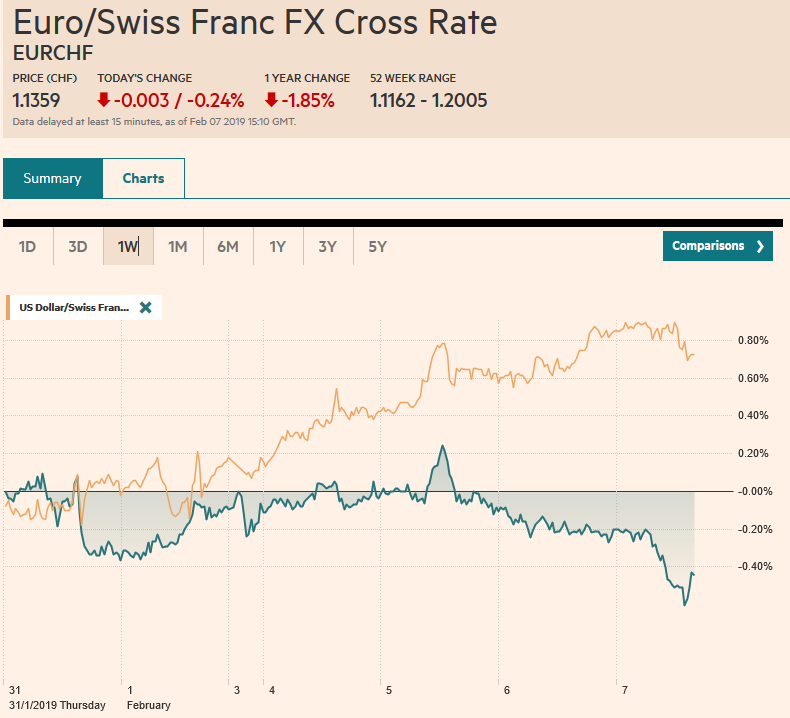

Swiss Franc The Euro has fallen by 0.24% at 1.1359 EUR/CHF and USD/CHF, February 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The five-day advance of the S&P 500 stalled yesterday and global equities are mixed today. Most Asian centers remain closed, Japan and some small markets were lower, while Taiwan, Australia, and India moved higher. The seven-day rally in Europe’s Dow Jones Stoxx 600 is under threat today. Australia and New Zealand bond yields fell, while European bonds are little changed, Italian bonds are underperforming, In the foreign exchange market, the dollar remains firm against the major currencies, and the Dollar Index is extending

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, JPY, MXN, newsletter, NZD, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.24% at 1.1359 |

EUR/CHF and USD/CHF, February 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

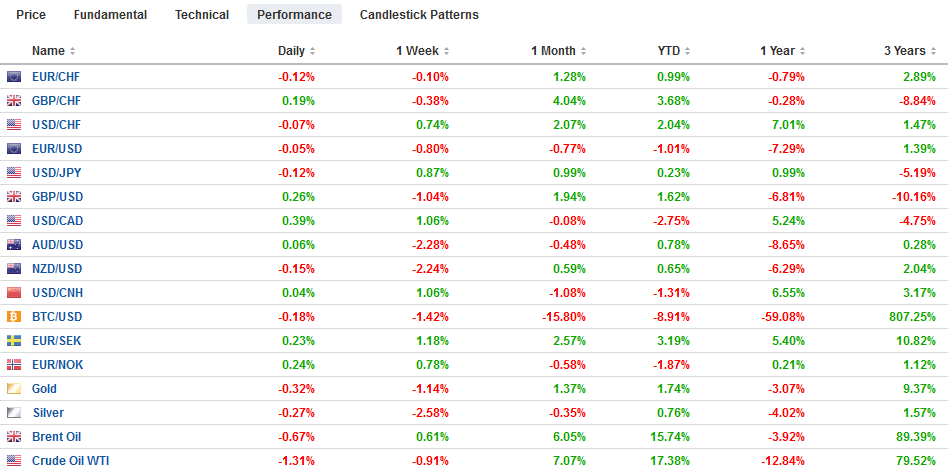

FX RatesOverview: The five-day advance of the S&P 500 stalled yesterday and global equities are mixed today. Most Asian centers remain closed, Japan and some small markets were lower, while Taiwan, Australia, and India moved higher. The seven-day rally in Europe’s Dow Jones Stoxx 600 is under threat today. Australia and New Zealand bond yields fell, while European bonds are little changed, Italian bonds are underperforming, In the foreign exchange market, the dollar remains firm against the major currencies, and the Dollar Index is extending its rally into fifth consecutive session, the longest since last September-October. Most emerging markets currencies are weaker. The Indian rupee is a notable exception. It is firmer even though the Reserve Bank of India surprised many with a 25 bp rate cut. The Bank of England meets, but not fresh action of guidance is expected. |

FX Performance, February 07 |

Asia Pacific

The Australian and New Zealand dollars have fallen out of favor. After rallying on a hawkish central bank statement, the Australian dollar came under pressure when Governor Lowe signaled a neutral stance. New Zealand reported an unexpected strong rise in unemployment from a revised 3.9% (from 4.0%, which was a ten-year low) to 4.3%. Slower employment growth and a dip in the participation rate were also reported.

At his first meeting, the new Governor of the Reserve Bank of India surprised most observers with a 25 bp cut in the repo rate to 6.25%. Only about a quarter of the Bloomberg survey anticipated rat cute, though as we noted yesterday, inflation and growth have been weakening. The decision to cut was on a 4-2 vote, but the shift to a neutral bias was unanimous decision. Last week Prime Minister Modi unveiled a fiscal stimulus initiative (ahead of elections later this year). The combination of easier monetary and fiscal policies tends to be associated with a weaker currency. Counter-intuitively the rupee is trading higher for the third consecutive session, despite the unexpected rate move. The dollar had gapped higher on Monday and the losses over the past three sessions, saw the dollar fill the gap. The greenback finished last week near INR71.25. It is not a little above INR71.40.

The dollar remains in tight ranges against the yen, though is edging up for the fourth consecutive session. It may be running into option-related offers with a $1.1 bln in expiring options struck at JPY110.00. The Australian dollar has marginally extended yesterday’s nearly 1.8% decline that brought it to $0.7100. The Aussie is straddling that area now. The low from the second half of January is was near $0.7075, which is the next immediate target, and a break may signal a move toward $0.7000-$0.7020. The New Zealand dollar’s losses are also being extended. Strong support is not seen until near $0.6700. It finished last month above $0.6900.

Europe

Economic data from the EMU continues to disappoint economists’ forecasts. Policymakers also continue to be surprised. The Bloomberg survey found median expectations for German industrial output to rise 0.8% in December and 0.4% in Spain. Instead, German industrial production slumped 0.4% and Spain’s industrial output dropped 1.4%. Italy reported December retail sales fell 0.7%. The median guesstimate was for a 0.2% decline. After reporting that some sources close to the ECB saw a new loan facility as urgent earlier in the week, Bloomberg reported yesterday that other sources still needed to be convinced. Today’s economic data coupled with the ECB’s month bulletin, acknowledging weaker growth is part of the compelling evidence that we expected to continue to build. Officials will want to get the most bang for the buck, which means milking the announcement effect for as much as possible as well.

There are two developments in the Brexit drama to note. First, Labour Corbyn has staked out what could be the party’s clearest stance on Brexit to date. He offered to support May’s bill provided she meet five conditions, of which staying the customs union. May does not appear ready to embrace his demands. Second, reports suggest that May’s brinkmanship tactics means that a House of Commons vote next week is too early. Instead, it looks as if the next vote would be a fortnight later (~February 25?).

At the end of last year, op-ed pages were full of hand wringing economists worried about the demand for Italian bonds after the ECB, who were told was the only buyer, ended its asset purchases. But lo and behold, Italian bonds have been in great demand. Last month saw a record reception to its 2035 bond sales. It came back with a 30-year bond syndicated sale that was more than five times oversubscribed. It seems too easy to conclude that Italy’s high yields are overcoming other concerns, but look at what happened in Japan. Japan’s 10-year bond sales earlier in the week drew the strongest demand in more than a decade, and today’s 30-year bond offering saw a bid-cover in excess of four times. Italy’s 30-year yield is near 3.77%, while Japan’s is near 60 bp. The US rounds out its quarterly refunding with a sale of $19 bln 30-year bonds today. The bid-cover was a little higher for the three-year note sale and a little softer for the 10-year sale yesterday, though indirect bidders (which asset managers and foreign central banks) in both auctions were stronger than previously. At the last 30-year sales, bids were for a little more than twice what the Treasury was selling.

The dovish ECB saw the euro slip through $1.13, the lower end of its range. The dovish FOMC saw the euro firm through $1.15 the upper end of its range. The series of weak EMU data has weighed on the euro, which is approaching the lower end of the range again. Short-term participants may turn move cautious as the $1.1300 level comes back into view. The single currency has fallen against the dollar each session this week, so far, and for its part, sterling extended its losing streak for a sixth session today. It has fallen below the $1.2925 shelf that it had appeared to be building over the past couple of days. There is a GBP200 mln option at $1.29 that will be cut today, but the next important chart support for sterling is not found until closer to $1.2830.

America

The economic calendar is light. The US reports weekly initial jobless claims and a pullback is expected after the previous week’s spike. Regional Fed Presidents Kaplan and Bullard speak today and Vice Chair Clarida also speaks. Mexico report inflation (which is expected to ease slightly) after of the central bank meeting, where rates are expected to remain at 8.25%. A rate hike is still priced in for H2 19.

The US dollar is rising against the Canadian dollar for the fourth session. It is testing the 20-day moving average near CAD1.3240. It has not closed above its 20-day moving average since January 2. It needs to get above CAD1.3285 to target CAD1.34. The dollar remains in a narrow range against the Mexican peso. We like it higher, but the greenback faces offer beginning near MXN19.20.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$EUR,$JPY,Featured,MXN,newsletter,NZD