In Europe, Switzerland, Estonia, Malta and Cyprus have the most advanced and mature blockchain ecosystems with well-developed startup scenes and high levels of regulatory maturity, a paper by the EU Blockchain Observatory and Forum says. More specifically, the European Commission (EC) blockchain think tank places Switzerland at the epicenter of blockchain activity, not only in Europe, but globally, noting the country’s massive blockchain industry of 800 dedicated blockchain providers, among which eight unicorns, an active venture capital (VC) ecosystem, and supportive regulators that have formulated favorable rules for the sector to thrive. Switzerland moved early to clarifying the legal situation of crypto-assets, the paper notes, with the earliest report by the

Topics:

Fintechnews Switzerland considers the following as important: 6a.) Fintechnews, Baltic, Blockchain/Bitcoin, EU Blockchain Observatory and Forum, European Commission (EC), Featured, newsletter, Regulation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In Europe, Switzerland, Estonia, Malta and Cyprus have the most advanced and mature blockchain ecosystems with well-developed startup scenes and high levels of regulatory maturity, a paper by the EU Blockchain Observatory and Forum says.

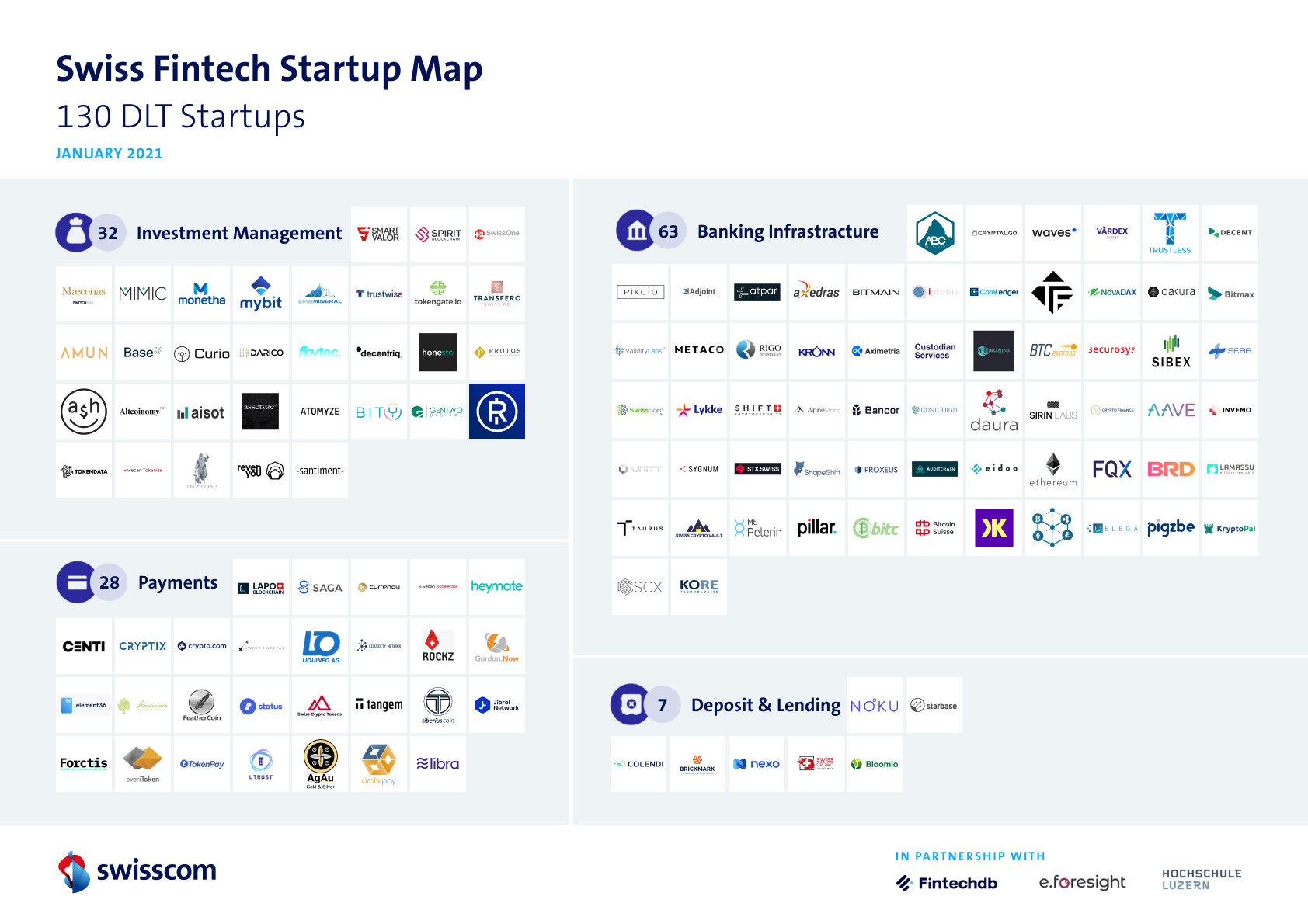

More specifically, the European Commission (EC) blockchain think tank places Switzerland at the epicenter of blockchain activity, not only in Europe, but globally, noting the country’s massive blockchain industry of 800 dedicated blockchain providers, among which eight unicorns, an active venture capital (VC) ecosystem, and supportive regulators that have formulated favorable rules for the sector to thrive.

Switzerland moved early to clarifying the legal situation of crypto-assets, the paper notes, with the earliest report by the federal government published in 2018 that analyzed the applicability of existing legal framework on blockchain. Since then, specific guidance and initiatives have been announced, and this year, the so-called DLT (distributed ledger technology) bill will come into effect. Many observers and experts believe this regulatory development will further cement Switzerland’s position as a global blockchain powerhouse.

Estonia is another European country that was quick to work on crypto-assets regulation. Today, the Baltic country provides a special “digital assets license” to exchanges and custodian crypto-asset wallet providers and allows for the setup of a company remotely though its e-residency program. Estonia counts 143 blockchain startups which have raised a total of EUR 257 million in funding.

Malta, the self-proclaimed “blockchain island,” offers licensing provision for virtual currency/digital assets companies as well. Malta has been among the world’s first jurisdictions to have a comprehensive regulatory regime for crypto-assets. Malta is home to 60 blockchain startups which has raised EUR 51 million in funding.

Cyprus, one of the region’s blockchain hotspot, adopted a national strategy to support and promote the technology in 2019, and is widely known for boasting the first ever academic course and full degree on blockchain. Today, the country is home to 27 blockchain startups that have raised a total of EUR 142 million in funding, making it one Europe’s most successful countries in attracting investment capital in blockchain.

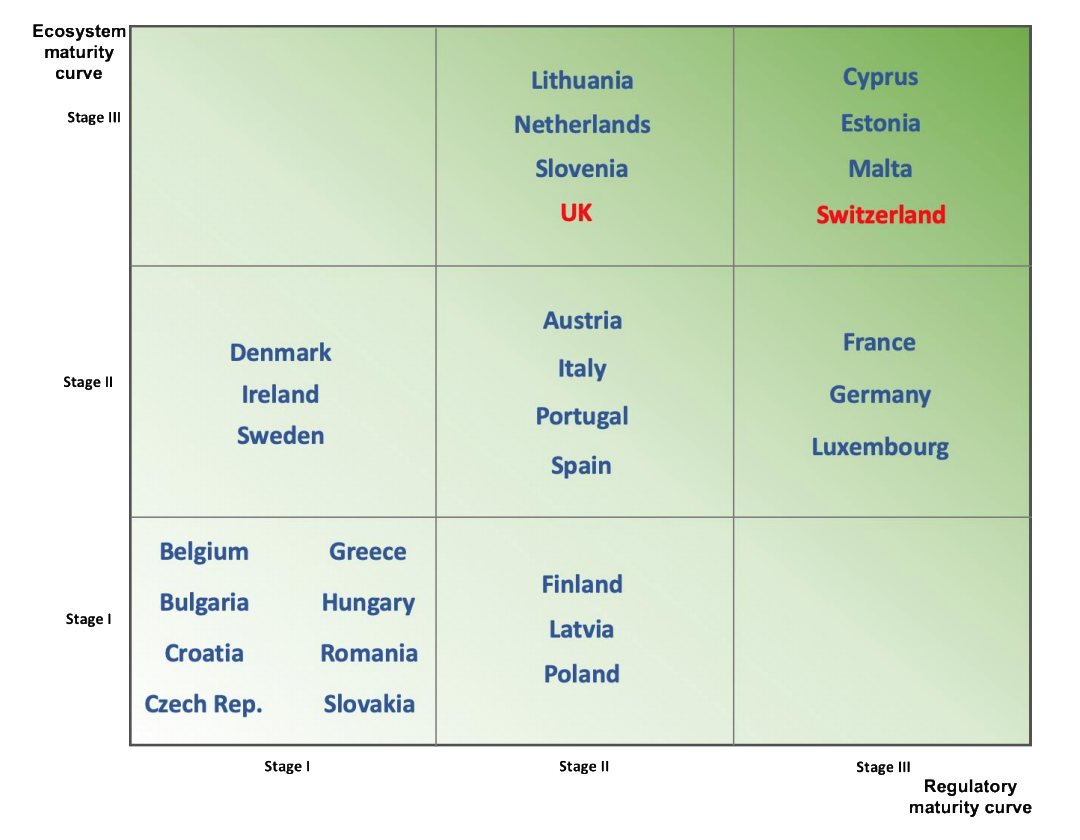

An heterogeneous regionBlockchain development and maturity vary drastic across European countries. At the other end of the spectrum, Belgium, Bulgaria, Croatia, Czech Republic, Greece, Hungary, Romania and Slovakia were found to have the least mature blockchain ecosystems with just a few blockchain startups – 38 companies the most (Czech Republic), and seven companies the least (Croatia). Meanwhile, countries including Lithuania, the Netherlands, Slovenia and the UK have burgeoning fintech startup communities but their regulatory frameworks could be improved. France, Germany and Luxembourg were found to have regulatory ecosystems that are mature, but relatively small blockchain startup ecosystems. European blockchain ecosystems maturity matrix, EU Blockchain Ecosystem Developments, EU Blockchain Observatory and Forum, Nov 2020 In 2018, 21 European Union (EU) member states and Norway adopted the European Blockchain Partnership (EBP), the first EU-wide initiative specifically devoted to blockchain. Since then, eight more countries have joined the partnerships, bringing the total number of signatories to 30. |

Among other projects, the EBP has been working on developing the European Blockchain Services Infrastructure (EBSI), a peer-to-peer (P2P) network of interconnected nodes running a blockchain-based services infrastructure. Initially, the system will support notarization services, diplomas and education credentials management, a European self-sovereign identity, as well as data sharing among customs and tax authorities in the EU.

Each member of the EBP will run at least one node. 25 nodes are currently live, and 11 nodes are currently in setup phase.

EU member states have been exploring the potential of blockchain and crypto-assets individually. France’s central bank recently completed a pilot transaction with a digital currency running on blockchain technology. Ukraine and Turkey are other European countries that are exploring the merits of central bank digital currency (CBDC). In the UK, two hospitals started using blockchain technology to keep taps on the storage and supply of COVID-19 vaccines.

Germany passed new legislation in December 2020 that allows all-electronic securities to be recorded using blockchain technology.

Tags: Baltic,Blockchain/Bitcoin,EU Blockchain Observatory and Forum,European Commission (EC),Featured,newsletter,Regulation