There are two other trends that don’t attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech’s phenomenal growth–financialization and expansion into mobile telephony– are both losing momentum. A third dynamic–Big Tech monetizing privately owned assets such as vehicles and homes– has also...

Read More »A dovish Fed could become even more so

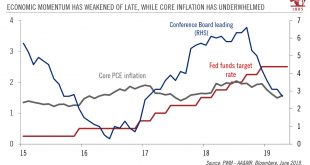

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months. We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance...

Read More »A Quiet Revolution Is Brewing

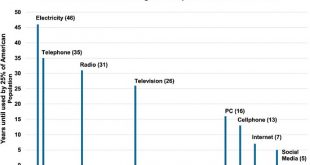

Politics as practiced in a bygone era of stability no longer offers any solutions to these profound disruptions. I recently read a fascinating history of the social, political and economic context of the American Revolution: The Radicalism of the American Revolution by Gordon Wood. What is particularly striking is the critical role played by rapid social changes in the mid-1700s. Conventional histories focus on the...

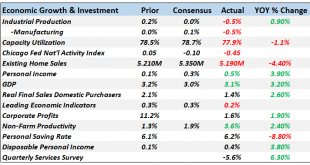

Read More »Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16,...

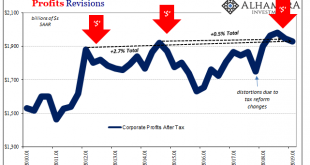

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

Read More »Why Being a Politician Is No Longer Fun

As a society, we are ill-prepared for the end of “politics is the solution.” It’s fun to be a politician when there’s plenty of tax revenues and borrowed money to distribute, and when the goodies get bipartisan support. An economy that’s expanding all household incomes more or less equally is fun, fun, fun for politicians because more household income generates more income tax revenues and more spending that generates...

Read More »Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

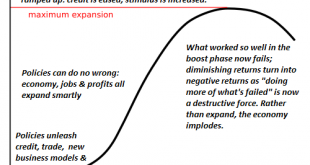

Read More »Lesson of the S-Curve: Doing More of What’s Failed Will Fail Spectacularly

That nothing is truly “free” will be another lesson of the S-Curve. I often refer to the S-Curve because Nature so often tracks this curve of ignition, rapid expansion, stagnation and decline. One lesson of the S-Curve is that the human bias to keep doing more of what worked so well in the past leads to doing more of what failed even as results turn negative. The dynamic in play is diminishing returns: the yield on the...

Read More »Forget “Money”: What Will Matter Are Water, Energy, Soil and Food–and a Shared National Purpose

If you want to identify tomorrow’s superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land. The status quo measures wealth with “money,” but “money” is not what’s valuable. “Money” (in quotes because the global economy operates on intrinsically valueless fiat currencies being “money”) is wealth only if it can purchase what’s actually valuable. As the world slides into an era of...

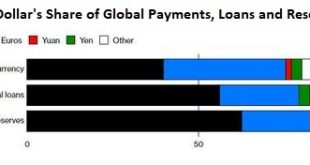

Read More »China’s Insurmountable Global Weakness: Its Currency

If China wants superpower status, it will have to issue its currency in size and let the global FX market discover its price. Quick history quiz: in all of recorded history, how many superpowers pegged their currency to the currency of a rival superpower? Put another way: how many superpowers have made their own currency dependent on another superpower’s currency? Only one: China. China pegs its currency, the yuan (RMB)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org