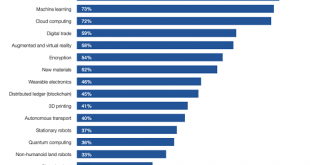

Deflation eats credit-dependent, mass-consumption economies alive from the inside. While AI (artificial intelligence) garners the headlines, the next wave of disruptive technologies extend far beyond AI: as the chart of technologies rapidly being adopted shows, this wave includes new materials and processes as well as the “usual suspects” of machine learning, natural language processing, data mining and so on. While...

Read More »Weakening Japanese momentum behind strong GDP figures

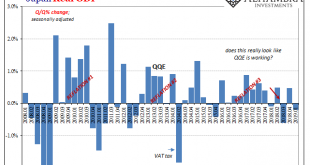

Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures. The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%. However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum. Declining corporate capex and sluggish household...

Read More »Two Intertwined Dynamics Are Transforming the Economy: Technology and Financialization

If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state. The two dynamics transforming the economy–technology and financialization–are intertwined yet widely viewed as unrelated. Critics and proponents of each largely ignore the other dynamic: critics of institutionalized fraud and other manifestations of financialization implicitly...

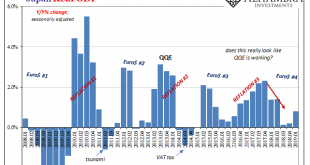

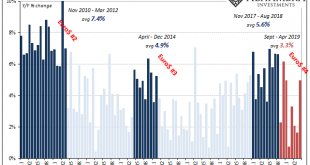

Read More »Japan’s Surprise Positive Is A Huge Minus

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five. Japan Real GDP,...

Read More »The Normalization and Institutionalization of Fraud

Normalizing and institutionalizing fraud undermines the foundations of the economy and the financial system. I am indebted to Manoj Samanta (twitter: @flation_debate) for the insightful concept the commoditization of fraud. The first step in the commoditization of fraud is to normalize fraud as Business as Usual (BAU) to the point that it’s no longer viewed as “wrong,” destructive or an aberration of evil-doers but as...

Read More »Downward Mobility Matters More Than Liberal-Conservative Labels

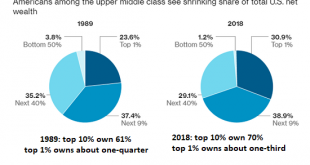

The real heresy here is the American economy is now rigged for downward mobility. In the conventional narrative, one’s economic class is overshadowed by one’s political belief structure: liberal, conservative, libertarian, etc. In terms of economic class, the conventional narrative divides people into their ideological beliefs about economic ideologies: free market capitalism, socialism, etc. Economic class is one of...

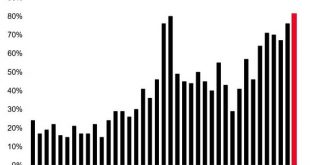

Read More »Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough. After the market slide through Christmas Eve, everything...

Read More »Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields. Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant...

Read More »Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so...

Read More »The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

The net result is we have an economy that’s supposedly expanding smartly while our well-being and financial security are collapsing. Gross Domestic Product (GDP) and other metrics of economic activity don’t measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org