”). Bastiat says it is true, and this is the seen. The glazier does...

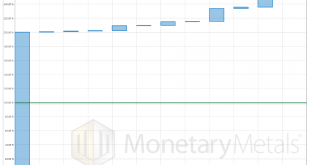

Read More »Gold Bullion International Lease #1 (gold)

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: May 29, 2019 Term: 1 year Lease Rate: 2.0% net to investors The lease is 260% oversubscribed. The graph of the offers is less illustrative than others, as...

Read More »The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy! Whether the writer is a bullion dealer, or...

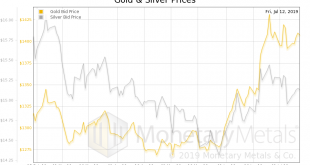

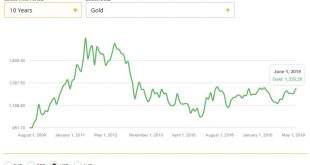

Read More »Gold To Reach 6 Year High Over $1,400 on Uncertain Outlook for Global Markets

by Bloomberg Gold is finally gaining the traction needed to boost prices to a level not seen since 2013 as concern mounts over increased trade war tensions and the global growth outlook. Bullion may touch $1,400 an ounce this year as investors hedge risk, according to Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone Inc. Spot gold was at about $1,326 an ounce on Monday after jumping to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org