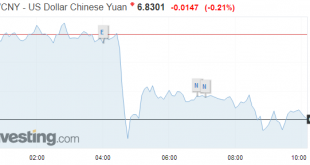

Swiss Franc The Euro has fallen by 0.01% at 1.1263. EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of...

Read More »FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past. First, the bar to dissuade the market against a 25 bp rate hike on...

Read More »The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North’s summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader. The effect of monetary tightening and fiscal stimulus...

Read More »FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

Swiss Franc The Euro has risen by 0.29% at 1.1275. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations...

Read More »FX Daily, August 30: Brexit Optimism Underpins Sterling

Swiss Franc The Euro has risen by 0.40% at 1.1315. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today’s markets. Disappointing...

Read More »FX Daily, August 29: Dollar Finds Support, but Downside Correction May Not be Over

Swiss Franc The Euro has risen by 0.47% at 1.1361. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main...

Read More »FX Daily, August 28: Greenback Remains On Defensive

Swiss Franc The Euro has risen by 0.07% at 1.143. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Corrective forces continue to weigh on the US dollar. Sometimes the narratives drive the price action and sometimes the price action drives the narratives. Currently the latter appears to hold sway. The dollar’s downside correction began around...

Read More »FX Daily, August 27: A Dog Day of Summer

Swiss Franc The Euro has risen by 0.03% at 1.1439. EUR/CHF and USD/CHF, August 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Last week’s dollar losses were initially extended in Asia before it came back bid. The euro briefly poked through $1.1650 for the first time in three weeks. However, the gains were sold into, and the euro finished the Asian session near $1.16,...

Read More »FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range. Even the Australian dollar, the worst performing of the major...

Read More »5 Things Investors Should Know About US Strategic Petroleum Reserves

SPR - Click to enlarge US Department of Energy announced yesterday offered for delivery between October 1 and November 30, 11 mln barrels of sour crude oil from the Strategic Petroleum Reserves. The move has nothing to do with operationalizing President Trump’s complaint that oil prices were too high. Instead, the sales are part of the fiscal compromise in 2015 budget legislation and the health care act of 2016. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org