SEBA Bank, a digital assets firm with a Swiss banking license from FINMA, announced that it has raised CHF 110 million in a significantly oversubscribed Series C funding round. The round was co-led by Altive, Ordway Selections, and Summer Capital, as well as DeFi Technologies, a NEO listed leader in decentralised finance. Alameda Research, a global cryptocurrency quantitative trading firm and liquidity provider, as well as core partner of FTX, also participated in...

Read More »SNB says successfully tested use of digital currency to settle transactions with top investment banks

The latest trial could see the introduction of central bank digital currency move a step closer in Switzerland. The SNB says that they integrated the digital currencies into payment systems and used them in simulated transactions involving UBS, Credit Suisse, Goldman Sachs, and Citigroup. The test showed it was possible to instantaneously execute payments, ranging from CHF 100,000 to CHF 5 million, elimination counter-party risk. I still think it will be a while...

Read More »SNB erwartet für 2021 Jahresgewinn von 26 Mrd. Franken

Die Nationalbank wird für das Geschäftsjahr 2021 nach provisorischen Berechnungen einen Gewinn in der Grössenordnung von rund 26 Mrd. Franken ausweisen. Der Gewinn ist insbesondere den Fremdwährungspositionen geschuldet. Bund und Kantone erhalten eine Ausschüttung von 6 Mrd. Franken. Bund und Kantone erhalten die maximale Ausschüttung von 6 Mrd. CHF. (Bild: ZVG) Die Schweizerische Nationalbank (SNB) liegt mit ihrem Gewinn für das Geschäftsjahrt 2021 deutlich...

Read More »BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems. Swiss National Bank and five commercial banks integrated wholesale CBDC in their existing back-office systems and processes. Tests covered a wide-range of transactions in Swiss francs – interbank, monetary policy and cross-border. Integrating a wholesale central bank digital currency (CBDC) into existing core banking...

Read More »SNB Sight Deposits: Inflation is there, CHF must Rise

Update January 10, 2021: Sight Deposits have risen by +1.9 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. We had finally arrived in the inflation scenario I was speaking about before. Inflation is the period, when both the Swiss franc and gold must go up. BUT : U.S. CPI is at 5%, at the highest value since the year 1990 (excluding one outlayer in Summer 2008). But European inflation has gone down to 1.9%., In...

Read More »Swiss National Bank expects annual profit of around CHF 26 billion for 2021

Confederation and cantons to receive distribution of CHF 6 billion According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion. The allocation to the provisions...

Read More »SNB profitiert von starker Aktienmarktperformance

Die SNB dürfte laut UBS für das Gesamtjahr 2021 einen Gewinn von fast 20 Mrd. Franken ausweisen. Dieser ist einer starken Aktienmarktperformance zu verdanken trotz belastender Zins- und Währungsveränderungen. Im letzten Quartal hingegen dürfte die Nationalbank wegen der deutlichen Aufwertung des Frankens gegenüber den meisten Währungen einen Verlust von über 20 Mrd. Franken erlitten haben. Nach Berechnungen der UBS dürfte die SNB für 2021 einen Gewinn von 18...

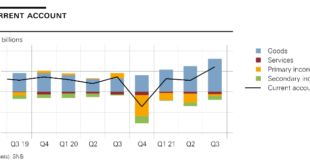

Read More »Swiss balance of payments and international investment position: Q3 2021

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting. Primary income counteracted the rise in the current account balance. While a receipts surplus was...

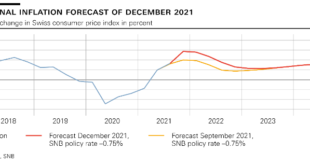

Read More »Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc. In so doing, it takes the overall currency situation into...

Read More »BBVA Switzerland Adds Ether to Its Crypto Trading Service

BBVA Switzerland, the Swiss franchise of Spanish multinational financial institution BBVA, has expanded its cryptocurrency custody and trading service with the addition of Ether to its investment portfolio. Its private banking clients and new gen customers will now have access to both Bitcoin and Ether, a statement from the company said. These digital assets can be viewed along with other traditional investments on BBVA’s app, and can automatically be converted to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org