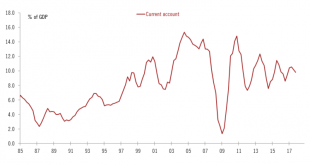

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc. In 2017, the current account surplus stood at around 9.8% of GDP or CHF66bn. This was...

Read More »Disentangling the Swiss current account

Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc as “overvalued”.In a...

Read More »Disentangling the Swiss current account

Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc was “overvalued”.In a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org