The Brexit date of 29th March has been delayed to the 12th April or the 22nd May as the EU provide a lifeline to the UK to help them avoid a no-deal scenario. This has helped the pound to rise and has provided some of the best rates to buy Swiss Francs in many months. The outlook for the pound is now looking much less rosy as investors await the latest news on Brexit and to see if the House of Commons will be likely to...

Read More »Swiss Balance of Payments and International Investment Position: Q4 2018 and review of the year 2018

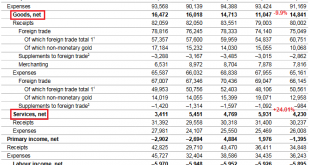

Key developments in 2018 The current account surplus for 2018 was CHF 71 billion, CHF 26 billion more than in the previous year. Changes in primary income (labour and investment income) had the greatest impact: Whereas one year earlier an expenses surplus of CHF 9 billion was recorded, owing to exceptionally large expenses for direct investment receipts in 2017, in the year under review there was a receipts surplus...

Read More »Pound falls against the Swiss franc owing to third meaningful vote uncertainty

The pound has once again felt the impact of the uncertainty caused by Brexit and the pound has fallen against the Swiss franc during yesterday afternoon’s trading session. We are now just over a week away from when the UK is due to leave the European Union and the latest update is that the EU will allow an extension until the end of June if Theresa May can get her deal backed in the next few days. Last night the Prime...

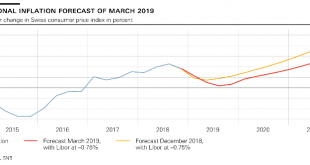

Read More »Monetary policy assessment of 21 March 2019

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as...

Read More »Rothschilds To Take Swiss Bank Private In 100 Million Francs Bid

Benjamin de Rothschild’s family plans to take Swiss Bank Edmond de Rothschild (Suisse) S.A. private as it consolidates and simplifies the bank’s legal structure. According to Bloomberg, Edmond de Rothschild Holding SA will acquire all publicly held Edmond de Rothschild (Suisse) bearer shares at 17,945 francs per share, a 6.7% premium to Tuesday’s closing price, in a deal worth about $100 million. The Swiss bank, which...

Read More »Pound to Swiss Franc Forecast: GBP/CHF rate hits near 1-year high

It is now very close to the best time to buy Swiss Francs with pounds since May 2018. The stronger pound and a reduced global risk appetite has seen the move on the GBP/CHF pairing. This is presenting a much improved opportunity to buy Swiss Francs with pounds. Any client wishing to buy or sell on this pairing might benefit from a quick review with our team to best understand what is next, and the potential outcomes....

Read More »1000-Franc Note Enters Circulation Today

Updated SNB banknote app available Issuance of the new 1000-franc note presented a week ago begins today, 13 March. The Swiss National Bank’s ‘Swiss Banknotes’ app has now been updated to include the new note. 1000-Franc Banknotes Circulation Today - Click to enlarge The app, which has been downloaded some 110,000 times, can be obtained free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com)...

Read More »Swiss National Bank releases new 1000-franc note

Fifth banknote in latest series showcases Switzerland’s communicative flair The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice. The inspiration behind the new banknote series is...

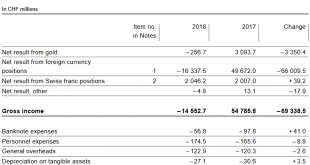

Read More »SNB loses 15 billion in 2018

Overview The SNB earned 2 billion on negative interest rates, but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, the results have huge swings that depends on the FX rate. But the SNB may lose 50 billion in one year and win 60...

Read More »Mit Negativzinsen die Wirtschaft ankurbeln? Nächste Irrlehre der SNB

Seit Jahrzehnten geistert die Illusion in den Köpfen der Oekonomen herum, man könne mit Zinssenkungen eine Wirtschaft ankurbeln. Den Vogel schiesst der vermeintliche „Starökonom“ von der Harvard University, Kenneth Rogoff, ab. Er prophezeit, dass künftige Wirtschaftskrisen mit Negativzinsen von bis zu minus 6 Prozent bekämpft würden. In der jüngsten Sonntagspresse nimmt sich die NZZ, die „externe Public Relations...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org