Swiss Franc The Euro has risen by 0.12% to 1.063 EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500’s longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong...

Read More »FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Swiss Franc The Euro has risen by 0.02% to 1.0798 EUR/CHF and USD/CHF, June 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe’s Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading...

Read More »FX Daily, June 3: Dollar is Sold and ROW is bought

Swiss Franc The Euro has risen by 0.42% to 1.0791 EUR/CHF and USD/CHF, June 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Two recent trends continue. Equities are moving higher, and the dollar remains heavy. Equity markets in the Asia Pacific region rose at least one percent, and South Korea, Singapore, and Malaysia rallied 2-3%. Europe’s Dow Jones Stoxx 600 is up more than 1% for the third consecutive...

Read More »What Chinese Trade Shows Us About SHIBOR

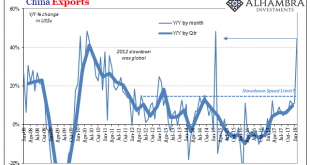

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists...

Read More »Just A Few More Pips

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the...

Read More »China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains...

Read More »China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

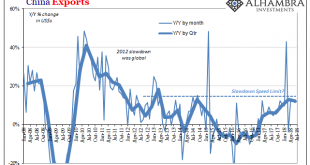

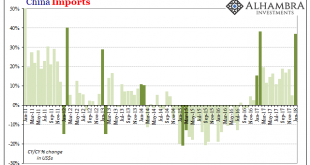

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative. A strengthening U.S. recovery is helping underpin China’s outlook as Asia’s biggest economy seeks to cut excess capacity and transition to reliance on...

Read More »CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February. For economic statistics, that meant extreme difficulty translating year-over-year...

Read More »Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed. Representative Toby Roth (R-WI) quizzed the...

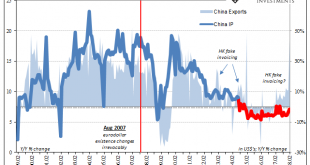

Read More »Industrial production: The Chinese Appear To Be Rushed

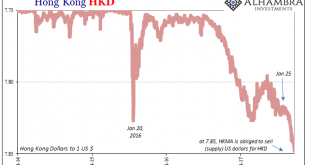

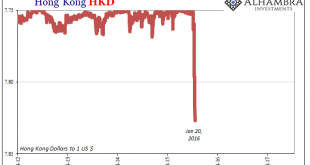

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org