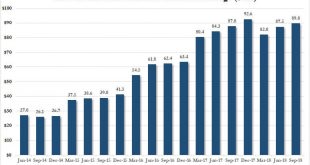

SNB US Stock Holdings In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB’s US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18...

Read More »Swiss National Bank expects annual loss of CHF 15 billion

Confederation and cantons to receive distribution of CHF 2 billion According to provisional calculations, the Swiss National Bank (SNB) will report a loss in the order of CHF 15 billion for the 2018 financial year. The loss on foreign currency positions amounted to CHF 16 billio n. A valuation loss of CHF 0.3 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to CHF 2 billion. The...

Read More »Brexit vote to dominate Pound to Swiss Franc exchange rates

Pound to Swiss Franc exchange rates The value of the Pound against the Swiss Franc has remained in a fairly tight range since the start of the year. However, in the last couple of days the Pound has made some small gains after the Swiss National Bank confirmed that their currency reserves have dropped slightly. We have also seen reports of positive sales of Swiss watches, which is one of Switzerland’s largest exports....

Read More »GBP/CHF Forecast: Swiss Franc at Best Level against the Pound in over a year

GBP/CHF forecast: Brexit uncertainty causes Swiss Franc to gain vs the Pound The Pound is now trading at its lowest level to buy Swiss Francs in over twelve months as the political uncertainty surrounding the UK is continuing to negatively affect the value of Sterling exchange rates. Clearly the uncertainty of what may happen in the next three months before the end of March is causing investment in the UK to drop off...

Read More »Police Warn of fake Swiss Franc Notes

Since the beginning of December 2018 more and more counterfeit 100 Swiss franc notes have been appearing in the Swiss canton of Valais in and around Sion and Conthey. ©-Ginasanders-_-Dreamstime.com_ - Click to enlarge The fake notes, which the local Police say can be spotted if compared to real ones, have been making their way into circulation via shopping centres, kiosks and service stations in the Sion and Conthey...

Read More »Swiss balance of payments and international investment position: Q3 2018

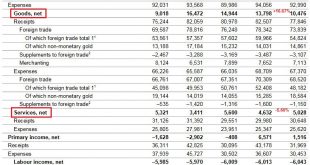

Current Account Key figures: Current Account: Down 35.7% against Q3/2017 to 14.6 bn. CHF of which Goods Trade Balance: Down 23.9% against Q3/2017 to 10.5 bn. of which the Services Balance: Plus 8.7% to 5.0 bn. of which Investment Income: Minus 39.7% to 7.6 bn. CHF. Current Account Switzerland Q3 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

Read More »SNB leave interest rates on hold, what next for GBP/CHF rates?

This morning the Swiss National Bank have left interest rates on hold at 0.75%, and market reaction between GBP/CHF has been limited. The Swiss Franc has rallied slightly against the US dollar and the Euro as forecasters were suggesting the SNB could cut interest rates further, however the events last night in the UK I believe outweighs the interest rate decision in Switzerland. GBP/CHF rates: Pound rallies against...

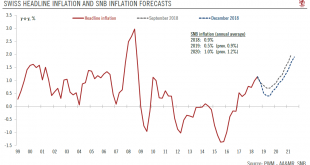

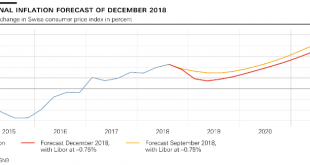

Read More »Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence. The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today. The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge. Importantly, the SNB’s inflation forecasts for 2019 and 2020 were significantly revised down—another argument for the...

Read More »Monetary Policy Assessment of 13 December 2018

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange...

Read More »The World’s Biggest Hedge Fund Is Getting Whacked, And Why “Moneyness” Matters

Authored by John Rubino via DollarCollapse.com, A few years ago the Swiss National Bank (SNB) – which traditionally held “monetary assets” like government bonds, cash and gold to back up the Swiss franc – decided to branch out into common stocks. This was a departure, but for a while a brilliant one. The SNB loaded up on Big Tech like Apple, Amazon and Microsoft, and rode them to massive profits, which enriched both the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org