Many Swiss dream of owning a single-family home in the countryside and passing it on to their children. For most, this dream is increasingly unrealistic. Journalist and deputy head of the swissinfo.ch editorial group for German, French and Italian. Earlier, worked for Teletext and Switzerland’s French-language national broadcaster. More from this author | French DepartmentSamuel Jaberg In 2015, before starting a family, Ophélie* and her partner Laurent* wanted to buy a rural property close to their parents’ homes in the Broye region of canton Fribourg, where they both grew up. Although they knew the search would be difficult, they began looking for a house on a large parcel of land. After scouring the online listings and visiting about ten properties,

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Many Swiss dream of owning a single-family home in the countryside and passing it on to their children. For most, this dream is increasingly unrealistic.

In 2015, before starting a family, Ophélie* and her partner Laurent* wanted to buy a rural property close to their parents’ homes in the Broye region of canton Fribourg, where they both grew up. Although they knew the search would be difficult, they began looking for a house on a large parcel of land.

After scouring the online listings and visiting about ten properties, they grew disillusioned.

“Either the houses were completely overpriced or they required too much work,” said Ophélie.

Their experience is not unusual in Switzerland. According to a study by mortgage experts MoneyPark published in June, more than 60% of tenants would like to buy a home – and single-family houses, ideally in a rural area, are the most popular choice. But 58% of the people surveyed said there was a shortage of properties for sale, and 49% said the prices were too high.

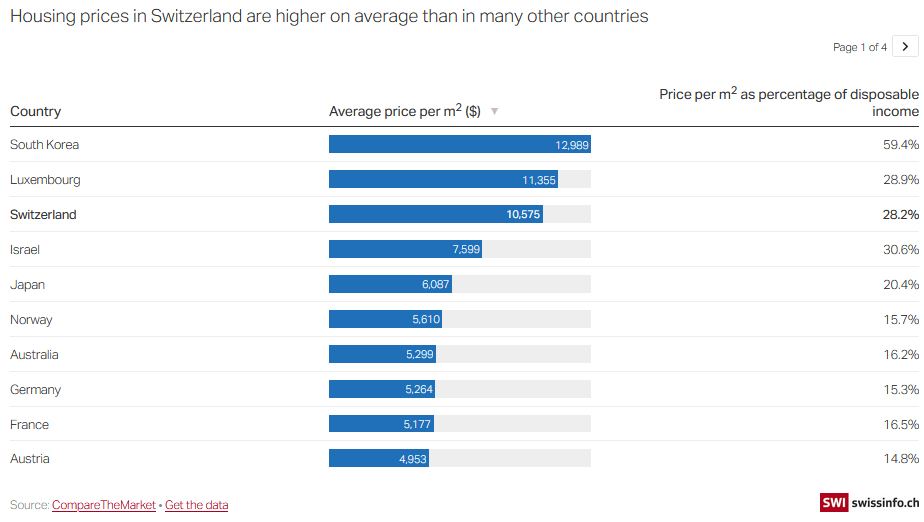

Family money required“Every study shows that the Swiss still strongly wish to buy homes,” said Yves Cachemaille, a property expert at the real-estate firm CBRE. “Unfortunately, prices are prohibitive for an increasing percentage of the population. More and more, a single-family home is becoming a luxury.” According to the property-services company Wüest Partner, real-estate prices have, on average, more than doubled since 2000. Over this same time period, the average salary has increased by only 25%, according to the Federal Statistical Office. In most regions of the country, it costs at least CHF1 million ($1.02 million) to buy a detached house with a garden. Only 30% of Swiss households have the capital necessary to buy an average single-family home, according to a Swiss Life study. Without an inheritance or a family loan, property ownership has become essentially unthinkable for most young adults relying only on their earned income. |

|

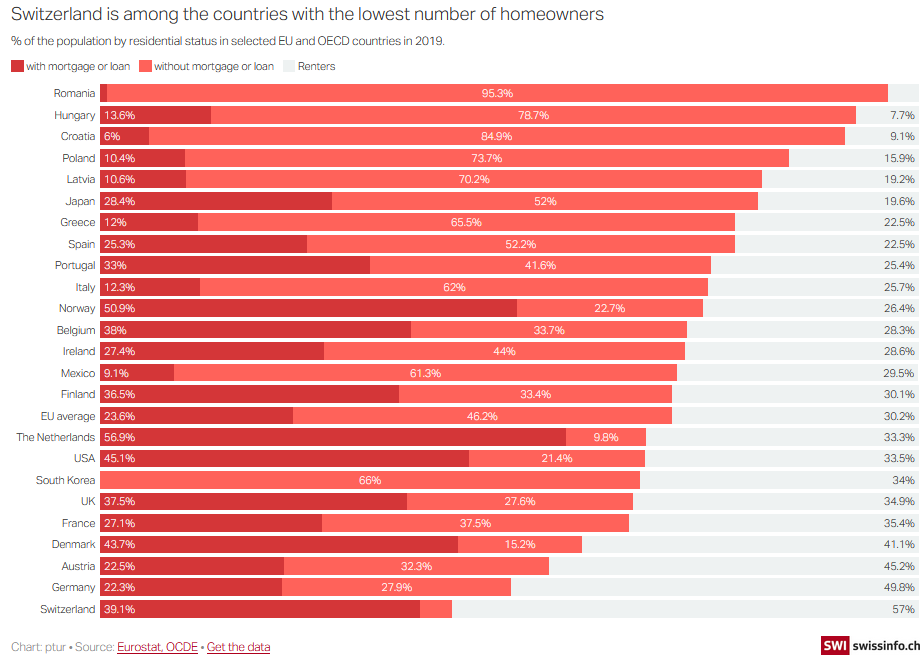

Housing as a source of inequalityThe high cost of properties has also exacerbated inequality: homeowners have benefited from low mortgage interest rates in recent years, while tenants are forced to pay rents that are extremely high, especially in cities. “While wage inequality hasn’t changed much in Switzerland, inequality has increased due to housing expenses,” explained Solène Morvant-Roux, an assistant professor in social economics at the University of Geneva. The wealthiest 20% of households spend only 10% of their income on rent; the lowest-income segment spends 30%. “Even with the current rise in mortgage rates, owning a home remains a safe financial investment that makes housing comparatively affordable,” Cachemaille said. Mortgage rates increased steadily in the first half of 2022 (the average rate for a fixed 10-year mortgage nearly doubled in that time) before stabilising somewhat. Only a minority of the Swiss population, however, can afford this type of investment. Close to 70% of European Union residents own their homes, but in Switzerland that’s true for less than 40%. This disparity stems from significant differences in national housing policies over the last half of the 20th century. “In Spain, after Franco, the state actively encouraged home buying,” Morvant-Roux explained. “In Great Britain in the 1980s, [then-Prime Minister] Margaret Thatcher supported individual interests in an effort to contain large-scale social unrest.” But priorities were different in Switzerland, where the focus lay in monetary stability and full employment. “Democratising access to home ownership never became a public-policy priority,” said the assistant professor. Switzerland is also unusual in that most people have to go into debt – often heavily – to buy property. This debt frequently lasts a lifetime and sometimes gets passed on to the next generation: “In most European countries, parents leave their homes to their children debt-free. In Switzerland, they hand over a mortgage,” said Morvant-Roux. |

This pattern of long-lasting loans owes a lot to the historically significant weight that Switzerland’s financial sector carried, she added. In the Swiss fiscal system, taxpayers can deduct mortgage interest directly from their taxable income. As a result, property owners have little incentive to pay down their mortgage debt. Since banks typically derive a significant portion of their financial turnover from mortgage interest, this fiscal arrangement offers them large gains.

More recently, the Swiss National Bank’s expansionist monetary policy has resulted in excess bank liquidity. This has increased the total sum of mortgage loans, making Switzerland the current world leader in property debt per household.

Many Swiss stay rooted

The Swiss tend to stay put in their existing housing, which exacerbates the challenges of buying property.

“In France, for example, your workplace determines where you live, and it’s not uncommon to buy and sell a home two to three times in your life,” Cachemaille said. “In Switzerland, it’s the opposite. People tend to look for work in the region where they live, even if changing jobs means having to commute farther to work.”

Once the Swiss have finally bought an apartment or a house, they generally hold on to it. Only 3% of the people surveyed by Money Park plan to sell their property within the next three years, and only 15% within the next four to eight years.

The soaring property prices have made long-term owners even more reluctant to sell their homes. They fear they will not find another apartment or house of a similar standard at a decent price. This creates some absurd situations: it is not unusual to find, within the same residential area, a retiree living alone in 200m2 (2,150sq ft) while a family of five has to share an apartment of 80m2.

A shortage likely to continue

The rising mortgage rates could slow the property-price explosion, and the number of listings has increased as the pandemic wanes, but the shortage of single-family homes is unlikely to end any time soon. Morvant-Roux expects the property market to remain under pressure because of Switzerland’s small size, its demographic pressures, and the scarcity of land authorised for construction.

According to the bank Credit Suisse, thousands of flats and houses occupied by baby boomers are likely to come onto the market between now and 2045. This should, over the longer term, ease the property market slightly. But it is unclear how many baby-boomer properties will end up for sale, since one out of every two homes tends to remain within a family.

Like nearly half of her compatriots, Ophélie ended up relying on her family to shift from tenant to home owner. Thanks to an inheritance, she was able to take over her mother’s house and, with some major renovations, transform it to her taste.

Initially, her partner Laurent was not thrilled with this option, but the couple now has two children and sees the many advantages of the property. “Not only financially but also emotionally, since this house has belonged to my family for several generations,” Ophélie said.

“We’ve found a home that suits us,” she added. “We plan to stay here for the rest of our lives and, ideally, pass it on to our children.”

*Not their real names.

Adapted from French by Katherine Bidewell/gw

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Tags: Business,Featured,newsletter