A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending. However, a paradigm can also prevent one from discovering an important new truth. This occurs because it can steer the thought process to the comfortable and the convenient. At the same time, it filters out information which may cause one to question these tempting conclusions. For example, the Medievals believed that the sun and planets revolved around the Earth. When

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, dollar price, Featured, Friedman, gold basis, Gold co-basis, gold price, gold silver ratio, Keynes, Monetarism, newsletter, paradigm, purchasing power, quantity theory of money, silver basis, Silver co-basis, silver price, yield purchasing power

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending.

However, a paradigm can also prevent one from discovering an important new truth. This occurs because it can steer the thought process to the comfortable and the convenient. At the same time, it filters out information which may cause one to question these tempting conclusions. For example, the Medievals believed that the sun and planets revolved around the Earth. When they peered through telescopes, they thought they saw the planets going forward for a while, then backward a bit, then forward again. They developed elaborate math to describe this so-called retrograde motion.

The Scientist vs the Medieval

The scientist does not see the possibility of alchemy, tarot cards, and ESP. If he observes a clever magic act like Penn and Teller, he looks for the trick. Even if he doesn’t see it—because those guys are really good at their act—he knows there is a trick of some sort.

The Medieval Monk does not see the possibility of physics, with universal laws like gravity that govern the motions of all objects. If he observes the planets through a telescope, he looks for a way to fit what he sees to the Geocentric paradigm. Even if he is shown a model of the solar system with the sun in the center, and the planets including Earth in rings around it, he looks for the trick.

A paradigm is a methodology to evaluate facts and explanations. But few call the paradigm itself into question. Both the scientist and the monk are following the thought patterns of their paradigms, and enjoy the esteem of their peers. In other words, their thinking is consistent with the prescriptions of their respective paradigms. The difference between them, of course, is that the Medieval Monk is using a false paradigm.

The Quantity Theory of Money Paradigm

By now, you may be wondering what all this discussion of paradigms has to do with monetary science. This field is dominated by one paradigm: the Quantity Theory of Money (QTM). Both proponents and opponents of the Federal Reserve evaluate matters monetary in terms of quantity. Milton Friedman famously said, “Inflation is everywhere and always a monetary phenomenon.”

This paradigm is so dominant, that people talk of the purchasing power of the dollar. That is, the prices of everything you can buy are implied to be intrinsic to the dollar itself. If you can buy a steak for $1.50 (as a reader recently told us), then that means the dollar has a strong power to purchase things. If the price of healthcare—forget the distortions and useless ingredients imposed by Obamacare—skyrockets, then the dollar has weak power to purchase stuff.

This notion extends further than the dollar. They think of the purchasing power of capital assets, too. That is, if you liquidate a farm, how many groceries could it buy? At a talk, Keith was confronted by someone in the audience who asserted that the purpose of an investment was to increase your purchasing power. This fellow did not seem to be aware of the paradigm which guided and filtered his thoughts. It was natural to him to think of trading capital assets for consumer goods.

We have written many essays describing the alternative to the purchasing power paradigm—we call it yield purchasing power. So far, the prevailing QTM paradigm retains its grip on the minds of economists and laymen alike.

Money Goes Into

This brings us to the topic for today. Since the last crisis in 2008, there has been a massive increase in the quantity of irredeemable currency that the prevailing paradigm considers to be money. There has not been a corresponding increase in the Consumer Price Index (despite the ferocious and relentless onslaught of useless ingredients). Indeed, as we have written, the prices of various goods such as fast food, blue jeans, and now steak, are lower than they had been years or even decades ago. However, few question the paradigm itself. Instead, they look for a trick. How many times have you seen articles claiming that the published inflation rate is a lie?

Instead of consumer prices, there has been a massive rise in the prices of equities and properties. We need an explanation of this dilemma. One candidate stands out. Economists tell us that the money did not go into consumer goods. It went into asset prices, they say.

This is a curious notion: to go into. It does not come from observing reality, but from the paradigm. This is a case where paradigms can becomes dangerous, when they steer thinking away from reality. The fact of the matter is simple: money (or irredeemable currency) does not go into or out of anything.

A simple example may help. Suppose Joe buys a house from Mary. Before the transaction, Joe has $500,000 and Mary has a house. After the transaction, Joe has the house and Mary has the $500,000. The dollars did not go into the house. They went into Mary’s bank account.

If Mary had bought the house from Bill a year earlier, for $400,000, then Joe is now paying her a higher price than she paid to Bill. But whatever the cause of this may be, it is not money going into the house. Or into houses in general.

The prevailing paradigm tempts one to believe in this notion, of money going into, because it’s simple and easy. It’s certainly easier than throwing the paradigm out, and starting from scratch on a new theory.

In this paradigm, changing prices are described as inflation or deflation. Thus non-rising consumer prices combined with skyrocketing capital asset prices is consumer goods disinflation and asset inflation. And the excess quantity of money that was printed (actually, borrowed) post-2008 went into asset prices, as opposed to consumer goods.

Alas, as the example of Mary and Joe demonstrates, we need a new paradigm. The prevailing one may have seemed to work in the Postwar period until 1981. Prices (and interest rates) were rising, as was the quantity of dollars.

Superstition

It reminds us of the old superstition, which held that a US president elected in a year ending in “00” was fated to die in office. This superstition seemed to work, until 1980. President Reagan presided over the end of both, proving that correlation is not causality.

As the presidential death curse did not fit with the prevailing scientific paradigm, no one clung to belief in it. But as of 2019, people still cling to the QTM. Monetary economics is more welcoming to magical thinking than physical science, including even cargo cult thinking.

The original cargo cultists believed that the cargo (i.e. the goods) were intrinsic to the paraphernalia of a landing strip. So when the US Army pulled out after World War II, they made facsimiles of military equipment, for example headphones from coconut shells. And with tiki torches in hand, they tried to summon the airplanes full of cargo.

We know this is irrational. But economics holds that the goods are intrinsic to the dollar. Not quite in the literal sense, but they speak of the purchasing power of the dollar the way a cargo cultist might have spoken of the cargo power of the army flashlight.

Magic Money Cult

And both the Keynesians and the Monetarists teach their slightly different versions of how central bank money printing can stimulate the economy, and make GDP, employment, and exports go up—everything up to but not quite including summon the cargo.

Modern Monetary Theory takes it one step further and says there’s no hard limit to how much good the central bank can do to us, except maybe the bathroom sink might overflow.

So in this paradigm, it’s not just prices of goods rising with increasing quantity of money. It’s that the goods are intrinsic to the dollar. Which is why it logically follows that central banks can make us wealthier if they print the right amount of money. And the only limitation on this is that it may make prices rise so fast as to alarm the mouth-breathing masses.

This fits with former Fed Chair Janet Yellen’s seminal paper (which Keith wrote about, for Forbes). To summarize:

- Disgruntled employees don’t work hard, and may even sabotage machinery

- So companies must overpay to keep them from slacking

- Higher pay means fewer workers, because companies have a finite budget

- Central bank printing provides corporations with more money to hire more people

- This causes inflation

- So give them all a raise, and print more—stay inside their decision loops

It also fits with currently-fashionable policy amongst the otherwise-free-marketers: the Fed should print that amount of money which causes GDP to rise by the right amount. In other words, the Fed should summon the right amount of cargo.

So what is the difference between Yellen, a member of the New Keynesian School, and the Monetarists? Well she focuses on labor as the target, and they focus on GDP. Both of these come from the same fallacious paradigm, which regards the goodies as intrinsic to the dollar. Their quibble is that the Yellen camp wants printing with discretion, whereas the Monetarists want printing under a rule.

Paradigm Trap

For those who are caught in the throes of a bad paradigm, there are no facts that will cause them to question the paradigm itself. Instead, all facts are jammed into the paradigm, and used to reinforce it. For example, we have non-rising consumer prices along with rising asset prices. Under the prevailing QTM paradigm, these are rationalized as two different kinds of inflation. The rationalization is that there are two different places into which money can go.

We can only reiterate our view, and hope that it serves as the antidote to this paradigm. Falling interest rates act as an increasing incentive for producers to borrow more to add more capacity. Increased supply of goods pushes down the prices of goods. At the same time, a lower rate both enables and motivates investors to exchange Treasury bonds for other assets. In other words, the earnings yield on equities and the cap rate on properties is dragged down with the falling bond yield. And asset prices are the inverse of yields.

Our view is based not on quantity, but on arbitrage. People are not motivated by aggregate statistics. They are motivated by incentives. If it is possible to borrow at 2% to build a hamburger restaurant that will make 10% return on capital, you can bet that hamburger restaurants will borrow to build more stores. If the supply of hamburgers goes up, then you can bet that the price of hamburgers will go down. And so will the return on capital in the hamburger business.

This, rather than QTM and inflation, is the way to understand non-rising consumer prices and skyrocketing asset prices.

Supply and Demand Fundamentals

Yesterday was the Labor Day holiday in the US.

The facts are that the euro lost another 1.4%, the pound another 1.1%, and the yuan another 0.9% this week. So, naturally, what’s getting play is a story that Bank of England governor Mark Carney said the dollar’s influence could decline. This is somewhat ironic, because in true Keynesian fashion, Carney believes in a “savings glut” which he laments has caused “low inflation”.

Everyone should be bellowing from the rooftops, not about the greatly-exaggerated death of the dollar, but that major currencies are dropping so fast! Analysts should be inquiring why they are falling, while their paradigm encourages them to think that it’s the dollar which is, or should be, falling.

We think it’s entirely appropriate to measure these currencies by the US dollar, as they are derived from the dollar. And we measure the dollar by gold. Since the recent peak, at 24.51 milligrams gold at the beginning of May, the dollar has fallen 12% to 20.34mg. It now seems to be within striking distance of its all-time low set in 2011, about 16mg.

In gold terms, since that same date, the euro has fallen over 18%. We don’t know why Europeans aren’t screaming “bloody murder” at this not-so-subtle looting. And to a somewhat lesser degree, Americans should be right there yelling too.

Instead, gold owners in both currency areas are celebrating. That’s because they adhere to the dollar paradigm. Although they know that the dollar loses value, they measure the value of everything else in dollars. They think gold is going up.

We have a radical idea: the dollar’s loss can be measured in gold.

That means: if the price of gold doubles, the gold owner may have twice as many dollars but those dollars are each worth half as much. It’s good to own gold, not for making profits but for avoiding the loss of the currency.

The dollar’s loss cannot be measured in consumer goods. That’s because every producer is constantly working to cut costs and prices. And every regulator, litigator, and taxinater is constantly working to add useless ingredients and drive up costs. Consumer prices are not stable.

It can be measured in gold. That’s because virtually all of the gold mined over thousands of years of human history is still in human hands. Gold has (by a country mile) the highest ratio of stocks to flows, and hence the greatest stability. Consumer goods have rapidly declining marginal utility. Gold has non-declining marginal utility, which is why we continue to accumulate. The market continues to absorb gold mine production, despite having accumulated so much. There is no apparent limit, in contrast to wheat, or even oil, or even copper.

It’s a crazy idea, using gold to measure value. Or so it seems—from the prevailing dollar / Quantity Theory of Money / purchasing power / inflation paradigm.

It was a fascinating week of price action. The price of gold dropped $7—but the price of silver went up almost a buck (96¢). Read on to see if this move was due to leveraged speculators buying futures, or fundamental buying of silver metal.

It is worth noting that, despite negative interest rates, the collapse (we assume) of business in Hong Kong, trade wars and tariffs, and likely credit crisis coming, there is no sign of backwardation in either metal. So there is no incipient gold or silver crisis.

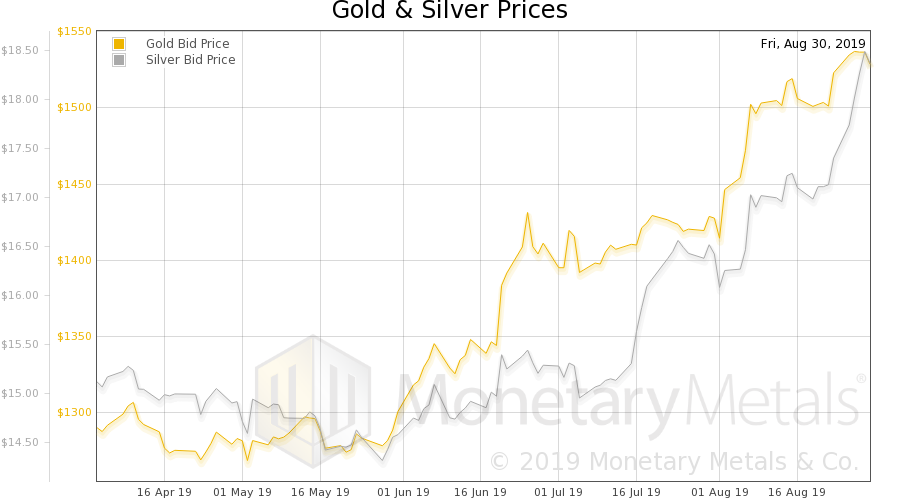

Gold and Silver PricesNow let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

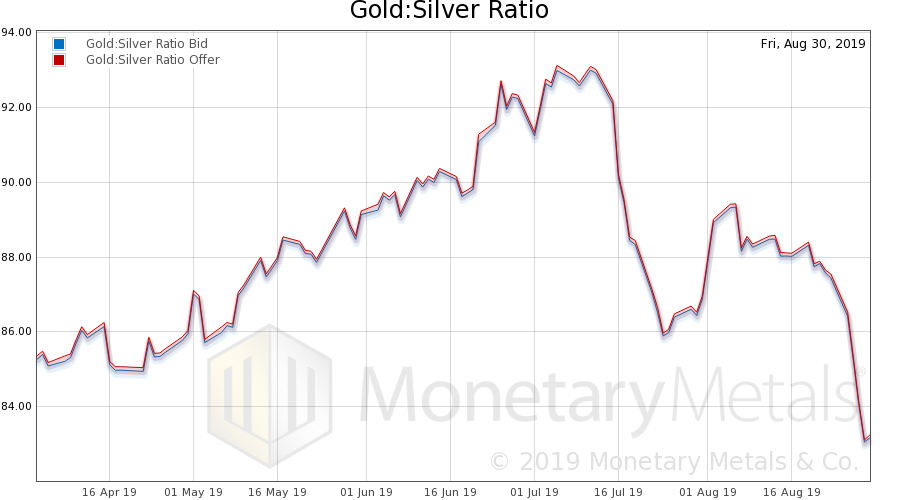

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped sharply week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

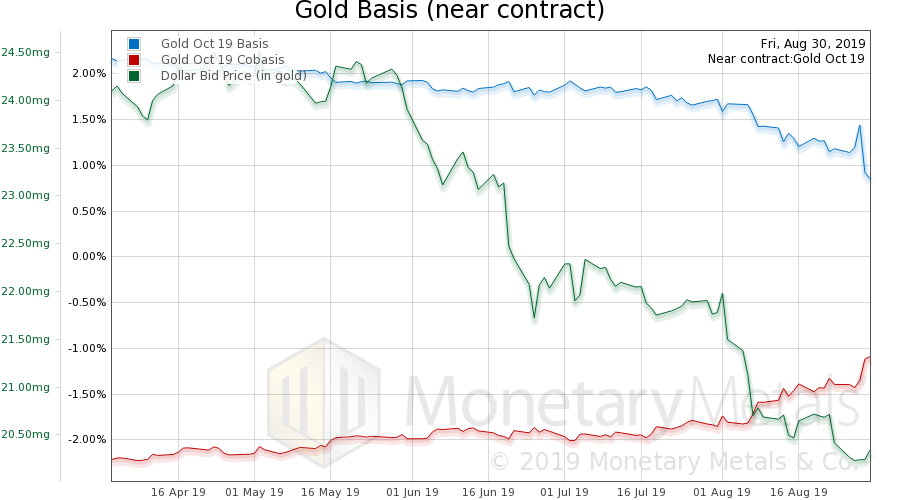

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. There is a bit of a rise in the scarcity of gold to the market (i.e. cobasis), at least in the October contract though not so much in the gold basis continuous. The action was not in gold this week. And the Monetary Metals Gold Fundamental Price dropped just as much as the market price, -$7 to $1,536. |

Gold Basis and Co-basis and the Dollar Price(see more posts on gold basis, gold co-basis. dollar price, ) |

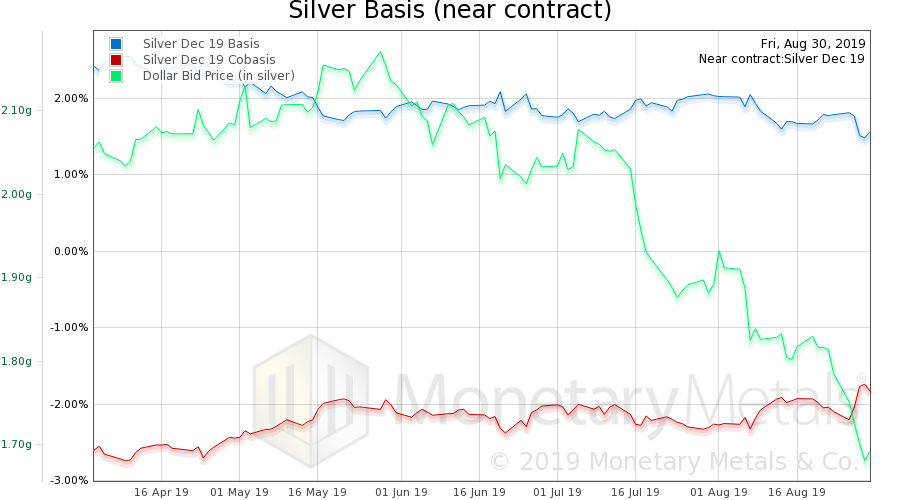

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Last week we wondered, “Is the cobasis rolling over?” There was no rollover, as we can see it has risen even despite a big drop in the price of the dollar from 1.79 to 1.69 grams (i.e. big increase in the price of silver, measured in dollars). Silver is no more abundant with a price over $18 than it was a dollar lower. The fundamental price moved up $1.27 to $18.31. This week, the ferocious buying of silver was led by buyers of physical metal, not leveraged futures market speculators. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Gold to Silver RatioThis week, our rhetorical question is: “will the gold-silver ratio revert to the mean?” The mean, as you can see from this graph is just over 60. At today’s price of gold, that would put silver at $23.85. Or if gold keeps going up, say to $2000, then silver would be over $31. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

© 2019 Monetary Metals

Tags: Basic Reports,dollar price,Featured,Friedman,gold basis,Gold co-basis,gold price,gold silver ratio,Keynes,monetarism,newsletter,paradigm,purchasing power,quantity theory of money,silver basis,Silver co-basis,silver price,yield purchasing power