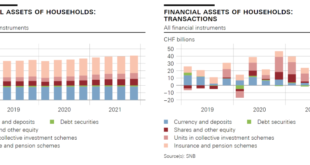

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic. Financial wealth of households increased significantly in 2021 Household financial assets increased by CHF 202 billion...

Read More »Geldcast update: calls for a more transparent Swiss National Bank

The Swiss National Bank (SNB) is very opaque by international standards. That has to change, says Yvan Lengwiler, professor of economics at the University of Basel. He explains his proposals in the latest Geldcast update. “There is no right to secrecy,” says Yvan Lengwiler – not even at the Swiss National Bank. He has joined forces with Stefan Gerlach of the EFG Bank and Charles Wyplosz, a professor at the Graduate Institute in Geneva, to form the “SNB...

Read More »UBS-Präsident Axel Weber verabschiedet sich mit Genugtuung

“Ich habe vor zehn Jahren die Nachfolge von Kaspar Villiger angetreten, der die Bank in den Wirren der Finanzkrise übernahm”, sagte Axel Weber am Mittwoch in einer Abschiedsrede an seiner letzten UBS-Generalversammlung zu den Aktionären. Damals habe er sich gesagt, die UBS müsse wieder als eine Ikone der Schweizer Wirtschaft wahrgenommen werden. “Ich darf heute mit Genugtuung feststellen, dass wir dies auch geschafft haben: UBS ist wieder eine starke Säule der...

Read More »Andréa M. Maechler / Thomas Moser: Life after Libor: A new era of reference interest rates

A new era of reference interest rates began at the start of this year. Libor, which had been the key reference rate for several decades and several currencies, including the Swiss franc, ceased to exist in many currencies at the end of 2021. SARON has now fully replaced Swiss franc Libor. This speech explains why reference rates play a central role in financial markets and discusses the circumstances under which some interest rates either achieve or lose reference...

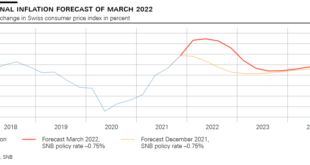

Read More »Quarterly Bulletin 1/2022 – Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of March 2022 The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 24 March 2022’) is an excerpt from the press release published following...

Read More »2022-03-30 – 1/2022 – Business cycle signals: SNB regional network

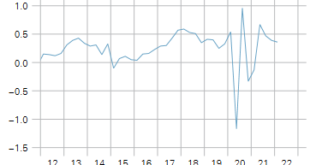

First quarter of 2022 Report submitted to the Governing Board of the Swiss National Bank for its quarterly assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 18 January and 8 March. Key points • Companies saw turnover...

Read More »SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Vulnerabilities have increased and Swiss real estate market Swiss apartments overvalued by 10% to 35% SNB continues to monitor developments in real estate market It is not roll of monetary policy to curb risk to financial system The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304. However at the low today, the pair did find support against what has been a swing area between 0.9293 and 0.92964. The...

Read More »Devisen: Euro legt in etwas weniger trübem Umfeld zu

Auch gegenüber dem Franken hat der Euro am Montag über die erste Tageshälft angezogen. Derzeit kostet er 1,0244, am Morgen waren es noch 1,0213 und am Freitagabend 1,0200. Der US-Dollar zeigt sich bei 0,9348 Fr. relativ stabil. In Marktkreisen gilt es als ziemlich sicher, dass die SNB zur Stützung des Euro auf Höhe der Parität zum Franken eingegriffen hat. Darauf deuten auch die am Montag publizierten Sichtguthaben der SNB, welche innerhalb einer Woche so stark...

Read More »Swiss National Bank renews its commitment to adhere to the FX Global Code

The Swiss National Bank (SNB) has renewed the Statement of Commitment to the FX Global Code based on the revised version of the Code dated July 2021. By signing this Statement, the SNB attests that its internal processes are consistent with the principles of the FX Global Code. The SNB also expects its regular counterparties to comply with the agreed rules of conduct. The FX Global Code sets out principles of good practice in the foreign exchange market. It was first...

Read More »Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix). The SNB’s proposal envisages a deadline for compliance with the increased CCyB requirements of 30 September...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org