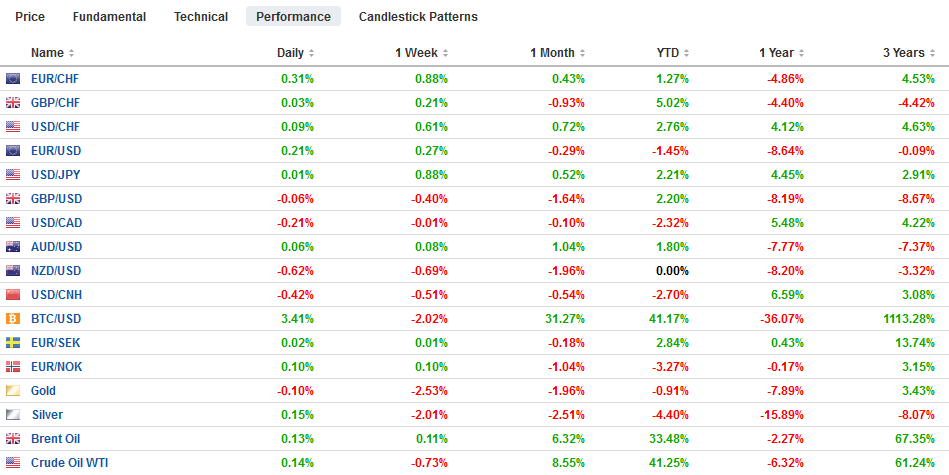

Swiss Franc The Euro has risen by 0.24% at 1.1395 EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The veracity of Chinese data will be questioned by economists, but today’s upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a “Draghi moment” and decided to do “whatever it takes” to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution. The stronger Chinese data helped lift extend the MSCI Asia-Pacific Index for the fourth session. Europe’s Dow Jones Stoxx 600 is struggling, and its five-day rally is at risk.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, Featured, New Zealand, newsletter, Singapore, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.24% at 1.1395 |

EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The veracity of Chinese data will be questioned by economists, but today’s upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a “Draghi moment” and decided to do “whatever it takes” to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution. The stronger Chinese data helped lift extend the MSCI Asia-Pacific Index for the fourth session. Europe’s Dow Jones Stoxx 600 is struggling, and its five-day rally is at risk. Benchmark yields are rising. The US 10-year is near 2.60%. It bottomed in late-March near 2.34%. The yield on the 10-year German Bund approached minus 10 bp at the end of last month and is now near +10 bp. The 10-year UK Gilt yield dipped below 100 bp a few weeks ago and is now near 1.25%. Japan’s 10-year yield remains below zero. The dollar itself is mostly heavier, though softer New Zealand inflation has heightened speculation of a rate cut as early as next month, and this is weighing on the New Zealand dollar. The euro is firm above $1.13, while the greenback is flat against the yen near JPY112.00. Most emerging market currencies, including Turkey and South Africa, are firmer. |

FX Performance, April 17 |

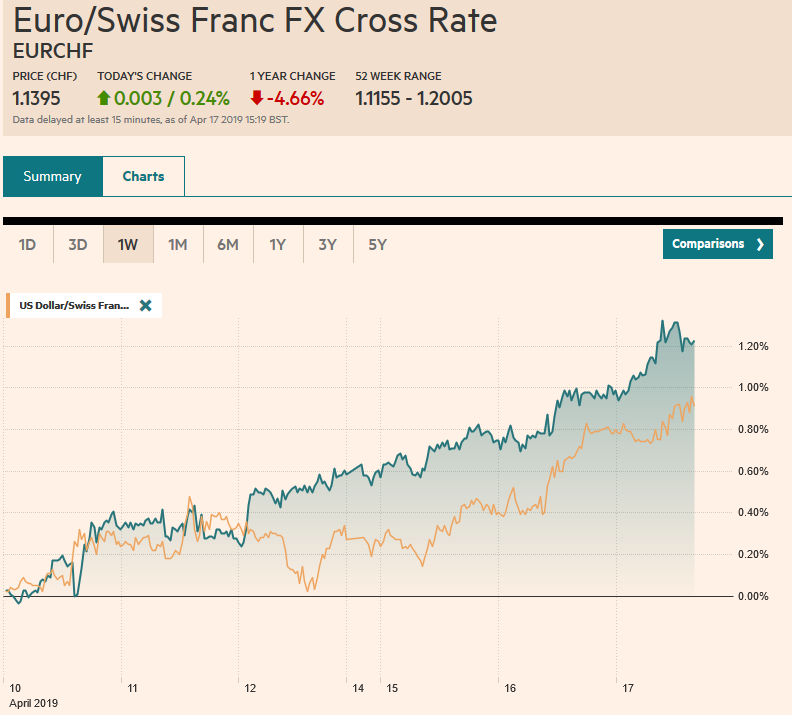

ChinaChina reported a batch of stronger than expected data. Industrial production jumped 8.5% year-over-year. The median forecast in the Bloomberg survey was for a 5.9% pace. Retail sales surpassed the median forecast for an 8.4% rise and instead increased by 8.7%. Fixed asset investment matched the 6.3% projected increase. These are said to translate into 6.4% year-over-year GDP, matching the Q4 performance. Many economists find inconsistencies in Chinese data and often question the accuracy. Nevertheless, the data seems broadly consistent with official efforts to strengthen the economy. Yet it does seem that challenges in the region remain and China is still at the center of it. Consider Japanese exports. They fell 2.4% year-over-year in March. It is the fourth consecutive month of decline. Exports to the US were up 4.4% and to Europe, up 7.3%. Shipments to China were off 9.4%. Singapore, which is a key hub in Asia, reported an 11.7% decline in non-oil exports in March on a year-over-year. Electronic exports were off nearly 27%, pharmaceutical exports were more than 36% lower, and petrochemical shipments more than 15% lower. |

China Industrial Production YoY, March 2019(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

Despite the drop in exports, Japan’s trade surplus was larger than expected at JPY528.5 bln, as imports were also weaker than expected. The 1.1% rise in imports was less than half the increase economists expected. Net exports then appear likely to have been a drag on Japan’s Q1 GDP. Other data point in the same direction. Earlier today Japan reported that February’s industrial output, which it had previously estimated rose by 1.4%, increased by only 0.7%. And the tertiary index, which covers the service sector was expected to pare January’s 0.6% increase by slipping 0.2%. Instead, it unwound all of January’s gain.

New Zealand’s Q1 CPI rose 1.5%. The median forecast was 1.7% after a 1.9% pace in Q4 18. The central bank itself expected 1.6%. The Reserve Bank of New Zealand had previously shifted to an easing bias, and the market has discounted about a 60% chance of a cut next month. It is fully discounted by the middle of Q3. The source of the disinflationary pressure is coming from the tradeable sector, where prices were 0.4% lower. Inflation in the non-tradeable sector is up 2.8%, the most in around five years.

The New Zealand dollar has recouped more than half of its initial decline that brought it briefly below $0.6670 to its lowest level since January 3. By late Asia, it had recovered to almost $0.6750 before stalling. The Australian dollar, in contrast, pushed above $0.7200 for the first time since February 21. It is meeting sellers there in Europe. There are roughly A$2.4 bln in expiring options struck in the $0.7150-$0.7175 area that may come into play in the North American session. The intraday technicals favor the downside. The dollar has been confined to about a quarter of a yen range as it continues to hover around JPY112.00. While some more work needs to be done to consolidate the move from JPY110, technically, the dollar appears headed toward JPY114.00, perhaps here in Q2.

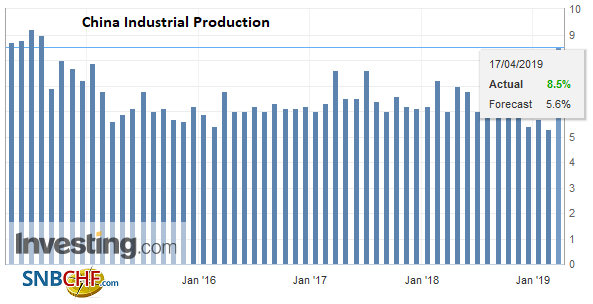

United Kingdom

UK March inflation was softer than expected. It appears that the decline in clothes and food prices, and slower increases in computer games, offset the rise in fuel prices. The headline pace was 1.9% above year-ago levels, the same as in February. A Thomson Reuters survey had UK economists looking for a 2% pace. The core was also steady (1.8%), though economists expected a small increase. Producer prices were mixed in a favorable way. Input prices were lower than expected, though the February increase was revised higher. Output prices were firmer than expected and here too the February series was revised higher. The UK reports March retail sales tomorrow. They are expected to have softened but still advanced on the quarter, unlike in Q4 18, where retail sales fell 0.1% a month on average. |

U.K. Consumer Price Index (CPI) YoY, March 2019(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

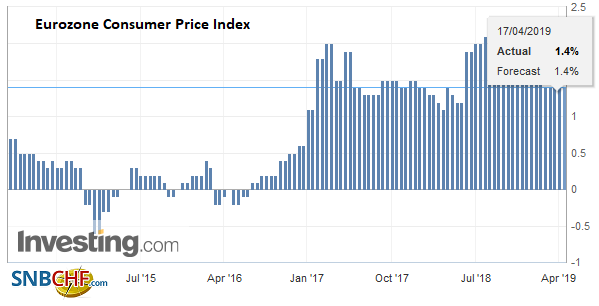

EurozoneThe eurozone confirmed March inflation readings. The headline increased by 1% in the month, reflected the usual seasonal pressures. The year-over-year rate stood at 1.4%, down from 1.5% in February and unchanged from March 2018. The core rate stands at 0.8%, unchanged from the preliminary reading and down from 1.0% in February. A year ago, it was at 1.1%. Separately, the EMU February trade surplus was reported at 19.5 bln euros (seasonally adjusted), up nearly 2 bln euros over January. The current account surplus was nearly27 bln euros. This is down from nearly 37 bln euros in January and compares with almost 32 bln euros in February 2018. Lastly, note that EU car registrations (a proxy for sales) fell 3.9% in March, It is the seventh consecutive decline, but had been improved in January and February. The stabilization of the Chinese economy may lend support to the German economy. However, China is only one source headwinds for Europe’s biggest economy. The disruption from Turkey is not helping. Uncertainty over Brexit is also a cross-current. There are also idiosyncratic challenges in the German auto sector. There is talk that China may lift the number of licenses it grants for major urban centers to help bolster slumping auto sales. The German economic ministry is not so optimistic. It cut its 2019 GDP forecast to 0.5% earlier today from 1.5% in 2020. Altmaier, the Economic Minister noted that German investment in infrastructure, education, and research are at record highs. Although many, including the IMF, call for Germany to spend even more, there is a reluctance on the part of German officials who find cover in the Stability and Growth Pact obligations. The euro is firm. It has recovered from yesterday’s dip to around $1.1280 amid reports that several ECB members doubted the projected H2 recovery, and there seemed to be a pushback against ideas of tiering the negative deposit rates. Several large options expire today. The most immediately relevant one is the nearly 660 mln euros at $1.1320. There are 1.5 bln euros struck at $1.13. On the top side, there are 2.8 bln euro in options between $1.1380 and $1.1390. We suspect the euro is at the tail end of what we see as a counter-trend rally that began on April 2 after a dip below $1.12. Sterling has slipped to a five-day low near $1.3030. It may be penned in by two sets of expiring options. There are GBP900 mln struck at $1.30 and GBP480 mln at $1.3050. |

Eurozone Consumer Price Index (CPI) YoY, March 2019(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United States

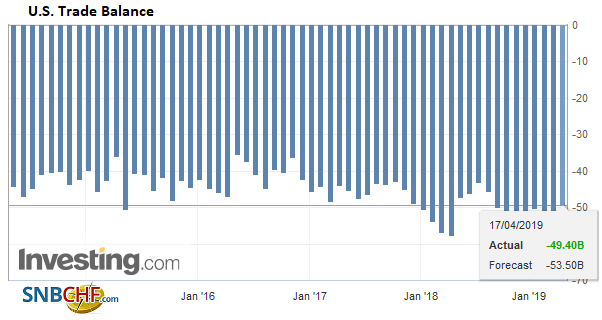

The US reports February trade figures (a larger deficit is expected) and wholesale inventories (likely extending the strong build in January). The impact on GDP expectations may be minor. What trade takes away inventory growth may largely offset. Yesterday’s industrial output disappointed. It seemed to stem from the auto sector, where rising inventory and slower sales have seen output pullback. Vehicle production fell 2.5% in March, and it was the second decline in three months. Excluding autos, industrial output rose 0.2% after a 0.5% contraction in February. The Fed’s Beige Book, ahead of the May 1 meeting, will be released. |

U.S. Trade Balance, February 2019(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports March CPI figures and February trade balance. Headline CPI is expected to rise toward 1.9% from 1.5% in February. However, the underlying measures are expected to be little changed, and it is there where the Bank of Canada takes its cues. Meanwhile, the marked deterioration in Canadian trade is expected to have continued. The shift to larger deficits began in earnest in November. Watch non-oil exports for more insight into what is happening.

The American Petroleum Institute estimated that US inventories fell by 3.1 mln barrels last week. The EIA will report the official estimate today. It was expected to show a 2.3 mln barrel build. Oil prices are near five-month highs, mostly it appears on concern about supply disruptions from Venezuela, Libya, and Iran, while OPEC+ show discipline. Separately, note that Vale is to restart one of its iron ore mines later this week.

The US dollar turned down from CAD1.34 yesterday and is testing CAD1.33 early in the European morning. This has essentially been the range this month.The odds seem to favor playing the range, which means that the dollar may be a better buy here at the lower end of its range. The dollar spiked to almost MXN19.00 yesterday after starting the week near MXN18.75. Emerging market currencies are bid today, and the peso will likely go with the flow. The Dollar Index remains as it has over the past two sessions, within the range established before the weekend–roughly 96.75 to 97.15.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Featured,New Zealand,newsletter,Singapore