Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this “growth,” but be prepared for the consequences when the costs of this optimization and dependency come due. Here’s the problem with concentrating most of the income and wealth in the top 5%: the whole economy now depends on their spending and “the wealth effect” of bubbles driving that spending. As the charts below show, the top tier of households own the vast majority of the wealth and take home roughly half of all income, including virtually all (97%) the income derived from capital. By inflating an enormous everything bubble, the Federal Reserve and other central banks have inflated the “wealth” of this top tier. This was of course the

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

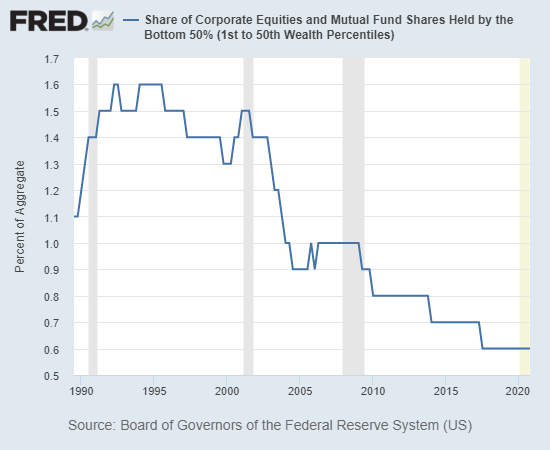

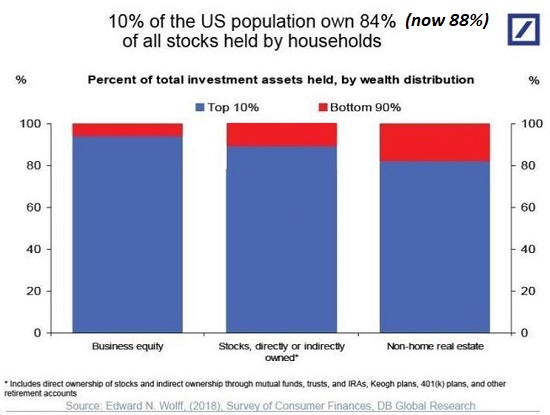

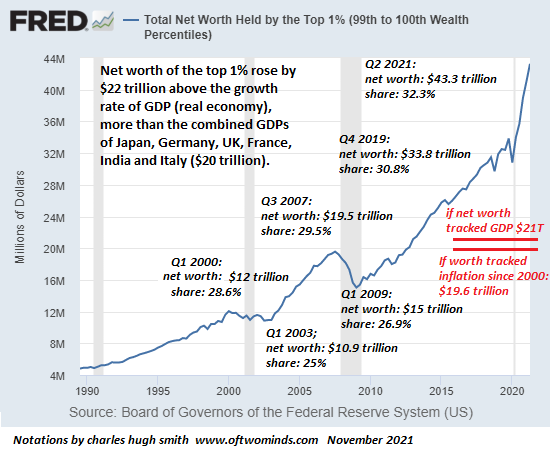

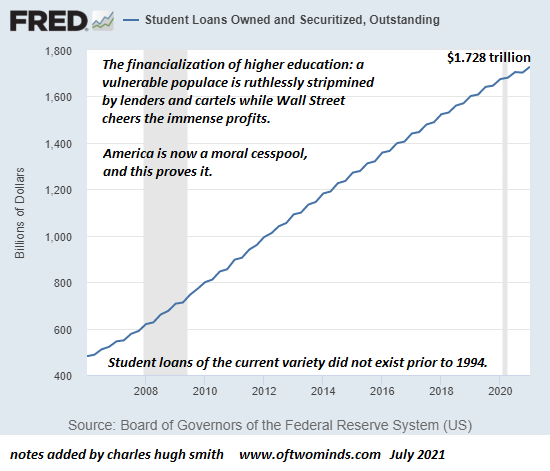

Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this “growth,” but be prepared for the consequences when the costs of this optimization and dependency come due. Here’s the problem with concentrating most of the income and wealth in the top 5%: the whole economy now depends on their spending and “the wealth effect” of bubbles driving that spending. By inflating an enormous everything bubble, the Federal Reserve and other central banks have inflated the “wealth” of this top tier. This was of course the plan: by artificially inflating asset bubbles, the central bankers believed that those seeing their net worth expand would loosen their purse strings and borrow and spend freely: the wealth effect. The problem with relying on the the wealth effect is that if wealth has concentrated in the top, then only the top will benefit. The bottom 50% own virtually no capital (see chart below) and the modest wealth owned by the bottom 90% generates a mere 3% of all income derived from assets (stocks, bonds, real estate, etc.). Monopoly Versus Democracy: How to End a Gilded Age (foreignaffairs.com): Ten percent of Americans now control 97 percent of all capital income in the country. In other words, the Fed has made the rich much, much richer not for being more productive but simply for being rich to start with. |

|

| For the top 5%, it increased by 4%, to $4.8 million. In contrast, the net worth of families in lower tiers of wealth decreased by at least 20% from 2007 to 2016. The greatest loss — 39% — was experienced by the families in the second quintile of wealth, whose wealth fell from $32,100 in 2007 to $19,500 in 2016.

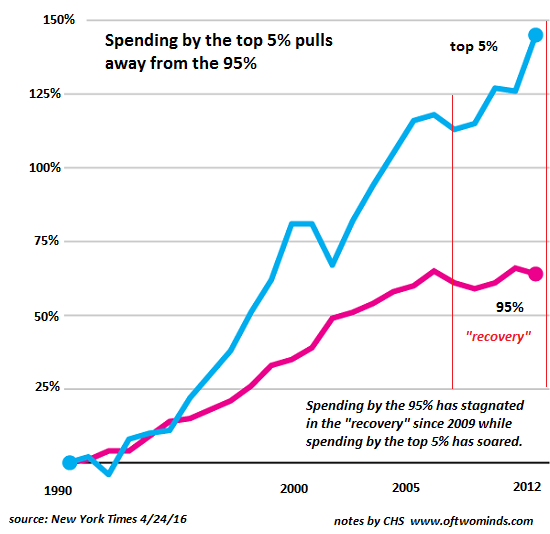

As a result, the wealth gap between America’s richest and poorer families more than doubled from 1989 to 2016. In 1989, the richest 5% of families had 114 times as much wealth as families in the second quintile, $2.3 million compared with $20,300. By 2016, this ratio had increased to 248, a much sharper rise than the widening gap in income. Since virtually all the wealth effect is concentrated in the top tier, it only affects the spending of the top tier. Spending by the bottom 95% has stagnated, and so the policy “fix” to this monumental inequality generated by inflating asset bubbles is to give cash to the bottom 90% via various “stimulus” programs. The bottom 90% promptly spent the free money but since neither their wealth nor their stagnating income increased, the spending boost from this snort of fiscal cocaine has already faded. |

|

| What happens when you concentrate half of all income and the vast majority of all wealth in the top tier? Your economy become completely dependent on 1) keeping that asset bubble expanding forever and 2) the spending of the top 5%.

The problem in making your entire economy dependent on spending generated by asset bubbles is that all bubbles pop. Strangely enough, printing trillions of dollars, borrowing additional trillions and blowing trillions on stock buybacks have consequences beyond just further inflating asset bubbles, systemic consequences which eventually deflate all the bubbles. The top 5% are now the key to the entire economy. If they start selling assets to lock in profits or reduce risk, the asset bubbles will pop because the bottom 95% don’t have the wealth or income to buy tens of trillions of assets from the top 5%: the top 5% buy and sell to other 5%-percenters because no one else has the income or wealth to buy tens of trillions in assets. If the top 5% reduce spending for any reason, then the economy craters. |

|

| The logic can’t be revoked by magical thinking:

1. Since all asset bubbles pop, this asset bubble will pop. 2. Once this bubble pops, the spending of those seeing their “wealth” diminish will decline. Since the spending of the top 5% has been the only source of higher consumption, the economy has been optimized to serve the top 5%. Hence the proliferation of fine-dining restaurants, pricey AirBNB rentals in exotic destinations, luxury brand boutiques, etc. Once the top 5% no longer have the means or desire to spend freely on discretionary purchases, a huge swath of the U.S. economy falls into an abyss. And since we’ve structured our system to make the rich richer so they can spend more, there is no substitute source of spending to replace the collapse of top 5% spending. Optimization and dependency have consequences. Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this “growth,” but be prepared for the consequences when the costs of this optimization and dependency come due. |

|

Tags: Featured,newsletter