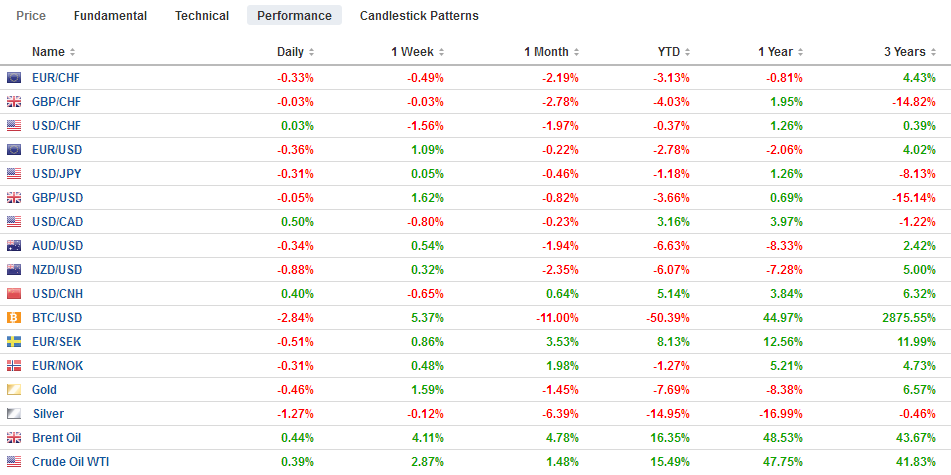

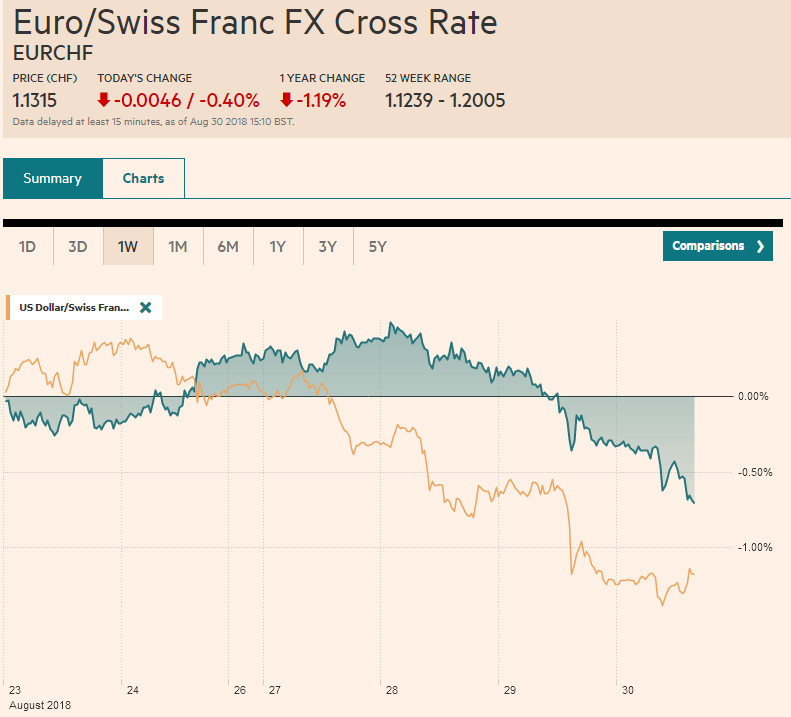

Swiss Franc The Euro has risen by 0.40% at 1.1315. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today’s markets. Disappointing data from Australia and New Zealand has seen the Antipodean currencies move lower. New Zealand’s business confidence fell to a ten-year low, and this sent the Kiwi tumbling. Its nearly 0.9% fall leads the majors. It is followed by the Australian’s dollar’s 0.25% loss in the wake of building approval

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.40% at 1.1315. |

EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today’s markets. Disappointing data from Australia and New Zealand has seen the Antipodean currencies move lower. New Zealand’s business confidence fell to a ten-year low, and this sent the Kiwi tumbling. Its nearly 0.9% fall leads the majors. It is followed by the Australian’s dollar’s 0.25% loss in the wake of building approval (-5.2% vs. the median forecast of -2.0%) and capex (-2.5% vs. the median forecast of a 0.6% increase) misses. The Aussie held yesterday’s low near $0.7275. Last week’s low was near $0.7240. |

FX Performance, August 30 |

Japan reported that July retail sales rose 0.1% after the heady 1.4% rise in June. The year-over-year rate of 1.5% was a bit better than expected. The Nikkei managed to eke out a minor gain to extend its advancing streak to eight sessions, though it continues to be frustrated near 23000. Most markets in the region fell, including a 1.15% drop in Shanghai (its third consecutive fall) and the MSCI Asia Pacific Index snapped a four-day advance with a 0.25% loss and an outside down session and a potential key reversal. That said, the pullback stopped just shy of closing the gap from Tuesday’s higher opening. We note that foreign investors continued to buy Korean and Taiwanese shares.

The dollar’s momentum carried it to nearly JPY111.85 yesterday has faded, and the dollar is consolidating in the upper end of yesterday’s range. In the bigger picture, the dollar continues to toy with the weekly downtrend line from 2015. It had been violated last month when the greenback was lifted to a high near JPY113.20 before pulling back. Depending exactly how the trendline is drawn, it appears to come in around JPY111.60. The dollar found support near CNY6.80 in recent sessions and recovered to CNY6.84, new highs for the week.

The euro is consolidating within the two-day range of $1.1650 and $1.1735. There are no significant nearby options expiring today but tomorrow that there is a $1.17 strike (1.3 bln euros ) and a $1.1725 strike (1.5 bln euros). The main economic data has come in the form of Spanish and Germany preliminary August inflation reports. Price pressures appear to have eased. In Spain, the harmonized measure slipped to 2.2% from 2.3%. In Germany, several large states showed a small easing of inflation. The national figure due out shortly could show slippage to 2.0% from 2.1%.

European shares of trading softer. The Dow Jones Stoxx 600 is off a little more than 0.5% after advancing 0.3% yesterday. All of the major sectors are lower, though real estate and telecoms are taking the biggest hit (off ~2%). With today’s loss, the benchmark is up 0.25% for the week but is off 1.8% on the month. The German DAX is off 1% today, the most among the major markets. The DAX is off nearly 3% this month. If sustained, it would be the biggest monthly loss since February.

Sterling is consolidating yesterday’s sharp gains after yesterday’s sharp advance. For the first time in months, and just as UK Prime Minister May suggested that leaving the EU without an agreement is “not the end of the world,” optimism helped sterling rally 1.2% yesterday, the most in seven months, and to new highs here in August. The glass which has been seen as half empty is now seen as half full. Both UK Brexit Secretary Raab and the EC’s head negotiator Barnier were not talking about the risks of no deal. To the contrary, with negotiations to resume Friday, Raab suggested that a deal was within reach. Barnier was reassuring. The EU, he acknowledged, wants to keep the UK ties as close as possible and is willing to negotiate a unique relationship.

Also, seemingly to lend sterling support, and note that is has appreciated almost four cents since the mid-August low near $1.2660 has been a backing up of UK interest rates. It is as if the entire 2-30 year yield curve increased by around 20-25 bp since the middle of the month. The 10-year breakeven is essentially unchanged over this period suggesting that the rise in nominal yields reflects an increase in real rates. Sterling’s gains are likely to prove short-covering. The net short sterling position, for example, in the futures market was the largest since May 2017. The gross short position has jumped from around 80k contracts at the beginning of the month to over 140k as of August 21. The next technical targets are around $1.3070 and then $1.3130.

In addition to NAFTA2.0 talks with Canada, which are said to be going well, the North American session also features potentially market-moving data. Canada reports Q2 GDP. It is expected to a have accelerated to 3.1% from 1.3% in Q1 (annualized). However, it reflects earlier momentum, and the monthly read for June may show a 0.1% gain following May’s 0.5% expansion. Recent official comments have reinforced market expectations for another rate hike in October. The US dollar continues to trade within Tuesday’s range of roughly CAD1.2890 and CAD1.2990.

The US reports July personal income and consumption data. We suspect both have downside risks to the market’s median forecast that each rose 0.4%. We are concerned that weakness in farm income will weigh on personal income, while 3.8% consumption pace in Q2 is unlikely to have been sustained. Personal consumption expenditures averaged a monthly gain of 0.4% in Q2. Weekly initial jobless claims are expected to have remained in their trough.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,newsletter