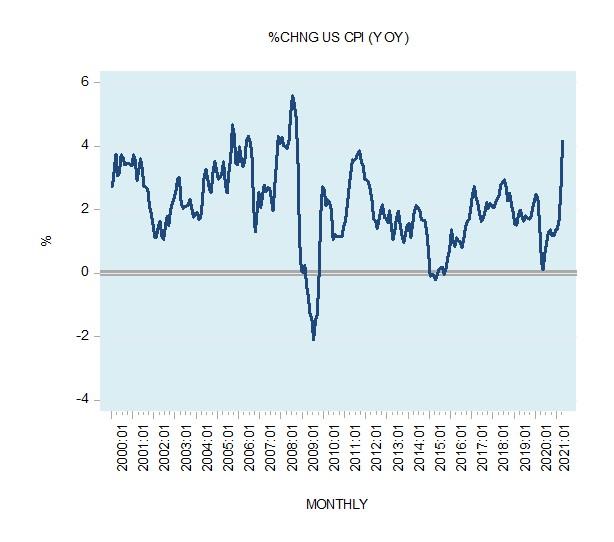

The increase in the growth rate of the Consumer Price Index (CPI) has fueled concerns that if the rising trend were to continue the Fed is likely to tighten its interest rate stance. Observe that the yearly growth rate in the CPI climbed to 4.2 percent in April from 2.6 percent in March and 0.3 percent in April 2020. We hold that because of massive increases in the money supply, it is likely that the growth momentum of prices is going to follow a rising trend. U.S. CPI YoY, 2000 - 2021 - Click to enlarge Note that the yearly growth rate of money supply climbed to 79 percent in February from 6.5 percent in February 2020. Various increases in the prices of goods are just the manifestation of increases in money supply. Once money enters a particular market,

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The increase in the growth rate of the Consumer Price Index (CPI) has fueled concerns that if the rising trend were to continue the Fed is likely to tighten its interest rate stance. Observe that the yearly growth rate in the CPI climbed to 4.2 percent in April from 2.6 percent in March and 0.3 percent in April 2020.

We hold that because of massive increases in the money supply, it is likely that the growth momentum of prices is going to follow a rising trend. |

U.S. CPI YoY, 2000 - 2021 |

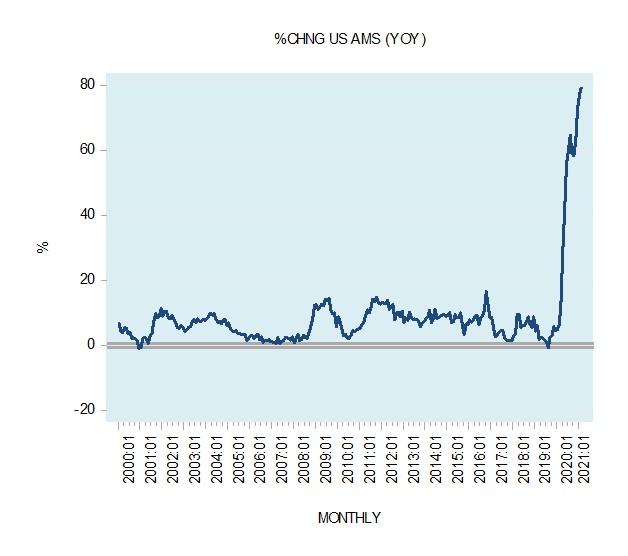

| Note that the yearly growth rate of money supply climbed to 79 percent in February from 6.5 percent in February 2020. Various increases in the prices of goods are just the manifestation of increases in money supply.

Once money enters a particular market, this means that more money is paid for a product in that market. Alternatively, we can say that the price of a good in this market has gone up. Note that a price is the number of dollars per unit of something. |

U.S. AMS YoY, 2000 - 2021 |

Hence, an increase in money supply, all other things being equal, implies that a greater amount of money is going to enter into various markets. This means that the prices of goods will follow suit.

Also, note that when money is injected it enters a particular market. Once the price of a good is rising to the level that is perceived as fully valued then the money leaves to another market, which is considered as undervalued. The shift from one market to another market gives rise to a time lag from increases in money and its effect on the average price increases.

Because of the time lag, the manifestation of the current strong increases in money supply in terms of the prices of goods is likely to become visible in the months ahead.

On account of the likely uptrend in the growth rate of the prices of goods in the months ahead we hold that the economic bust is going to emerge regardless of whether the Fed is going to tighten its interest rate stance or not. Here is why.

Money Supply and Liquidity

In a market economy, a major service that money provides is that of the medium of exchange. Producers exchange their goods for money and then exchange money for other goods. As the production of goods increases, this results in a greater demand for money. Conversely, as economic activity slows down the demand for money follows suit.

The demand for money is also affected by changes in prices. An increase in the prices of goods and assets leads to an increase in the demand for money. People now demand more money to facilitate goods and assets that are more expensive. A fall in the prices of goods and assets results in a decline in the demand for money.

According to Mises,

The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power.1

Changes in the Supply of Money and Liquidity

Consider an increase in the supply of money for a given state of economic activity. Since we did not have here a change in the demand for money, this means that people now have a surplus of money. No individual wants to hold more money than is required. An individual can get rid of surplus money by exchanging the money for goods and assets. Individuals as a group however cannot dispose of the surplus of money just like that. They can only shift money from one individual to another individual.2

The mechanism that generates the reduction of the surplus of money is the increase in the prices of goods and assets. Once individuals start to employ the surplus of money in acquiring goods and assets this pushes goods and asset prices higher. As a result, the demand for money increases. All this in turn works towards the decline in the monetary surplus.

Whilst increases in the money supply for a given level of economic activity results in a monetary surplus, a fall in the money supply for a given level of economic activity leads to a monetary deficit.

Individuals still demand the same amount of money. To accommodate this they will start selling goods and assets for money, thus pushing goods and asset prices lower. At lower prices, the demand for money declines and this in turn works towards the elimination of the monetary deficit.

When Changes in Liquidity Occur Due to Factors Other Than Changes in the Money Supply

A monetary surplus or a deficit can also emerge in response to changes in economic activity and changes in prices.

For instance, an increase in liquidity can emerge for a decline in economic activity whilst the stock of money and the prices of goods and assets remain unchanged. A decline in economic activity results in a fewer goods produced. This means that less goods are going to be exchanged – implying a decline in the demand for money. Conversely, an increase in economic activity whilst the stock of money and the prices of goods and assets stay unchanged produces a monetary deficit.

If an increase in the prices of goods and assets, all other things being equal, takes place this triggers an increase in the demand for money. This puts downward pressure on liquidity. To restore the balance individuals are likely to start selling goods and assets in order to accommodate the increase in the demand for money. Conversely, a decline in the prices of goods and assets triggers a decline in the demand for money and within all other things being equal to the increase in liquidity.

Note that changes in real economic activity and changes in prices are factors that affecting the demand for money. Hence, we can suggest that changes in liquidity are driven by changes in the supply of money minus changes in the demand for money.

Consequently, changes in liquidity are defined as

% Change in Liquidity = % Change in Money Supply – % Change in Real Economic Activity – percent Change in Prices

We can thus establish that changes in monetary liquidity are the outcome of the interplay between the supply and the demand for money.

Easy Monetary Policy Sets the Stage for an Economic Bust

Again, the yearly growth rate of the US money supply as depicted by our AMS (Austrian money supply) metric stood at 79 percent in February this year against 6.5 percent in February 2020. This massive increase has likely severely undermined the pool of real savings and set the platform for large increases in the prices of goods and assets. We suggest that within all other things being equal, a rising momentum of prices is going to increase the demand for money thereby weakening the excess money growth, i.e., the monetary liquidity.

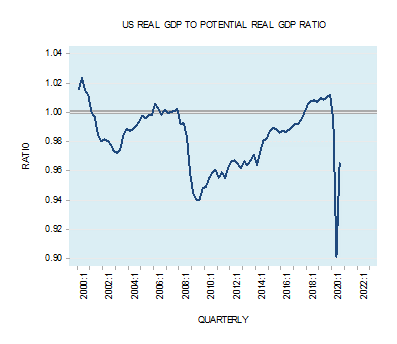

This is likely to result in the selling of goods and assets and to the decline in the growth momentum of prices. Consequently, within all other things being equal nominal economic activity in terms of GDP is likely to come under downward pressure.

We suggest that a weakening in the pool of real savings due to very loose monetary and fiscal policies is going to exert a further downward pressure on the growth rate of GDP.

Note that the likely economic slump is because of the increase in the prices of goods and assets coupled with the weakening in the pool of real savings. The increase in prices is expected to weaken the monetary liquidity thereby setting in motion the selling of goods and assets thus depressing the goods and asset prices momentum. Observe that the trigger to all this is past strong increases in money supply.

If the Fed were to embark on aggressive monetary pumping to counter economic recession this is going to dilute further the pool of real savings and make things much worse. Note that the economic slump is likely to emerge regardless of whether the Fed is going to tighten its interest rate stance or not. The key cause for this is the increase in the growth momentum of goods and asset prices because of past strong monetary growth.

Hence, we could end up in an economic slump as a result of the past strong monetary growth. The economic slump is likely to emerge regardless of whether the Fed is going to tighten its monetary stance or not. The severity of the slump is going to be dictated by the state of the pool of real savings.

- 1. Ludwig von Mises, Human Action: A Treatise on Economics, 3d rev. ed. (Chicago: Contemporary Books, 1966), p. 421.

- 2. Murray N. Rothbard, The Mystery of Banking (New York: Richardson and Snyder, 1983), pp. 29–41.

Tags: Featured,newsletter