The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing. The idea is that such a policy mixed draws capital inflows. This is exactly what is happening. The June TIC data was reported yesterday, and there was a net purchase of $114.5 bln of US...

Read More »FX Daily, August 17: Dollar Limps into the Weekend

Swiss Franc The Euro has risen by 0.11% to 1.1348. EUR/CHF and USD/CHF, August 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading heavily against most of the world’s currencies today. The main exceptions come from the emerging markets where the Turkish lira, Russian ruble, and Mexican peso are the chief exceptions, and their losses are modest....

Read More »Great Graphic: Crude Approaches Year-Old Trend Line

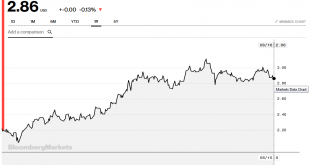

Crude oil has been climbing a trendline for the past year. This Great Graphic depicts this trend on a weekly bar chart. Depending exactly the line is drawn, it comes in now near $65 a barrel. The technical indicators are consistent with further losses. Oil is off for a third day, alongside other industrial commodities, including copper. In addition to concerns about the economic impact from the trade tensions, the...

Read More »FX Daily, August 16: Emerging Markets Stabilize, Dollar Eases a Little

Swiss Franc The Euro has risen by 0.48% to 1.1322. EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Two developments have helped turned sentiment, or at least arrested the markets’ momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira. This may...

Read More »Great Graphic JPY Struggles at Trendline

This Great Graphic is a weekly bar chart of the dollar-yen exchange rate. It shows a three-year downtrend line (white line). The US dollar had popped above it last month, but this proved premature and has not closed about it for a month. The trendline is found near JPY111.55 now. Connecting the 2016 dollar lows and the low from late March this year is a red line. It is found near JPY105.60. Together both lines mark a...

Read More »FX Daily, August 15: Lira Rallies on Cut in Swaps, but Fails to Dent Dollar Demand

Swiss Franc The Euro has fallen by 0.09% to 1.1264. EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Turkish lira is extending yesterday’s recovery today on the back of actions by officials that are aimed at limiting foreign access to the lira to short. Without introducing new capital controls, regulators halved the amount of swap...

Read More »Cool Video: CNBC Discussion on Turkey

Marc Chandler I had the opportunity to join Professor Hanke to discuss the crisis in Turkey. The professor sketched out his view expressed in a recent op-ed piece in the Wall Street Journal, arguing that Turkey is best served by adopting a currency board, anchoring the lira to hard currency, like the euro or dollar, or gold. I do not see Turkey’s problem being essentially a currency crisis, but a broader crisis of...

Read More »FX Daily, August 14: Brief Respite but Little Relief

Swiss Franc The Euro has fallen by 0.41% to 1.1282. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Corrective pressures grip the capital markets today, helped by the easing of the selling pressure on Turkey, but its more a respite than a relief as no new policy initiatives are behind the lira’s upticks. The implication of this is that it...

Read More »Great Graphic: Possible Head and Shoulders Top in Euro

The euro appears to have carved out head and shoulder top. As this Great Graphic depicts, the euro was sold through the neckline at the end of last week and is 1% below it today. It is not unusual for the neckline to be retested. It is found near $1.15. It also dovetails with our near-term caution given that the euro is likely to close below its Bollinger Band for the second consecutive session (~$1.1440). The left...

Read More »FX Daily, August 13: Turkey Drives Risk-Off, but Pressure Abating

Swiss Franc The Euro has risen by 0.12% to 1.1351. EUR/CHF and USD/CHF, August 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org