(Disclosure: Some of the links below may be affiliate links) Robo-Advisors are a good way to invest when you do not want to invest directly through a broker. They will manage your money for a fee. While more expensive than DIY investing, Robo-Advisors are significantly cheaper than an advisor from a bank.True Wealth is a leading Robo-Advisor in Switzerland. They are the first Robo-Advisor, started already seven years. And they are also the cheapest available in Switzerland.I have reviewed other Robo-Advisors in the past. Now is the time to review True Wealth. I will take a look in detail at their investment models, their fees, and their security.True WealthTrue Wealth LogoTrue Wealth was founded in 2013 by David Herren and Felix Niederer. And the service became available to the public in

Topics:

Mr. The Poor Swiss considers the following as important: Investing, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

Robo-Advisors are a good way to invest when you do not want to invest directly through a broker. They will manage your money for a fee. While more expensive than DIY investing, Robo-Advisors are significantly cheaper than an advisor from a bank.

True Wealth is a leading Robo-Advisor in Switzerland. They are the first Robo-Advisor, started already seven years. And they are also the cheapest available in Switzerland.

I have reviewed other Robo-Advisors in the past. Now is the time to review True Wealth. I will take a look in detail at their investment models, their fees, and their security.

True Wealth

True Wealth was founded in 2013 by David Herren and Felix Niederer. And the service became available to the public in 2014. As such, it is the most mature Robo-Advisor in Switzerland. They now have more than 5000 clients in Switzerland. And they are managing more than 290 million CHF of assets for their clients.

They have two main selling points:

- Low fees

- Simple investing

Another cool thing is that they have a virtual account. It means you can open an account and test many things. And only later, you can decide whether you want to transfer money. At any time, you can convert your virtual demo account into a real account.

You can use their investment services from your browser. While they do not have a mobile app, their website is mobile-friendly. So you can still do things on your phone.

So, we are going to analyze everything about True Wealth!

If you want more information about True Wealth, read my interview with Felix Niederer, the CEO.

If you are not clear on how Robo-Advisor work and what they do, read my article about Robo-Advisors.

Investment Models

Let’s see how does True Wealth invest your money.

True Wealth follows a passive investing strategy. True Wealth is only investing in index funds. To be specific, they are investing in Exchange Traded Funds (ETFs).

Using passive index funds is great news! I believe this is the best way to invest for most people.

You will not be able to choose the ETFs directly you invest in. Instead, the Robo-Advisor will decide on a portfolio for you. Based on several questions that the tool will ask you, a portfolio will be designed based on your own needs. But do not worry, you will have your say in it!

They will ask many questions to evaluate your risk tolerance. For instance:

- How long and how much do you plan to invest?

- How long and how much do you plan to divest?

- What would you do if your assets lost 10% of their value?

- And so on.

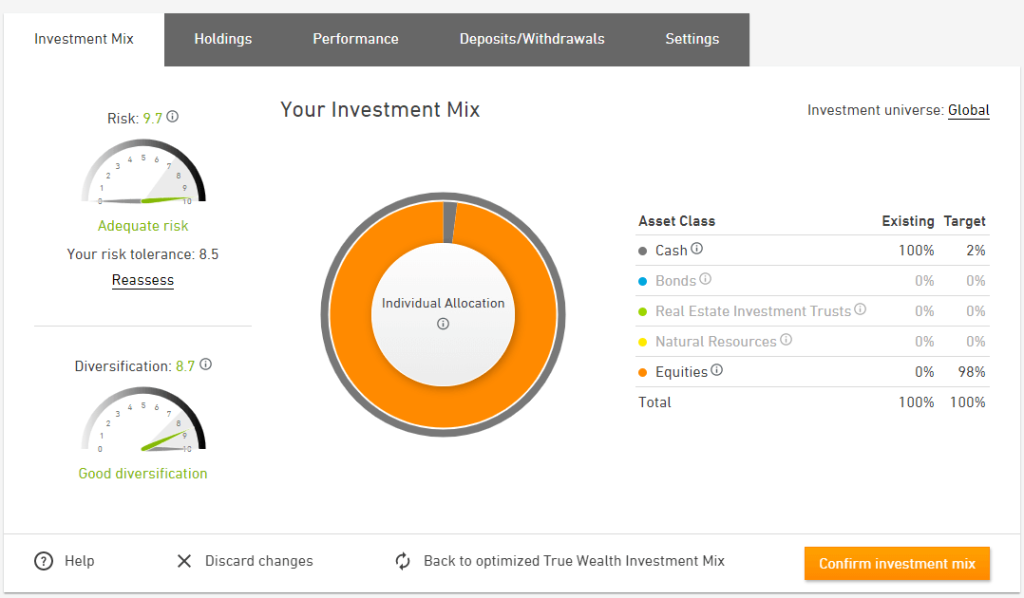

Once you are done answering these questions (it will take you two or three minutes), you will get your portfolio. For instance, here is mine after answering them:

It is an interesting portfolio. I think it makes quite a lot of sense for the general public. Based on the answers I give, I can understand why they would choose this portfolio. However, for me, it is not aggressive enough.

However, the default portfolio is not an issue because you can customize the portfolio! Customization is a great thing about True Wealth! You have great freedom in customizing your investment portfolio!

First, you can configure each of the asset classes. You can remove all the bonds, real estate, and natural resources, for instance. Or you can increase the allocation of bonds or have more cash.

In my case, I set the portfolio to the maximum amount of stocks (98%). You can choose the portfolio that suits your needs the most. They always keep 2% cash at a minimum to help to rebalance and pay for fees.

The optimization can go even further. You can customize the composition of each of the asset classes per region. For natural resources, you can choose between metals and diversified natural resources.

For me, this is an excellent level of customization. Some people would like to go one step further by choosing the ETFs directly. But, I would argue that if you want to select your own ETFs, you should not invest with a Robo-Advisor in the first place. You should invest by yourself with a broker account.

Overall, I think that the investment system of True Wealth is excellent. You will invest only in low-cost ETFs. And you will be able to customize your portfolio up to the details.

Deposit and Withdrawals

We can also take a look at how funding and withdrawing works.

First, I need to mention a downside in that True Wealth has a minimum of 8500 CHF to invest with them. 8500 CHF is a bit too much of an entry point for many people that want to get started. And many people would probably like to try the service without investing that much money. On the other hand, you can test the service by creating a virtual account.

To fund your account, you will be able to deposit money on your account by transferring money to a personal IBAN. Your cash is held in your name at the custodian bank account, so you get a personal IBAN.

If you want to withdraw your money, you will also be able to do so from the interface. The transfer can only be done to an account in your name. If you want to go lower than 8500 CHF, you will have to close your account.

Overall, this is a standard way of withdrawing and depositing money into your account. There are no surprises here.

Fees

Now, let’s look at the fees. If you are investing for the long-term, investing fees are extremely important.

Up until June 2020, True Wealth had an incredibly simple system for fees: 0.5% management fee per year on top of the fees of the ETFs. Together, these two fees are what you are going to lose to fees every year.

The fees of the ETFs will depend on your portfolio. From what I have seen, it will vary from 0.13% to 0.2%. The expensive ETF is the Real Estate ETF. If you do not invest much in Real Estate, you are unlikely to go higher than 0.2%. My very aggressive portfolio has only 0.13% fees!

Together, it means that that the TER of True Wealth will be between 0.63% and 0.70%, on average. This TER is excellent.

From June 2020, it gets even better if you have a large amount invested at True Wealth. From a 500’000 CHF portfolio to an 8’000’000 CHF portfolio, the fees will decrease from 0.50% to 0.25%! For instance, a 1’000’000 CHF portfolio will only cost 0.39%. These low TER are a great result. You can find the details on their website. If you plan to retire early and invest with a Robo-Advisor, it is terrific for your future.

Now, there is an extra fee on top of this: the stamp duty tax. If you want details about this, I have an article about the Swiss Stamp Tax. This fee is paid one each purchase and sale of ETFs. It will cost you 0.15% for a foreign ETF and 0.075% for a Swiss ETF.

It is difficult to say how much this will cost in the percentage of your portfolio since it is also based on the purchase price and sale price. Also, it is not due each year. Overall, it should add up to less than 0.05% per year on average. It is a pity that True Wealth does not include this in their total fees! It would make things simpler.

Overall, I think that the fees of True Wealth are excellent! When you compare with other Swiss Robo-Advisors, they have significantly lower fees! In total, you can invest for a minimum of 0.63% TER! I just wish they would include Swiss Stamp Tax in their management fees like other Robo-Advisors are doing.

Of course, the fees are higher than for DIY investing. Robo-Advisors are a tradeoff of simplicity versus cost. If you do not mind the hassle of investing by yourself, you can save on fees. But if DIY investing is not for you, Robo-Advisors are the next best thing.

If you are not convinced that fees are important, I urge you to look at what investing fees are doing to your retirement money.

Is it safe to invest with True Wealth?

If you are going to invest any significant amount of money with an online service, you need to take a look at its safety.

First, let’s look at how assets are stored. Your assets are not held by True Wealth itself. Instead, a custodian bank holds your assets. True Wealth is using two custodian banks:

- Basellandschaftliche Kantonalbank (BLKB)

- Saxo Bank Switzerland

You can choose which one you prefer. In both cases, your shares are protected from the bankruptcy of True Wealth since they are held in your name. With BLKB, you have unlimited protection for your cash. With Saxo Bank, your cash is protected up to 100’000 CHF. In most cases, your cash will be safe since you should not hold that much cash.

In the case of both custodian banks, they cannot lend your securities to other investors. Not allowing securities lending improves the safety of your assets. And this is a nice guarantee provided by True Wealth.

So, you are very well protected against bankruptcy or takeover of True Wealth.

Is True Wealth Secure?

Now, we can also take a look at the technical security. We do not want a hacker to steal all our assets!

For that, all communication with True Wealth will be encrypted. And you can use Second Factor Authentication (2FA) to add an extra layer of security. I highly recommend that you do so for each online service you use. They are offering support for the most used 2FA platforms. So this is great!

On top of that, your assets can only be transferred to an account in your name. This limitation is very good for security! If a hacker took hold of your account, they would also have to hack your bank account to get your funds. This security makes it unlikely to lose your assets!

Overall, I think that the technical security of True Wealth is as good as it can be. It seems that True Wealth is very aware of this security side. And this is excellent news for its investors.

Now, do not forget that the most significant security problem is usually the human factor. So, you need to take online security seriously.

Sustainable Investing with True Wealth

Sustainable investing is very popular these days.

And fortunately for investors that are motivated by this, True Wealth also lets you invest sustainably.

When you design your portfolio from True Wealth, you can choose between two investment universe:

- Global: All stocks for each asset class

- Sustainable: Only stocks from sustainable companies for each asset class

So, you only have to change a single thing, and your entire portfolio becomes focused on sustainable investing.

When you choose the sustainable universe, True Wealth will use Socially Responsible Investing (SRI) ETFs from MSCI. So, all the ETFs will be replaced by their SRI equivalents.

These ETFs are more expensive than the base one. So, the TER of your portfolio will be higher if you choose sustainable investing. For instance, the portfolio I selected for me had a TER of 0.63% went up to 0.80% with the sustainable universe.

I think that the True Wealth system for Sustainable Investing is quite good. I just wish that the ETFs were cheaper. But that is not something that True Wealth has much control over. Their approach to sustainable investing is similar to what most other Robo-Advisors are doing.

If you are not clear about that, read what is Sustainable Investing, ESG, and SRI.

True Wealth Advantages

Let’s summarize the main advantages of True Wealth

- Fees are significantly lower than other Swiss Robo-Advisors.

- Passive investing will let you reap the benefits of the stock market in the long-term.

- Excellent customization of your portfolio.

- You can invest sustainably with True Wealth.

- True Wealth has good security.

- Your assets are well protected in case of bankruptcy.

- Very transparent information.

- Simple to use.

- Free demo account that you can use directly.

True Wealth Disadvantages

Let’s summarize the main disadvantages of True Wealth:

- You need at least 8500 CHF to invest with True Wealth

- Stamp Duty is not included in the management fees.

FAQ

What is the minimum you can invest with True Wealth?

You need at least 8500 CHF to start investing with True Wealth.

How much will you pay in fees for True Wealth?

You will pay a management fee of 0.5%. On top of that, you will have to pay the fees of the funds. The total should amount to about 0.65% to 0.70% per year.

Who can invest with True Wealth?

All legal residents of Switzerland that are at least 18 years old can invest.

What happens if True Wealth bankrupts?

If they go bankrupt, your assets are safely stored in a custodian bank. Your cash will be protected by up to 100'000 CHF in case of bankruptcy of the custodian bank.

Conclusion

Overall, I am impressed by True Wealth. They are proposing a great investment system with very low-cost. And on top of that, the freedom to choose your portfolio is high! You can decide on your exact portfolio.

If I had to choose a Robo-Advisor, I would invest with True Wealth. They are the cheapest Robo-Advisor in Switzerland. And these low fees will make a significant difference in your returns for the long-term. Also, the fact that you can tune the portfolio to your needs will make it good for most people.

There are only two things that I do not like about True Wealth. First, Swiss Stamp Duty is not included in the management fees. Also, I think that the minimum of 8500 CHF for investing is a bit steep for many people that want to get started.

Other than that, it is an excellent service!

Keep in mind that I do not use a Robo-Advisor myself. I invest in stocks by myself in a broker account. DIY investing is more complicated. But I pay much lower fees than with a Robo-Advisor. In the end, it is a tradeoff, whether paying an advisor or doing it yourself.

To read more, you can read my article about Robo-Advisors in Switzerland. Or you can read about Selma, another good Robo-Advisor.

What about you? What do you think about True Wealth?

True Wealth Review 2020 - Cheapest Robo-Advisor

True Wealth is the earliest of the Swiss Robo-Advisor and also the cheapest! They provide a great service and give you great freedom in the customization of your portfolio.

Price Currency: CHF

Operating System: Web

Application Category: Robo-Advisor

5