In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank. Economic environment In the period between the publication of the last Financial Stability Report and the end of 2021, economic and financial conditions for the Swiss banking system remained favourable. GDP has returned to, or even exceeded, pre-crisis levels in most countries and unemployment rates have receded globally....

Read More »Тhomas Jordan: Introductory remarks, news conference

Ladies and gentlemen It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »Andréa M. Maechler: Introductory remarks, news conference

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan. Situation on the financial markets Volatility on the financial markets has increased again significantly since the beginning of the year (cf. chart 1). This was driven by the sharp rise in inflation abroad and by attendant expectations regarding a speedier tightening of...

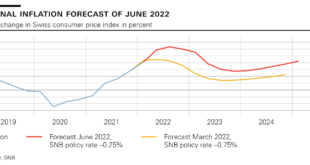

Read More »SNB Monetary policy assessment of June 2022

Swiss National Bank tightens monetary policy and raises SNB policy rate to −0.25% The SNB is tightening its monetary policy and is raising the SNB policy rate and the interest rate on sight deposits at the SNB by half a percentage point to −0.25% to counter increased inflationary pressure. The tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the...

Read More »Aktien Schweiz Schluss – SMI fällt auf tiefsten Stand seit März 2021

Am Schweizer Aktienmarkt ist es auch am Dienstag weiter abwärts gegangen. Die Angst vor einem Abgleiten der Weltwirtschaft in eine Rezession hatte die Anleger fest im Griff. Niedriger war das Barometer der 20 grössten börsennotierten Unternehmen letztmals im März vergangenen Jahres. Weiterhin litten die Börsen unter einem “Cocktail aus Inflation, steigenden Zinsen und daraus resultierender Rezessionsangst”, so ein Marktanalyst. Zumindest bis zur Bekanntgabe des...

Read More »Swiss central bank rejects ‘creative’ demands to change course

The Swiss National Bank is not prepared to release any further reserves. Keystone / Martin Ruetschi The Swiss National Bank (SNB) continues to beat off demands to fight inflation by raising interest rates and to distribute more reserves to cantons and other causes. SNB president Barbara Janom Steiner showed signs of frustration in a speech on Friday that defended the policies of the central bank. “There are ever more varied proposals – and indeed, increasingly,...

Read More »Martin Schlegel wird neuer SNB-Vizepräsident

Schlegel (Jahrgang 1976) wird laut Mitteilung vom Mittwoch per Anfang August die Leitung des II. Departements der SNB übernehmen. Der neue Vize-Chef ist ein SNB-Urgestein. Er ist seit knapp zwanzig Jahren in verschiedenen leitenden Positionen für die SNB tätig, zuletzt seit September 2018 als stellvertretendes Mitglied des Direktoriums im I. Departement. Schlegel bringe mit seiner hohen Fachkompetenz und seiner breiten, langjährigen Erfahrung in notenbankpolitischen...

Read More »SNB Governing Board: Federal Council appoints Martin Schlegel as Vice Chairman of the Governing Board

Petra Gerlach and Attilio Zanetti become Alternate Members of the Governing Board At its meeting of 4 May 2022, the Federal Council appointed Martin Schlegel as Vice Chairman of the Governing Board of the Swiss National Bank with effect from 1 August 2022. He will succeed Fritz Zurbrügg on the Governing Board when the latter steps down at the end of July 2022. Martin Schlegel has been a member of the Enlarged Governing Board and Deputy Head of Department I since 1...

Read More »Aktien – Wie «Amateure» sich an der Börse selber helfen können

Die Kolumne «Gopfried Stutz» erschien zuerst im Credit Suisse und UBS liefern uns ein schönes Lehrstück. Die UBS verspekulierte sich in den USA derart, dass die Schweizerische Nationalbank deren faule Kredite in der Finanzkrise von 2008 übernehmen und somit die Grossbank vor dem Kollaps retten musste. Derweil vermochte die Credit Suisse die Verluste selber zu stemmen und erhielt dafür Anerkennung. Heute ist es gerade umgekehrt: Die UBS schreibt wieder ansprechende...

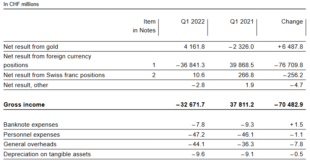

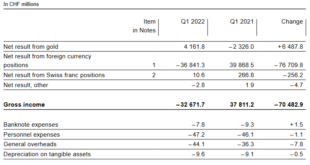

Read More »Interim results of the Swiss National Bank as at 31 March 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org