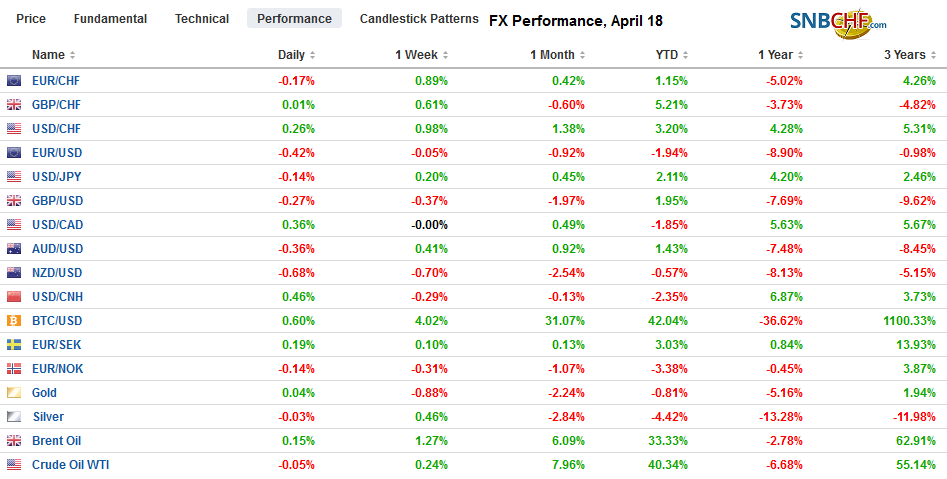

Swiss Franc The Euro has fallen by 0.15% at 1.1393 EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook. Disappointing flash PMI data weighed on sentiment, but also is helping spur a bond market rally. The US 10-year yield is pulling back after the test on the 2.60% area. The Germany 10-year Bund yield

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Eurozone Manufacturing PMI, Eurozone Services PMI, Featured, newsletter, trade, U.K. Retail Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.15% at 1.1393 |

EUR/CHF and USD/CHF, April 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

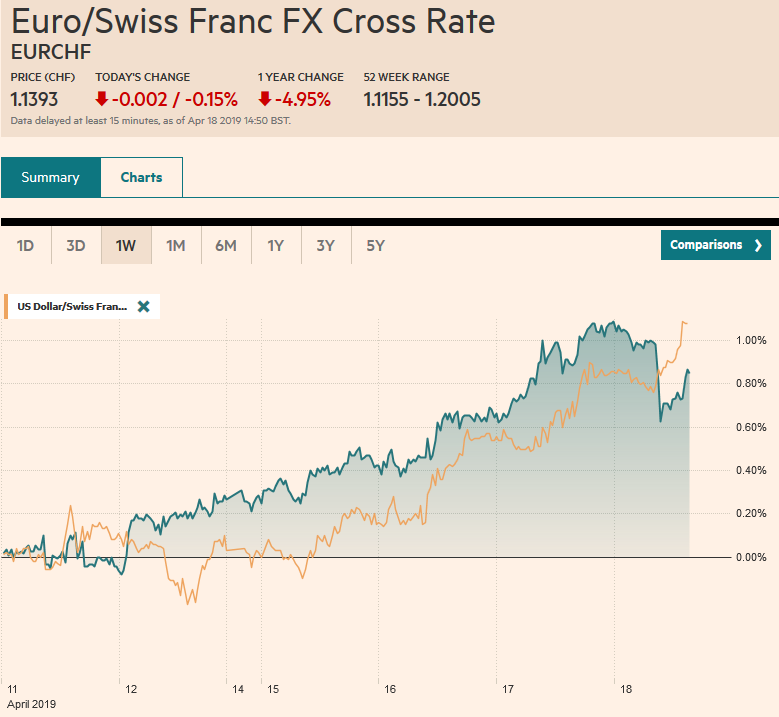

FX RatesOverview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook. Disappointing flash PMI data weighed on sentiment, but also is helping spur a bond market rally. The US 10-year yield is pulling back after the test on the 2.60% area. The Germany 10-year Bund yield has been halved today to four basis points. The US dollar is mostly firmer, with the yen the notable exception among the majors. News that Turkey has used dollar swaps to boost reserves has weighed on the lira, which is trading at new lows. Investors cheered the reelection of Wadodo for a second term in Indonesia. Local stocks and the rupiah are firmer. |

FX Performance, April 18 |

Asia Pacific

After being spun for weeks with nearly daily claims of progress, the media is now reporting that a US-China trade deal is close. The new signal is that a couple more rounds of negotiations are all that it may take and that Trump and Xi can meet at the end of May (May 27?). US Lighthizer will go to Beijing at the end of the month, and then Vice Premier Liu will return to the US in early May. Separately, despite the recent batch of Chinese data appearing to show a recovery, there is talk about more stimulative measures.

Australia reported better than expected employment data, but the Australian dollar has not found much love and is holding near yesterday’s lows. Australia created more jobs than expected (25.7k vs.15k), and these were all full-time positions (48.3k), and the February fall was revised nearly away (-1.7k vs. -7.3k). The participation rate increased, and this saw the unemployment rate tick up to 5.0% from 4.9%. Separately, the flash PMI was mixed. Manufacturing slowed to 51 from 52, while services rose to 50.5 from 49.3. The composite poked back above the 50 boom/bust to 50.6 from 49.5. Next week, Australia’s Q1 CPI will be reported. It is expected to have softened.

After briefly rising through $0.7200 yesterday, the Australian dollar is near $0.7160 near midday in Europe. The employment data has not dissuaded the market from looking for a rate cut, which is priced in by the end of Q3. There is an A$1.1 bln option at $0.7175 that expires today. Support is seen in the $0.7140-$0.7150 area. The weakness in equities and slippage in yields has buoyed the yen, though its flash PMI remained below 50 for the third month (49.5 vs. 49.2). The dollar made a fresh low for the week, just below JPY111.80. With $2 bln in options struck at JPY112.00-JPY112.10, the upside looks to be blocked, but the market does not appear to have given up on it. The dollar broke below CNY6.70 yesterday on the back of the better than expected data optics but has bounced back above it today and at CNY6.7040, it is virtually unchanged on the week.

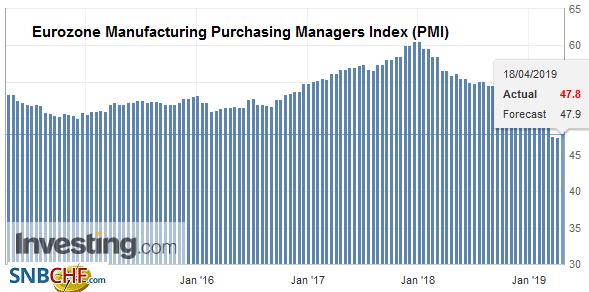

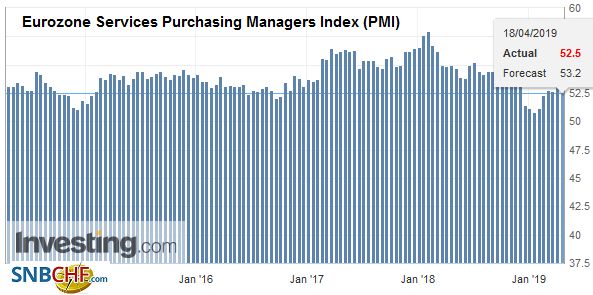

EuropeThe euro has been sold on the disappointing flash PMI. Earlier in the week, reports suggest that several ECB policymakers expressed doubts about a recovery in H2, and ECB President Draghi has acknowledged the risks remain on the downside. German manufacturing continued to contract (44.5 vs. 44.1). The service PMI edged up to 55.6 from 55.4. The composite rose to 52.1 from 51.4. New business fell for the fourth month, and the export book continued to shrink. The French manufacturing PMI worsened slightly (49.6 vs. 49.7). Economists in the Bloomberg survey looked for improvement to 50. The service PMI did expand (50.5 vs. 49.1), which was actually a bit better than expected. The composite rose to 50 from 48.9. The aggregate PMI for the eurozone was weaker than that implied by German and French numbers, and this likely reflected deterioration in the periphery. The aggregate manufacturing PMI edged up to 47.8 from 47.5, |

Eurozone Manufacturing Purchasing Managers Index (PMI), April 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| while the service PMI fell to 52.5 from 53.3. Both were weaker than expectations. The composite fell to 51.3 from 51.6. |

Eurozone Services Purchasing Managers Index (PMI), April 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

United Kingdom

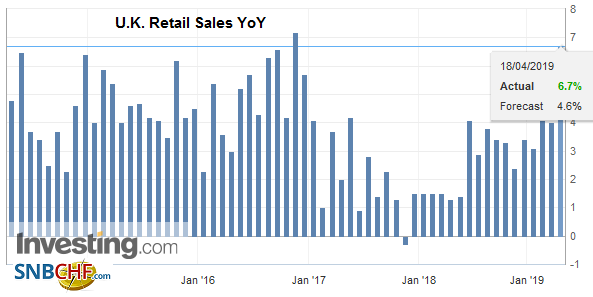

UK retail sales surged in March. The 1.2% increase, excluding petrol, defied expectations for a 0.3% decline. Moreover, the February series was revised up to 0.4% from 0.2%. Retail sales rose an average of 0.9% a month in Q1 19 after a minus 0.1% average in Q4 18. It matches the best quarterly showing since 2001. A robust labor market, real earnings increase, and strong consumption would likely bias the Bank of England toward a rate hike if it weren’t for the uncertainties surrounding Brexit. A softer and later Brexit, we have argued, is bullish for sterling as it allows monetary policy to come back to the fore. However, in the current context as it stands, sterling was not bought on the favorable data. |

U.K. Retail Sales YoY, March 2019(see more posts on U.K. Retail Sales, ) Source: investing.com - Click to enlarge |

It has not been a particularly good week for Europe-US relations. The negotiating directive specifically excludes agriculture and focuses exclusively on industrial goods and conformity (which refers to trying to harmonize or mutually recognize technical requirements). The US sought broader talks. The Trump Administration announced the US will no longer waive the part of a 1996 law that allows US citizens to sue foreign companies over property lost in the Cuban Revolution. The intended targets are what the Trump Administration calls the Troika of Tyranny (Venezuela, Nicaragua, and Cuba), but European (and Canadian) companies could be vulnerable. In fact, the reason it has been waived since it was first passed was due to the hostile response from US allies, and, perhaps, due to the legal basis. Europe argues this is an attempt to apply US laws outside of US territory (extraterritoriality). It threatens to challenge the US actions at the WTO. Also, the 50 largest US companies that have claims also have assets in the EU that ostensibly could also be vulnerable.

The euro fell from roughly $1.13 to about $1.1240 in response to the disappointing flash PMI. The euro’s correction had run out of steam near $1.1325, though the bottom picker had been emboldened by the large speculative short (in the futures market) and a shift in the put-call skew (three-month risk reversal turned positive). Note that the $1.1235 area corresponds to a key retracement of the euro’s recovery from the April 2 low near $1.1185. There are some chunky options expiring today ahead of what will be for many a long holiday weekend. There are nearly 650 mln euros struck at $1.1250, 1.9 bln euros at $1.1225, and about 975 mln euros at $1.12. Initial resistance now is likely around $1.1280. Better retail sales failed to prevent sterling from slipping to its lowest level in two weeks (~$1.30). Since mid-February, sterling has dipped below there a handful of time but has not closed below it.

America

The US reports March retail sales. Retail sales are important because they account for a bit more than 40% of consumption, which drives the US economy. To put this in perspective, consider that that US consumption is roughly the same percentage of the world economy as the entire Chinese economy (~16%-17%). Retail sales slipped 0.2% in February after a 0.7% gain in January. Recall that retail sales averaged a 0.2% decline in Q4 18 and a 0.1% gain in Q3 18 and for all of last year. The median estimate in the Bloomberg survey is for a 1.0% increase in March. That would put the Q1 average at 0.5%.

While we do not think the US is recession-bound or that a resumption of QE or a 50 bp cut in interest rates are needed, we suspect the risk to retail sales is on the downside. There are two reasons that do not appear to be fully appreciated: tax refunds and the auto sector. People are not getting the refunds that they expected, and this will impact savings (such as mortgage payments or delinquencies) and other forms of financing (home equity loans). Tax refunds are running around 4% below year-ago levels. Auto sales looked like they picked up, but this was because of fleet sales that were near two-year highs. Household purchases fell 4%. Auto inventories are rising, and output is being cut, which is a drag on manufacturing. Vehicle production was cut by 2.5% in March, the second decline in three months. It is at the lowest level since last July.

Canada reports February retail sales. They have fallen for the past three months, and risk would seem to be on the downside of the median Bloomberg survey forecast looking for a 0.4% increase. The Canadian dollar initially rallied in response to the news of a smaller trade deficit and firm CPI. However, the improvement in trade reflected higher oil prices. Non-oil exports fell. Total exports are off 6% since last year’s peak. Canada has exported less oil due to curtailments in Alberta, where a new government has been elected that is committed to reversing the previous government’s decision.

The US dollar initially slumped to CAD1.3275 yesterday, but the break below CAD1.33 proved false, and it quickly snapped back from the lowest level since March 20. The dollar has not closed below there since March 1. The greenback is approaching the upper end of its range near CAD1.34, which it has not closed above this month. The range still looks likely to hold despite being frayed. In this context, it means that the US dollar may get toppish on further upticks. The Mexican peso is consolidating at softer levels. The US dollar tested MXN18.75 earlier this week. It stalled near MXN19.00. Resistance is pegged just above there in the MXN19.02-MXN19.10 area. The Dollar Index is up about 0.3%. If it were to hold on to these gains, it would be the biggest rise so far here in April.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Eurozone Manufacturing PMI,Eurozone Services PMI,Featured,newsletter,Trade,U.K. Retail Sales