Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday. Taleb famously supercharged his career – and earned a considerable sum of money (though turns out it was less than Taleb felt he deserved) – thanks to his trading profits from...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »Sornette’s Supercomputer Is Betting On A Market Crash

Via FinancialSense.com, One of the world's most powerful supercomputers, retrofitted for trading the stock market, appears to be betting on a crash in the months ahead. The Financial Crisis Observatory (FCO) at ETH Zurich released its latest Global Bubble Status Report on July 1st. As we discussed with FCO’s director, Didier Sornette, on our podcast in May, they use one of the world’s leading supercomputers to monitor global markets each day for two distinct bubble-like...

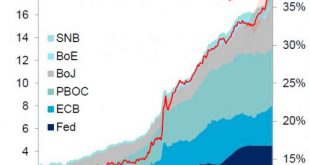

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

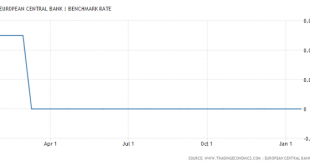

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More »Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org