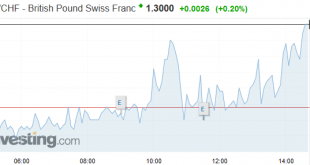

Swiss Franc CHF Exchange Rates Graph - Click to enlarge The pound has rallied higher against the Swiss Franc with rates for the GBP/CHF pair now sitting over 1.32. Pound to Swiss Franc exchange rates have been lifted on the back of some optimism over Brexit, that a deal will be reached between Britain and the EU. The markets are awaiting developments over the contentious Irish backstop which could pave the way...

Read More »Strong Trade Balance Data Supports the Franc

The Swiss Franc has been boosted during early morning trading as investors find the latest Trade Balance data supportive of the economy, with the Trade Balance data coming in showing a surplus of CHF3bn. The strength of the Swiss economy is its exports; in watches, chocolate and specialized industrial engineering. The franc has risen marginally and this could represent a stronger Swiss franc down the line as investors...

Read More »La Dépossession façon BNS. Entretien ORBIS TERRAE

Interview de Vincent Held, auteur du Crépuscule de la Banque nationale suisse, par Orbis Terrae, Bernard Antoine Rouffaer, janvier 2019 L’ouvrage de Vincent Held aborde une série de sujets brûlants : la politique d’affaiblissement du francs suisse menée par la Banque nationale suisse (BNS), l’imbrication de cette politique avec celles des banques privées suisses, la politique d’acquisition d’obligations d’Etat en...

Read More »The SNB’s Karl Brunner Distinguished Lecture Series: Raghuram Rajan announced as next speaker

The Swiss National Bank (SNB) has named Raghuram Rajan as this year’s speaker for its Karl Brunner Distinguished Lecture Series. Professor Rajan has made outstanding contributions to both economic practice and economic research on the global stage. His roles have included Governor of the Reserve Bank of India from 2013 until 2016 and Chief Economist at the IMF between 2003 and 2006. He has held a professorship at the...

Read More »Mark Carney Steadies GBP/CHF Rates on Global Viewpoint

- Click to enlarge The pound to Swiss franc exchange rate has been steadied following comments from Mark Carney during a briefing on the global economy at the Barbican centre in London yesterday. I was fortunate to be in attendance and was struck by Carney’s confident manner, although he highlighted some major risks ahead which would be key for GBP/CHF rates. Sterling was weaker going into the talks, particularly...

Read More »Chaos-Politik der SNB mobilisiert SVP und SP: Milliarden für Vorsorge

Mit „links und rechts“ hat unsere Schweizerischen Nationalbank (SNB) ihre grosse Mühe. Da ist zunächst ihre Bilanz, bei der sie unfähig ist, „links und rechts“ voneinander zu unterscheiden. Unverstanden gerät sie nun folgerichtig auch politisch immer mehr unter Druck: konsequenterweisee von „links und rechts“. Von „links und rechts“ wird nämlich endlich gefordert, dass die SNB ihre Überschüsse aus dem Negativzins den...

Read More »GBPCHF rates hit near 3-month highs

The Pound to Swiss Franc exchange rate has soared dramatically following a series of revelations in the currency markets and global economy. A big factor is of course Sterling strength, which has arisen on the back of increased feelings that the UK will avoid a no-deal Brexit. This could manifest next week in a Parliamentary vote on whether or not to rule out a no-deal Brexit. The Pound is much stronger on this news,...

Read More »Folgt nun der umgekehrte Frankenschock?

An ihrer ersten Sitzung im neuen Jahr hat die Europäische Zentralbank (EZB) ihren Kurs bestätigt. Das Wertschriftenkaufprogramm ist definitiv beendet. Fortan kauft sie netto keine zusätzlichen Anleihen mehr zu. Sondern sie ersetzt nur noch die bestehenden Papiere, die sie in ihrem Portefeuille hält. Läuft eine Anleihe aus, erwirbt sie mit den Mitteln vergleichbare Anleihen, mehr nicht. Der Unterschied: Bisher druckte...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to...

Read More »Will the SNB ever make profits again?

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle: Rising Bond and Stock Prices until 2017 Until 2017, the SNB was able to profit on a secular tendency where both stock...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org